Loans

PenFed Credit Union Personal Loan application: do it online easily

Read this PenFed Credit Union Personal Loan application guide and learn how to get this loan quickly and easily.

Advertisement

PenFed Credit Union Personal Loan: apply in minutes and get a fast approval

The PenFed Credit Union Personal Loan is especially good for borrowers with good credit (690 FICO points or better) and who are PenFed members.

This loan is also an excellent option for those seeking to secure a loan or add a co-borrower to their application. This is our guide to the PenFed Credit Union Personal Loan application.

How to apply for the PenFed Credit Union Personal Loan

Before we start the PenFed Credit Union Personal Loan application, let’s have a look at what are the lender’s requirements for applicants.

Keep in mind that meeting the requirements does not guarantee you will get approved for the loan, but it does highly increase your chances.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Eligibility requirements

In order to qualify for a PenFed Credit Union Personal Loan you must have a 2-year-long credit history which the lender can look into. Also, your debt-to-income ratio must be below 55%.

On top of that, having good to excellent credit will highly increase your chances of getting approved for this loan.

Apply online by filling up the form

If you are on your desktop computer, go to PenFed’s website and locate the “Loans” option at the top right third of the page to start your PenFed Credit Union Personal Loan application.

It is between “Mortgage $ Home Equity” and “Learn”. Then, run your mouse cursor over the option to reveal a dropdown menu.

If you are applying from your mobile phone, tap the three-line menu at the top right corner of the page.

Then tap the “Loans” option, which will reveal the types of loans. Tap “Personal Loans” and then tap “Personal Loans” again.

Now, regardless of your device, locate the green “Check Your Rate” button on the page and click on it.

If you are already a member, you can log in on the next screen. If not, you can click on “check your rate” again.

For this guide, we will click on “Check Your Rate”. Now, select the reason for your loan, the loan term, and how much you would like to borrow at PenFed Credit Union Personal Loan.

Then, scroll down and enter your first and last names, along with your date of birth, Social Security Number, email address, and mobile phone number.

After that, scroll further down and enter your address information. This must include street address, country, Zip Code, city, and state.

Further down below, you will enter your financial information, including personal annual income and monthly housing payments.

Then, below, read the text before checking the three boxes to certify you agree.

At this point, you may select the option to apply with a co-borrower if you wish.

Then, check the box to confirm you are not a robot and click Continue. You’re just one step far from your PenFed Credit Union Personal Loan.

Submit and wait for your loan offer

Now the website will send you a one-time passcode to verify your identity. Once you have confirmed it, PenFed Credit Union will analyze your information and make a personal loan offer.

If you are happy with the offer, you may choose to take the loan. Congratulations!

Another recommendation: LendingPoint Personal Loans

But maybe you have less-than-perfect credit, and the previously mentioned loan does not suit you. Do not worry, we have another recommendation made for people with poor credit.

LendingPoint Personal Loans only requires a soft credit check for you to pre-qualify. With it, you get fast access to funding, access to a free credit score, and you can even change your payment date.

LendingPoint Personal Loans review

With LendingPoint Personal Loans you do not need perfect credit to get approved for a loan, and applying only takes a few minutes.

About the author / Danilo Pereira

Trending Topics

Sell on eBay and increase your income

Selling on eBay is one of the best ways to increase your income. Learn how to do it with our tips and start making money!

Keep Reading

What is a penalty APR and how does it work?

A missed credit card payment can lead to a lot of trouble, and one of them is a penalty APR. Learn how it works and how you can avoid it.

Keep Reading

Bank of America® Unlimited Cash Rewards review

Read our Bank of America® Unlimited Cash Rewards review to learn if the features and benefits of this card are what you’re looking for.

Keep ReadingYou may also like

United Quest℠ Card review: Up to 100,000 Bonus Points!

Check out this United Quest℠ Card review and learn about this card's high rewards on travel and large welcome bonus!

Keep Reading

Best cards for students: it’s better than you imagine!

The best credit cards for students have no annual fee, rewards programs, and many other benefits. Read this list to choose yours.

Keep Reading

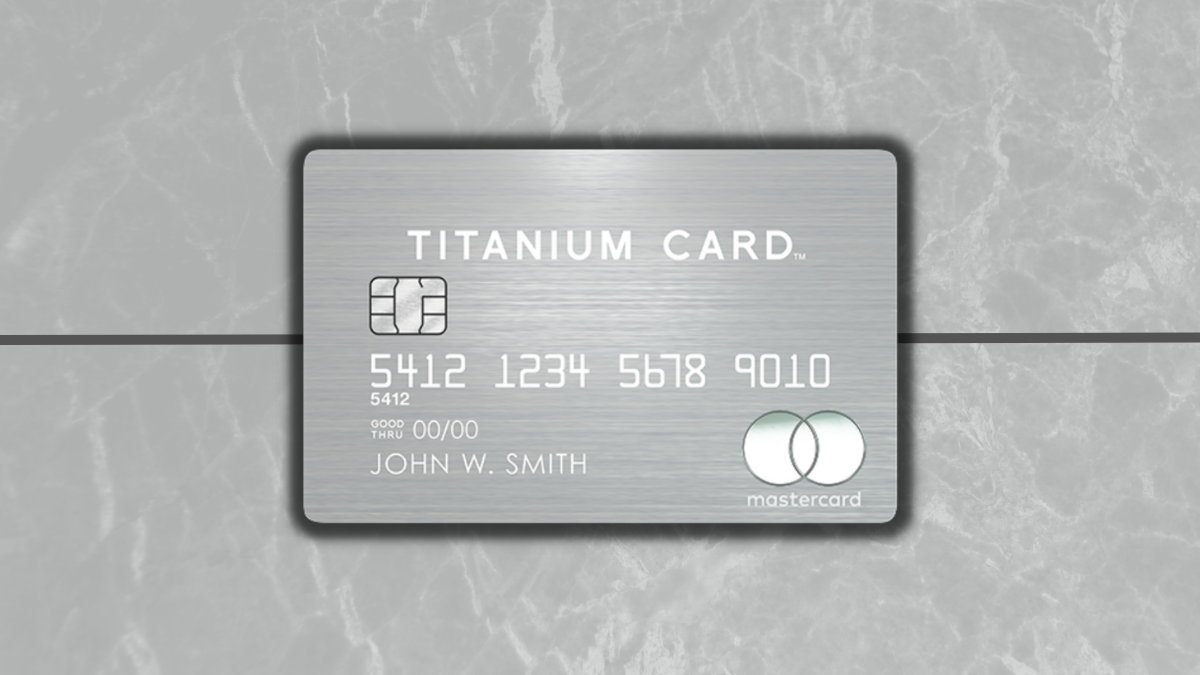

Mastercard® Titanium Card™ application

Learn how easy and secure the Mastercard® Titanium Card™ application process is and take a step towards luxury with a few simple clicks.

Keep Reading