Discover the exceptional rewards and perks that come with the Bank of America® Premium Rewards® Elite.

Bank of America® Premium Rewards® Elite: Earn Points, Get Rewards, Enjoy Perks.

Advertisement

The Bank of America® Premium Rewards® Elite credit card is ideal for frequent travelers and diners. Its rewards program, welcome bonus, and annual travel credit are among the most marketable features. The card offers increased earnings and rewards bonuses at different status levels based on the assets held, and it has no foreign transaction fees.

The Bank of America® Premium Rewards® Elite credit card is ideal for frequent travelers and diners. Its rewards program, welcome bonus, and annual travel credit are among the most marketable features. The card offers increased earnings and rewards bonuses at different status levels based on the assets held, and it has no foreign transaction fees.

You will remain in the same website

Do you want access to higher earnings, enhanced rewards, and lavish travel benefits? Then getting your hands on the Bank of America® Premium Rewards® Elite Credit Card might be just what you need. Check its perks below!

You will remain in the same website

The rewards program of the Bank of America® Premium Rewards® Elite credit card offers users 2 points per dollar spent on travel and dining purchases and 1.5 points per dollar spent on all other purchases. Points can be redeemed for travel, cashback, gift cards, and more. The card also offers increased earnings and rewards bonuses at different status levels based on the assets held, with the highest level offering 3.5 points per dollar spent on travel and dining purchases and 2.625 points per dollar spent on all other purchases.

The welcome bonus for the Bank of America® Premium Rewards® Elite credit card is 50,000 bonus points after spending $3,000 within the first 90 days of account opening. This is worth $500 in travel statement credit.

The annual fee for the Bank of America® Premium Rewards® Elite credit card is $550. However, the card offers an annual $200 travel credit, which can be used towards travel purchases such as airfare, hotels, and rental cars, effectively reducing the net annual fee to $350.

No, the Bank of America® Premium Rewards® Elite credit card does not have foreign transaction fees, making it a good choice for frequent international travelers.

To qualify for the status levels in the Bank of America® Premium Rewards® Elite credit card rewards program, users need to have certain assets with Bank of America and/or Merrill Lynch. Gold status requires $20,000+ in assets, Platinum status requires $50,000+ in assets, and Platinum Honors and above status requires $100,000+ in assets. Assets can include deposits, investments, and loans.

Ready to take advantage of the Bank of America® Premium Rewards® Elite credit card? Follow our quick and easy application guide by clicking the link below.

How to get your Bank of America® Premium Rewards®

In this Bank of America® Premium Rewards® Elite application guide we are going to show you how to get this card in just a few minutes.

Curious about what other credit cards are out there? Check out the Chase Sapphire Preferred® Card.

With this card, you can earn bonus points on travel and dining, and redeem them for valuable rewards.

Want to learn more? Click the link below to get started.

How to apply for a Chase Sapphire Preferred card?

If you'd like to enjoy everything this card has to offer, read this content and you'll learn how to apply for your Chase Sapphire Preferred credit card.

Trending Topics

American Express Serve® FREE Reloads Card application

Learn all the details about the American Express Serve® FREE Reloads Card application process and how you can request yours.

Keep Reading

How to join Spring Bank with an online application?

In this Spring Bank application guide you are going to learn how to start banking with this bank to help society and the environment.

Keep Reading

How to get your Standard Bank Blue Credit Card

In this Standard Bank Blue Credit Card application guide you are going to learn how to get this card with personalized interest rates.

Keep ReadingYou may also like

TymeBank Credit Card review

Get the lowdown on the TymeBank Credit Card. We review features, pros and cons to help you make an informed decision before signing up.

Keep Reading

Moving to the U.S.? Here’s how to set up your finances!

One of the most important steps you can take is to learn how to set up your finances if you’re a new U.S. resident! Read on to learn more.

Keep Reading

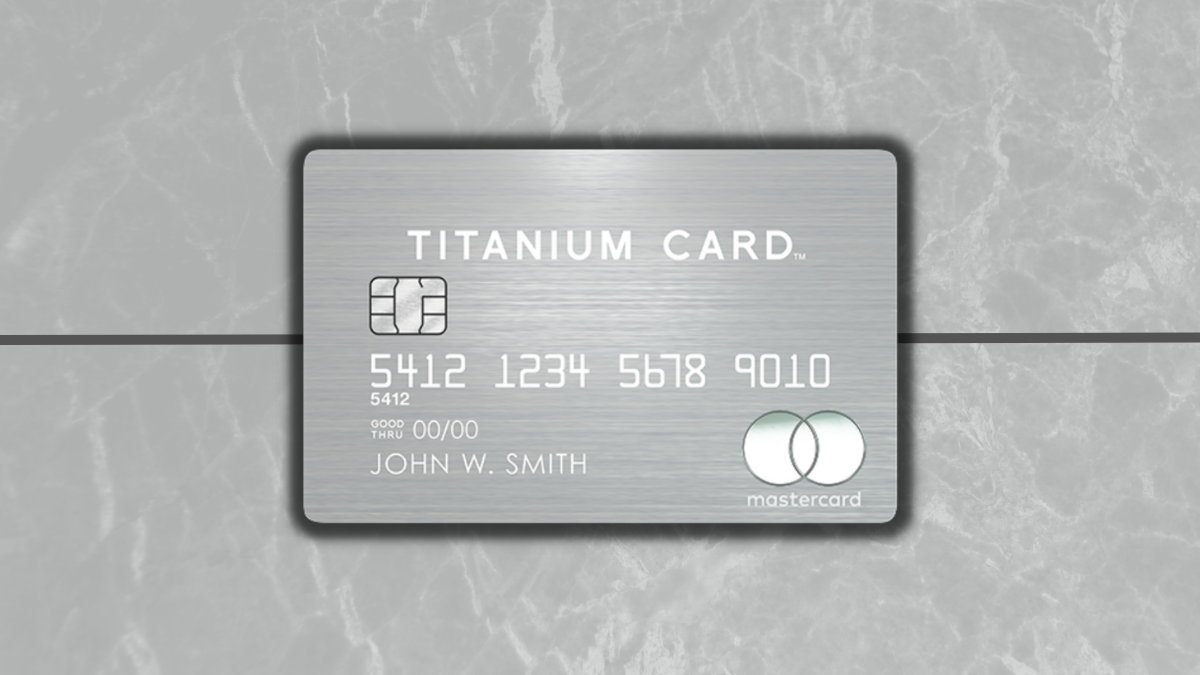

Mastercard® Titanium Card™ application

Learn how easy and secure the Mastercard® Titanium Card™ application process is and take a step towards luxury with a few simple clicks.

Keep Reading