Credit Cards

First Citizens Rewards Business Review: Business Potential!

Earn 10,000 bonus points, enjoy points on gas, and explore versatile redemption options for your hard-earned rewards with the First Citizens Rewards Business Credit Card!

Advertisement

From a generous bonus offer to earning 3 points on gas, experience a credit card designed for your success!

Want to enjoy a variety of redemption options tailored to your business needs? Then review the First Citizens Bank Rewards Business Card and learn how to make the most of your spending!

Fuel your business growth with the First Citizens Rewards Business Card. So, keep reading and explore this card’s features, benefits, and potential drawbacks to see if it’s the right fit for your business!

- Credit Score: A credit score that falls in the range of 600 or more is recommended for approval.

- Annual Fee: Enjoy the benefits and rewards without any additional yearly cost.

- Intro offer: If you’re a new card member, after spending at least $3,000 in the first 90 days, you can get up to 10,000 bonus points.

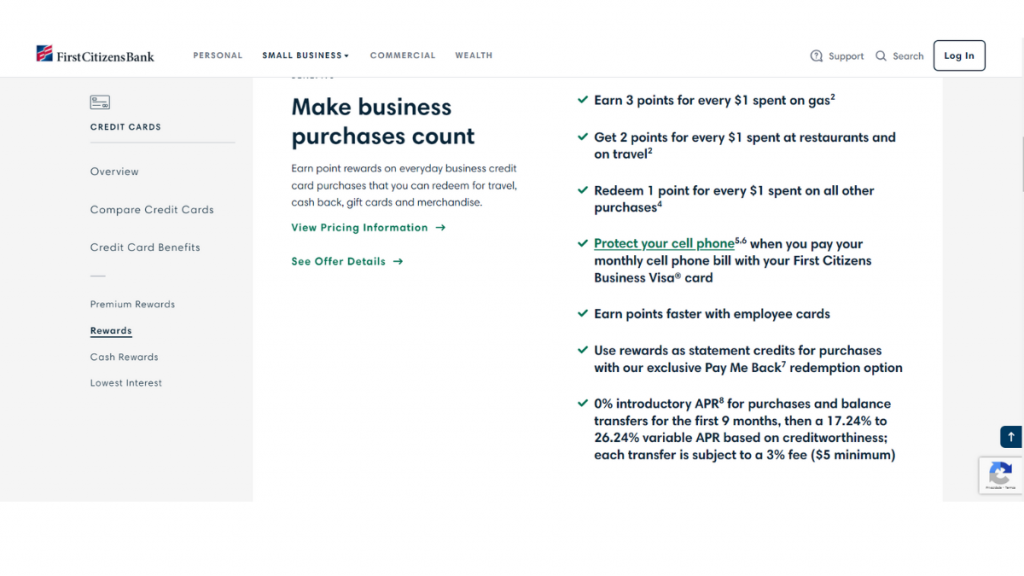

- Rewards: This credit card rewards you with triple points for each dollar expended on gas. Besides, you can enjoy double the points on restaurants and travel expenses. All other purchases give you 1 point. Cash back, travel rewards, and more are among the redemption options available.

- APR: During the initial 9 months from opening your account, savor the benefit of a 0% introductory APR. After that, it ranges from 17.24% to 26.24%.

- Other Fees: Take note that balance transfers incur a 3% fee, with a minimum charge of $5 applicable.

First Citizens Rewards Business: how does it work?

The First Citizens Rewards Business Card is a very versatile financial tool, as you’ll find in this complete review. After all, the conception of this card revolves around elevating your capacity for business purchases.

Firstly, its Rewards Program gives you points on gas, allowing you to fuel both your vehicle and your business success simultaneously. Besides, the card also presents an attractive introductory offer.

The substantial bonus of 10,000 points serves as an excellent kickstart for businesses looking to maximize their rewards from the outset.

Moreover, the 0% introductory APR on both purchases and balance transfers offers a financial buffer as you navigate the initial phases of card usage.

Additionally, the absence of an annual fee ensures that you can fully embrace the advantages of this card without worrying about unnecessary costs.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Significant benefits and disadvantages you may find

Before applying for the First Citizens Bank Rewards Business Card, it’s essential to review the advantages and weigh the drawbacks to be sure this is the right financial tool for your business.

Benefits

- Lucrative bonus incentive;

- Seamless financial start with 0% introductory APR;

- Added perk of cell phone protection;

- Valuable points for every dollar spent on gas;

- Array of redemption options tailored to your preferences;

- International transaction savings.

Disadvantages

- Limited total points that can be earned within a billing cycle;

- Commercial spend bonus exclusivity;

- Restricted initial APR duration;

- Cash advances are a costly financing option.

Is a good credit score required for applicants?

Yes, a good to excellent credit score is preferred, though the specific score requirement isn’t explicitly stated.

Learn how to apply and get the First Citizens Rewards Business Card

Ready to unlock the potential of the First Citizens Bank Rewards Business Card after this complete review? Then, it’s time to check out a seamless guide to its application process below!

Learn how to get this credit card

Explore the initial stages of eligibility assessment and understand the final submission of documentation in this easy step-by-step.

- Check out your eligibility: Firstly, access the official First Citizens Bank website and click on the “Small Business” tab, next select “Credit & Financing”. Then, click on “Credit Cards”. Look for the First Citizens Rewards Business and click to review the card.

- Locate the nearest branch: When you’re sure this is the card for your business, click on “Find a Branch” to find the one nearest you.

- Apply in person: Upon entering the branch, approach a banking representative or customer service desk. Express your intention to apply for the First Citizens Rewards Business Card.

- Application form: Request an application form from the representative, and complete it with accurate and up-to-date information. When you’re done, submit your form.

- Await approval: If your application is approved, you will receive your First Citizens Rewards Business Card along with any welcome materials. The banking representative can guide you through the activation process.

What about another recommendation: Ink Business Unlimited® Credit Card!

Not sure the First Citizens Rewards Business Card is a good choice after reading this review? Then check the Ink Business Unlimited® Card, and enjoy a transparent rewards structure.

With this amazing credit card, businesses can enjoy cash back on every purchase. So, enjoy a detailed review to choose the right business card that best meets your unique needs.

How to get an Ink Business Unlimited® Credit Card

Learn how easy it is to get an Ink Business Unlimited® Credit Card with our step-by-step guide and start earning more today!

About the author / VInicius Barbosa

Trending Topics

Novo Business Checking Account review

In this Novo Business Checking Account review you will see how it can help you streamline your bookkeeping and invoicing.

Keep Reading

What are typical investment fees?

Trying to figure out what investment fees are? In this article we are going to give you a few important things you need to know.

Keep Reading

Oportun Personal Loans application

Learn how the Oportun Personal Loans application process works and have access to funds fast to cover whatever you may need them for!

Keep ReadingYou may also like

SavorOne Rewards Card application process

Learn how to easily apply for the Capital One SavorOne Rewards Card and get unlimited rewards for your everyday spending!

Keep Reading

100 Lenders application process: get multiple lenders’ offers in 2 minutes

Learn how the 100 Lenders application process works and get access to multiple lenders' offers with a single application form.

Keep Reading

BlueBird Amex debit card review: No bank account? No problem.

In this BlueBird Amex debit card review you will see that it is possible to get a card with no fees even if you don't have a bank account.

Keep Reading