Earn unlimited cash back rewards on every purchase while you build a solid credit score!

Capital One Quicksilver Secured Cash Rewards Card – Easy qualifying process and no annual fee!

Advertisement

A credit card can be a powerful tool for rebuilding your credit score. And if you’re looking for a card that offers cash back rewards, the Capital One Quicksilver Secured Cash Rewards Credit Card is a great option. With this card, you’ll earn 1.5% cash back on all your purchases – and there’s no annual fee. You can qualify even with a limited credit history and begin your credit building journey with a $200 deposit.

A credit card can be a powerful tool for rebuilding your credit score. And if you’re looking for a card that offers cash back rewards, the Capital One Quicksilver Secured Cash Rewards Credit Card is a great option. With this card, you’ll earn 1.5% cash back on all your purchases – and there’s no annual fee. You can qualify even with a limited credit history and begin your credit building journey with a $200 deposit.

You will be redirected to another website

Are you looking for a credit card that will give you rewards, security and reliability? The Capital One Quicksilver Secured Cash Rewards Credit Card offers all of these features – plus a few surprises. Check them out below!

You will be redirected to another website

Yes. The Capital One Quicksilver Secured Cash Rewards Credit Card is one of the best first-time credit cards because it doesn’t charge an annual fee, has a relatively low minimum security deposit and offers unlimited cash back rewards on purchases. The issuer also reports all account activity to credit bureaus, which means that responsible use will help you build and establish your credit score.

The minimum you can deposit on your Capital One Quicksilver Secured Cash Rewards Credit Card account is $200, and the maximum depends on your overall creditworthiness upon evaluation. That maximum amount ranges between $1,000 and $3,000.

The Capital One Quicksilver Secured Cash Rewards Credit Card is a Mastercard product. That means you can use it anywhere in the world where merchants accept Mastercard. Capital One does not charge any foreign transaction fees for international purchases either.

You can apply and get approved for the Capital One Quicksilver Secured Cash Rewards Credit Card even if you have a credit score as low as 300. This is a secured card, which means your security deposit works as a collateral (and your spending limit), so it’s much easier to get than unsecured cards. However, you must meet all eligibility criteria from Capital One to get the card.

Are you looking for a way to start building your credit and earn rewards at the same time? The Capital One Quicksilver Secured Cash Rewards Credit Card could be the perfect card for you.

Check the link below to learn how you can easily apply for it online and what to expect from the application process.

How to get the Capital One Quicksilver Secured?

Learn how to apply for the Capital One Quicksilver Secured Cash Rewards Credit Card and start repairing your credit while earning cash back rewards!

But if you want to check out other rewarding secured credit cards, the Discover it® Secured Credit Card is a solid alternative. With this card, you’ll earn 1-2% cash back on eligible purchases and a welcome bnus at the end of your first year.

In the following link, we’ll look over the Discover it® Secured Credit Card’s features, perks and benefits, and show you how you can apply for it. Read on!

How to get the Discover it® Secured Card?

Check our easy step-by-step guide that will help you get your Discover it® Secured Card easily and fast!

Trending Topics

TrueAmericanLoan application process: Find just the right loan!

In this TrueAmericanLoan application, you will learn how to use this platform to start getting multiple loan offers within minutes.

Keep Reading

AMEX SimplyCash™ Preferred credit card review

You can get a card with a $400 potential welcome bonus. Read this AMEX SimplyCash™ Preferred review to see how it works.

Keep Reading

Bank of America® Customized Cash Rewards Secured review

Get approved easily and pay no annual fee! Check out this Bank of America® Customized Cash Rewards Secured review and learn more.

Keep ReadingYou may also like

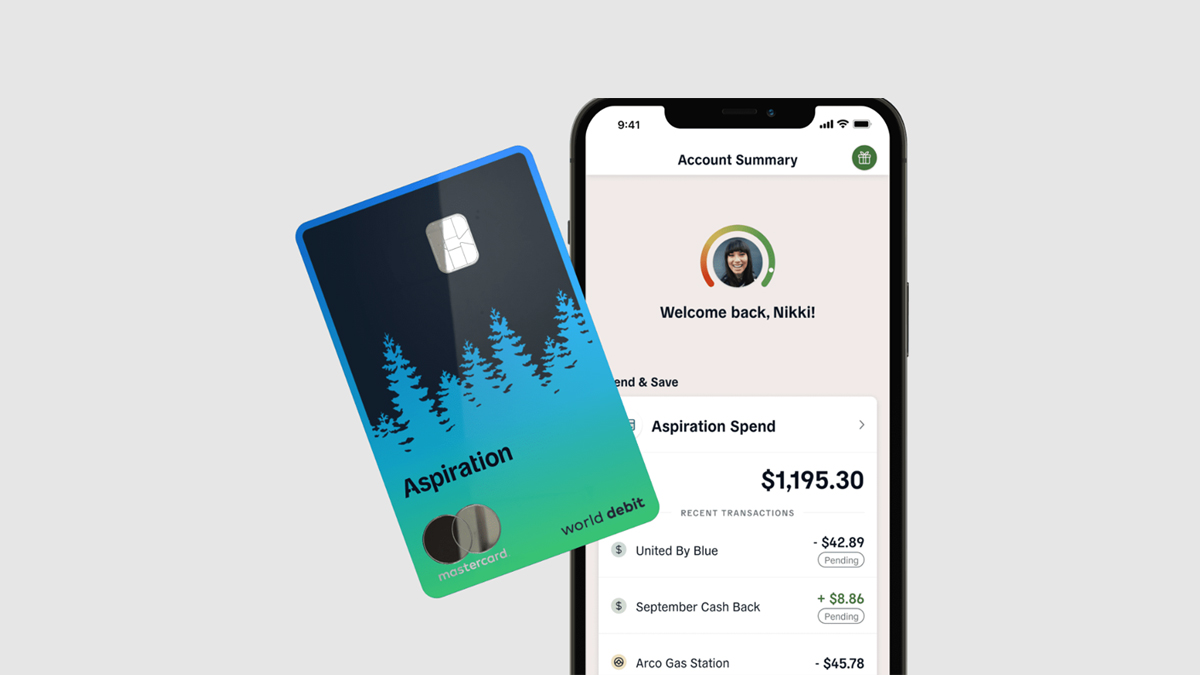

Aspiration Plus Account application

Learn everything you need to know about the Aspiration Plus Account application process and start earning interests right away!

Keep Reading

How to get your Merrick Bank Double Your Line™ Platinum Visa®: online application

In this Merrick Bank Double Your Line™ Platinum Visa® application guide, we will show you how to apply for this card.

Keep Reading

Best Free AI Apps for Android and iPhone

Unravel the potential of the best AI apps for iPhone and Android, transforming your mobile device into a hub of creativity and convenience.

Keep Reading