Account (US)

How to open your ACE Flare® Account easily

Read our ACE Flare® Account application guide and learn how to get this account to have access to its benefits.

Advertisement

ACE Flare® Account: Access to a high-yield savings account and a convenient prepaid card

How about keeping close control over your finances while earning interest on your balance? This account offers you all of that. This is our guide to help you open your ACE Flare® Account.

Get access to a high-yield savings account that earns you 6% APY, and make free cash withdrawals if you set up direct deposits. Apply today and get these and many other benefits.

Learn how to get this ACE Flare® Account online

Applying for the ACE Flare® Account is super easy. You can do everything online, and the whole process takes only a few minutes to complete.

So have your personal info and documents at hand, and let’s get this done.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Applying from your desktop computer

On Flare Account’s main page, locate the “Get Started” button at the top right corner of the page and click on it.

Applying from your mobile phone

Access the Flare Account main page and locate the three-line menu at the top right corner of the page. Then, click the menu to reveal its options and click on “Get Started”.

Proceed to open your ACE Flare® Account

Fill in the form with all the information it requires. This includes personal info such as your first and last name. It also includes contact info such as your address, email address, and phone number.

Be prepared to provide employment and financial information, as the website may also require those. Once you have filled everything in, you must submit it for approval.

The institution will then verify your identity before it can approve your credentials. Once it has been approved, you will have immediate access to your account.

Also, you should receive your card in the mail within a couple of business days. Congratulations! You have finished your ACE Flare® Account application.

How about another recommendation? BlueBird Amex debit card

It is always wise to compare offers before buying anything. To help you do just that, we have put together another excellent article about the BlueBird Amex debit card.

This is a prepaid card that does not charge any monthly or purchase transaction fees. As such, it is ideal for those trying to keep close control over their spending.

Also, since it only allows you to spend as much as you have loaded into it, it is very useful to prevent you from incurring overdraft fees. And speaking of fees, this card does not charge an annual fee.

Moreover, it works just like a regular debit card, with no further complications. You can use it in any merchant or store that accepts American Express.

It is possible to reload the card through direct deposit or by making transfers from a bank account you have linked to the card.

Plus, the card has more than 30,000 MoneyPass ATMs where you can make withdrawals and 24/7 customer support.

If you would like to learn more about this card, click the link below, and we will tell you all about it.

BlueBird Amex debit card review

See how the BlueBird Amex debit card allows you to have access to it even if you do not have a bank account.

About the author / Danilo Pereira

Trending Topics

LendingClub Personal Loan application

Get the funds you need and have the flexibility to use them for anything. Learn how to apply for a LendingClub personal loan today!

Keep Reading

Blue Business® Plus card American Express® online application process

In this Blue Business® Plus card American Express® application guide you will learn how to get this card within just a few minutes.

Keep Reading

Safe investments in Canada: learn the best options

You can find excellent safe investments in Canada to start investing without risking all your money. Keep reading to learn about them.

Keep ReadingYou may also like

Credit One Bank® Platinum Visa® for Rebuilding Credit review

Is the Credit One Bank® Platinum Visa® for Rebuilding Credit Credit Card a good choice for you? Read this review to find out!

Keep Reading

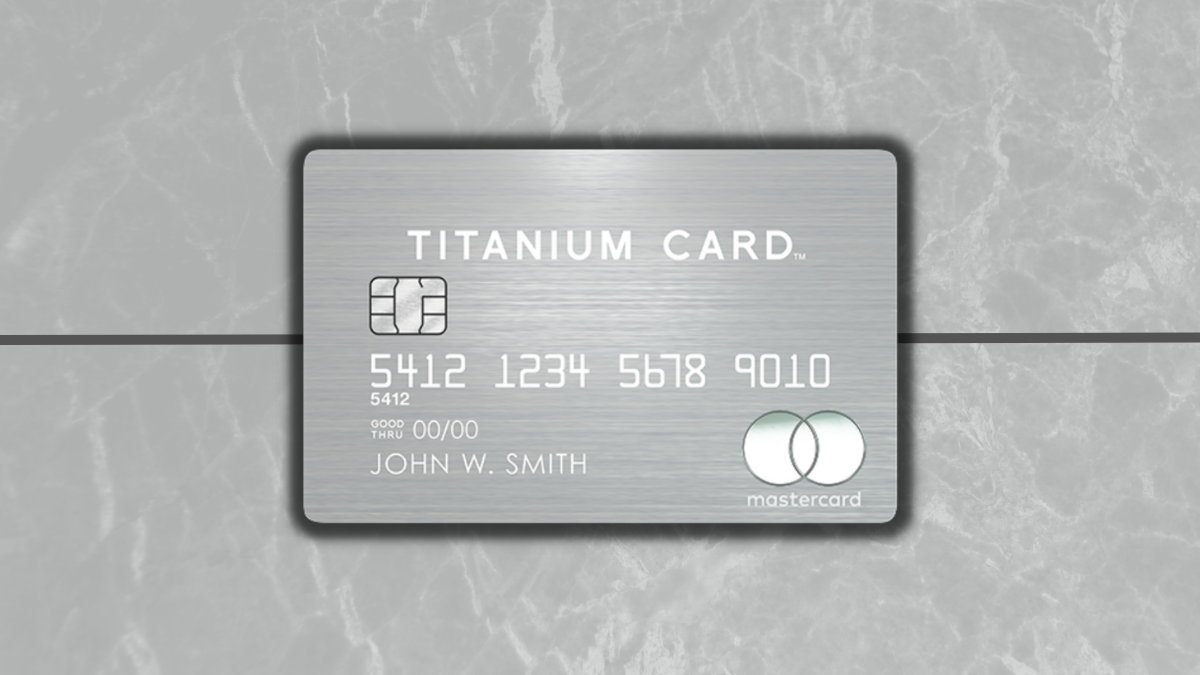

Mastercard® Titanium Card™ application

Learn how easy and secure the Mastercard® Titanium Card™ application process is and take a step towards luxury with a few simple clicks.

Keep Reading

Chase Bank application

The Chase Bank application process is easy! Learn how it works and what you can expect from one of the nation’s biggest banking institutions.

Keep Reading