Loans

Zippyloan review: get a loan easily

Read this Zippyloan review to find out how this tool helps you get many loan offers by filling in a single form.

Advertisement

Zippyloan: A faster and easier way to get your funds

Whether you are looking for a short-term loan or need to borrow for a more extended period of time, this loan aggregator has your back. Have a look at this Zippyloan review and learn about it.

Applying for Zippyloan: Get multiple loan offers

Read this Zippyloan application guide and learn how to get multiple loan offers by filling in a single online form.

With low borrowing minimums, quick approval and fast fund disbursement, this tool focus is to provide borrowers with a fast and easy service that everyone can access.

You can use your loan to pay bills, consolidate debt, take a vacation, and much more.

- APR: Dependent on credit score, loan amount, loan term, credit history, and possibly other factors.

- Loan Purpose: Large purchase, renovation or repair, debt consolidation, other unexpected expenses, and more.

- Loan Amount: $100 to $15,000

- Credit Needed: No minimum

- Terms: Up to 5 years

- Origination Fee: Dependent on lenders

- Late Fee: Dependent on lenders

- Early Payoff Penalty: Dependent on lenders

How does Zippyloan work?

Zippyloan is an online loan aggregator which matches borrowers with lenders, offering a number of personal loan options that fit a variety of profiles.

Through this tool you will find loans ranging from $100 to $15,000, which you can use to pay for small or big expenses such as utility bills, home improvements and much more.

With this tool, your personal loan limit varies according to lenders. Because Zippyloan is not a lender, it does not define loan terms and amounts. Rather, these are dependent on the lenders.

You can find loan terms ranging from 6 months to 72 months, but you can find what they call “payday loans”. These are very short-term loans which you will repay in full by your next payday.

There are no minimum income requirements for you to apply through Zippyloan.

However, you must be able to provide proof of income, otherwise you may not qualify.

If you do not have a good credit score, you do not need to worry.

You can still submit an application, and Zippyloan will likely match you with a lender willing to hand you some cash.

With Zippyloan you will basically apply for multiple loans with a single application form, and then have lenders competing for your business.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Zippyloan: should you apply for it?

Now you are familiar with this lender’s details. However, our Zippyloan review would not be complete without a comparison between its benefits and disadvantages.

So have a look at the list of pros and cons we have prepared for you below.

Pros

- Fast approval and funding

- It does not require a good credit score

- Offers lenders with low borrowing minimums

- Get multiple loans offers through a single application

Cons

- Low maximum loan amount

- Potentially high interest rates

- Does not guarantee you the platform will match you with a lender

- Sells your info to lenders

What is the required credit score?

Zippyloan does not have any credit score requirements. However, lenders available on the platform have their own specifications about credit requirements, and not all credit scores will get equal offers.

Learn how to apply for Zippyloan

If you like how Zippyloan works, you can take the next step and use it to get your loan. Just click the link below and we will take you through the process step by step.

Applying for Zippyloan: Get multiple loan offers

Read this Zippyloan application guide and learn how to get multiple loan offers by filling in a single online form.

About the author / Danilo Pereira

Trending Topics

First Access Visa® card application

You can apply for the First Access Visa® card in just a few minutes and no hard inquiry will be made on your credit score.

Keep Reading

The Best Instant Approval Department Store Credit Cards

Don't wait to shop in style! Our blog post showcases the best department store cards that offer instant approval.

Keep Reading

Honest Loans: Get multiple loan offers with one application

Learn how to use this amazing tool to find the best loan offers filling a single application at the Honest Loans website.

Keep ReadingYou may also like

How to get your Crypto.com Visa Card: online application and generous perks

In this Crypto.com Visa Card application guide you will learn how to get this card so that you can use your crypto for real-world purchases.

Keep Reading

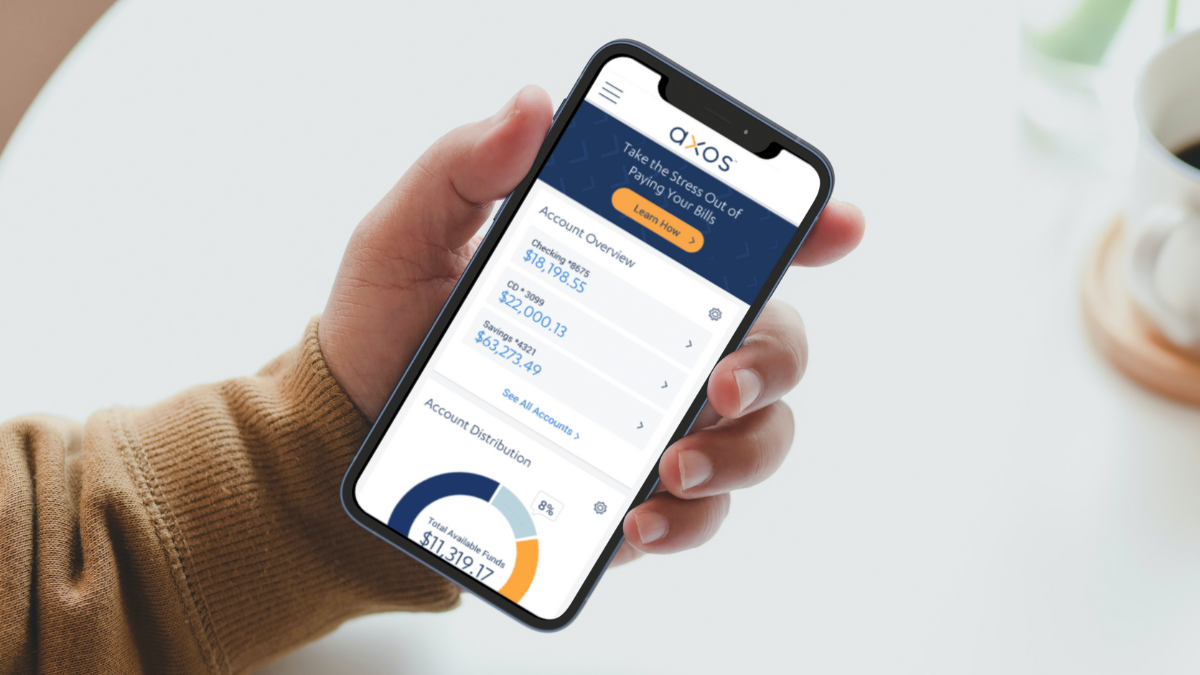

How to open your Axos Rewards Checking account easily

In this Axos Rewards Checking account application guide we are going to show you how you can open an account in just a few minutes.

Keep Reading

Best Egg Personal Loan review

Get the facts and insights on the Best Egg Personal Loan with our in-depth review. Learn all you need to know about their services!

Keep Reading