Investments

What is sustainable finances?

If you are asking yourself the question "What is sustainable finances?", you have come to the right place. We are going to tell you what you need to know about it.

Advertisement

Sustainable finance is the new trend in the investment world. Find out what it means in this article

Finance is undergoing a significant transformation as people come to understand that money represents more than just financial wealth. Environmental, social, and economic issues are increasingly important issues when discussing the goals of finance.

This is leading to the rise of sustainable finance. This means taking into account environmental, social, and governance (ESG) factors when making any type of investment decision.

Money has a far-reaching influence that goes beyond a balance sheet. We can use money to address a variety of issues. They include mitigating climate change, combating inequality, and promoting sustainable employee relations.

The opportunities for incorporating ESG considerations into financial decisions are endless.

Despite ongoing efforts, a lack of financing seems to be the main barrier to achieving the net zero goals set by many countries.

Safe investments with the best low-risk options

You don't need to take high risks to start investing, Pick one of these low-risk investments and you'll keep your money safe.

As a result, there has been a growing focus on sustainable finance and its untapped potential to provide the funding needed to create a more sustainable future.

The principles behind ESG finance make both ethical and financial sense. A survey conducted by the World Economic Forum has sounded an alarm.

Economists agree that the costs of not taking action on climate change could reach $1.7 trillion per year by 2050 and potentially exceed $30 trillion by 2075.

However, the sustainable finance market is already worth $30 trillion and is expected to experience rapid growth in the coming years.

Some experts believe that ESG assets could be the “growth opportunity of the century.” Given these figures, it is clear that sustainable finance is not only the right thing to do.

Sustainable finance is also a smart financial choice. It is the future of finance.

The Rise Of Sustainable Finance

There is currently a conflict occurring in the corporate world, as companies struggle to balance their sustainability goals with the demands of their business.

One notable example of this conflict was the battle between small investment firm Engine No.1 and Exxon Mobil, a major carbon emitter.

Engine No.1, supported by major players in finance such as Blackrock and Vanguard, successfully installed three climate-conscious directors onto Exxon’s board.

This victory for climate activists was made possible by a new wave of activist investors and the support of some of the largest players in finance. As a result of this push for board-level change, sustainable finance is becoming more common in the world of wealth and investment.

Larry Fink, CEO of Blackrock, stated in his annual letter to executives that “no issue ranks higher than climate change.” He even predicted that the next 1,000 “unicorns” (successful start-ups) will be companies that help to decarbonize the economy.

The increasing focus on sustainability in finance has also led to a demand for sustainable options on the retail side of finance and banking.

A survey conducted by Eurogroup found that 67% of consumers across all age groups expect their bank to be engaged in sustainability efforts.

For example, around 70% of Gen-Zers and Millennials are interested in using a carbon footprint tracker if their bank offered one. However, there is still a lack of supply when it comes to these types of sustainable financial products and services.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Governments and global institutions step in

In order to address the challenges facing the world, a growing number of central banks and governing bodies are implementing regulations. Such regulations aim to standardize a field that has previously gone without.

In 2015, the Paris Agreement and the UN Sustainable Development Goals established a plan for the private and public sectors. The plan outlined how countries would work together to align financial flows with sustainability efforts.

Then, in 2018, the European Commission released an action plan for sustainable growth as part of its Green Deal framework. This plan aims to turn the abstract concept of sustainable finance into concrete action.

The Sustainable Finance Action Plan (SFAP) has three primary objectives:

- Reorienting capital flows towards sustainable investment to achieve sustainable and inclusive growth;

- Managing financial risks related to climate change, environmental degradation, and social issues;

- Fostering transparency and long-term thinking in financial and economic activity.

To support the SFAP, the EU has implemented the EU Taxonomy. This is a green classification system that defines which economic activities we can consider environmentally sustainable.

The EU has also implemented the Sustainable Finance Disclosure Regulation (SFDR). It requires mandatory ESG disclosures to increase transparency among financial market participants.

Recently, the US Securities and Exchange Commission announced plans for new climate disclosure rules. The purpose of these rules is to provide investors with information about the climate-related risks faced by a company.

This appears to be as a significant shift in the world’s largest financial market. It gives investors more power to hold companies accountable for their net-zero claims and helps to combat greenwashing.

ESG is not a flawless initiative

Like any innovation, sustainable finance and ESG investing have their challenges. It is true that nations are making efforts to establish a strong regulatory environment for sustainable finance. However, there is still a lack of understanding and realization of its full potential.

To effectively navigate the often-unpredictable world of ESG finance, there must be clear market standards for defining and reporting ESG ratings.

There must also be concrete actions to address issues such as greenwashing and modern slavery in complex supply chains.

However, these challenges should not discourage engagement with ESG. Instead, they should serve as a signal for areas for improvement. They are also a reminder that ESG is not a one-size-fits-all solution or a quick fix. Rather a comprehensive approach to promoting sustainability.

So, what does all of this mean for banks? Overall, the environment for sustainable finance is strong and rapidly growing.

For example, Dutch bank ING recently announced that it will no longer finance new oil or gas projects. Finance is evolving, and sustainability is playing a significant role in this evolution.

Considering the potential for sustainability, the market demand, and the current environment for sustainable finance, innovative financial institutions have a rare opportunity.

They can position themselves as pioneers in the world of sustainable finance. At the same time, they can make a profit and contribute to a better future.

Sustainability is also a valuable tool for creating value for financial service providers. The Sustainable Development Commission found that companies with an ESG-focused approach financially outperform those that do not. It’s a win-win-win situation. Time is of the essence in this area.

Use a debit card that helps you to offset carbon footprints

If you care about sustainability, there is a debit card tailored for you. Actually, if you do not care about sustainability, you should start right away. Getting this debit card is a good step toward this goal.

The Aspiration Spend & Save™ debit card has useful benefits, and you can get it for free or pay a small monthly fee to upgrade your rewards.

To learn everything about this convenient debit card, read the full review on the following link.

Aspiration Spend & Save™ debit card review

You deserve a better way to spend your money that will help you save more, while you help to minimize your environmental impact.

About the author / Danilo Pereira

Trending Topics

Cryware: the malware that’s targeting crypto hot wallets

There’s a new malware targeting crypto hot wallets. The Cryware info-stealing strategy can cause irreversible damage to investors’ funds.

Keep Reading

NedBank Gold Card online application

Here’s a guide on how to apply for the NedBank Gold Card with all the information you need to know about this exclusive credit card.

Keep Reading

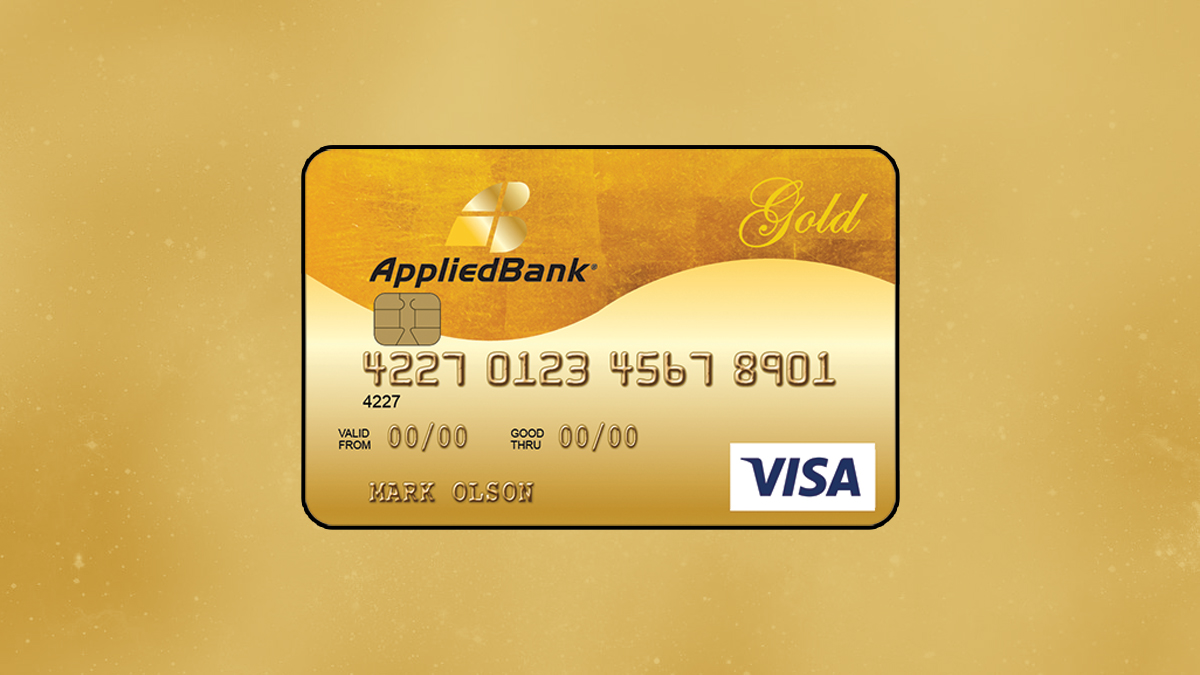

Applied Bank® Secured Visa® Gold Preferred® Card application

Learn all you need to know about the Applied Bank® Secured Visa® Gold Preferred® Card application process and get your score up!

Keep ReadingYou may also like

Education Loan Finance application

Learn how the Education Loan Finance application process works and how you can get your rates estimates without affecting your score!

Keep Reading

How to get your JetBlue Plus Card: online application

In this JetBlue Plus Card application guide, you will learn how to get this card to start earning 6X per dollar on JetBlue purchases and more.

Keep Reading

Members 1st Federal Credit Union Personal Loans application guide

Read this Members 1st Federal Credit Union Personal Loans application guide to apply in minutes and get fast approval!

Keep Reading