Loans

Rise Credit Review: A Reliable Lending Solution!

With a quick application process and payments reported to major credit bureaus, Rise Credit can help you build positive financial habits! Enjoy an empowering better way to borrow!

Advertisement

Empower your financial future with a better way to borrow and get quick access to funds!

Not sure about getting a loan? Explore Rise Credit and review its features that allow you to rescind a loan within a specified period without incurring any fees or interest charges!

Moreover, with Rise Credit, borrowers have the flexibility to choose a payment schedule that aligns with their financial situation. This flexibility offers an opportunity for different financial profiles.

Beyond the conventional lending experience, Rise stands as the perfect option for those seeking a better way to borrow. So, keep reading and find out how this revolutionary platform works.

- APR: The exact rate is determined during the application process, but it ranges from 60% to 299%;

- Loan purpose: Rise Credit loans cater to a range of financial needs;

- Loan amount: Borrowers can apply for loan amounts ranging from $2250 to $5000;

- Credit needed: Specific credit score requirements aren’t explicitly mentioned;

- Terms: From 16 to 36 months;

- Origination fee: N/A;

- Late fee: N/A;

- Early payoff penalty: Doesn’t charge a fee for early payoff.

Rise Credit: how does it work?

So, if you’re in need of some quick funds, Rise Credit offers a user-friendly application process that you’ll review later in this post. But it’s important first to understand how it works.

Firstly, the platform considers a range of factors to determine approval, including credit history, income, and loan repayment history. So, before you start, make sure you’re eligible.

Moreover, borrowers can expect to access loan amounts ranging from $2250 to $5000. And the repayment terms are customizable, spanning from 16 to 36 months.

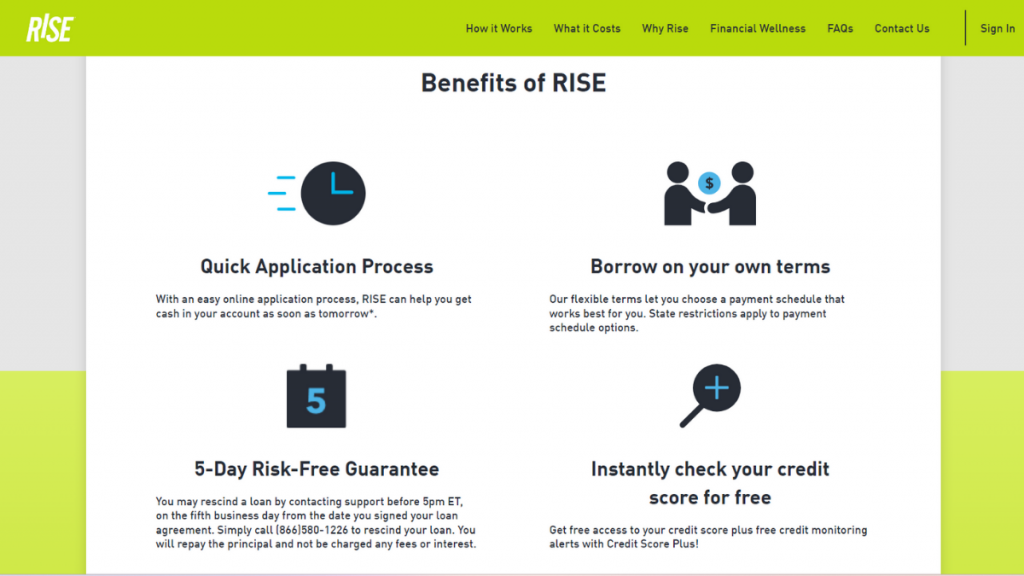

This way you can choose a payment schedule that aligns with your budget. Plus, Rise takes pride in providing quick access to cash. This ensures you can address your financial needs promptly.

But, one of the most distinguishable features is the 5-day risk-free guarantee. With it, borrowers have the option to rescind a loan.

All you have to do is contact the support before 5 pm ET on the fifth business day from the loan agreement signing date. This allows you to reconsider your decision without incurring any fees.

Finally, Rise Credit offers tools to help customers build and understand their credit. Payments are reported to a major credit bureau, enabling borrowers to showcase positive financial behavior.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Significant benefits and disadvantages you may find

From flexible terms to potential drawbacks, review the pros and cons of Rise Credit and make sure this is the right financial tool for your situation.

Whether you’re drawn to its flexible repayment terms or considering the nuances, explore the topics below and get a thorough understanding of this lending platform.

Benefits

- Flexibility to choose a timeline for repayment;

- Guarantees a risk-free period;

- Tailored amounts to borrow;

- Enables borrowers to showcase positive financial behavior;

- Transparent application process.

Disadvantages

- APR based on the borrower’s financial situation;

- Subject to minimum income requirements;

- State-imposed constraints on terms.

Is a good credit score required for applicants?

Although not the sole determinant for eligibility, a good credit score is advantageous when applying for Rise Credit.

Rise Credit application

Want to get quick access to funds? Then review this easy step-by-step and learn how to apply for Rise Credit!

- Visit Rise Credit website: Start by visiting the official website. Then, navigate to the application section, usually prominently displayed on the homepage.

- Click “Apply Now.” Firstly, you’ll need to create an account to access the form. Next, log in and fill out the application form with personal details such as your name, address, date of birth, and contact information.

- Choose loan amount: After providing the necessary information, select the loan amount you are seeking and choose the repayment terms.

- Submit application and await approval: Finally, submit the form. Rise Credit will evaluate your application, considering factors like credit history and income. Once approved, Rise Credit will deposit the funds in your bank account.

What about another recommendation: CreditFresh!

So, I’m not sure Rise Credit is for you, and I want to review other valuable options. What about CreditFresh? This platform offers a streamlined online application, ensuring quick access to funds.

Whether you are new to the world of online lending or exploring options beyond conventional loans, CreditFresh is a potential solution for your credit needs. So, get insights that will help you make the right choice!

CreditFresh Review: Enhance Your Credit Profile!

If you want to borrow responsibly, build your credit, and access funds whenever you need them, review CreditFresh Line of Credit!

About the author / VInicius Barbosa

Trending Topics

Cash App: how does it work?

Unlock the secrets behind the success of Cash App and learn how it works to simplify digital payments and even crypto investments.

Keep Reading

Honest Loans: Get multiple loan offers with one application

Learn how to use this amazing tool to find the best loan offers filling a single application at the Honest Loans website.

Keep Reading

Indigo® Mastercard® Credit Card review

Read our Indigo® Mastercard® Credit Card review to learn how this unsecured card can put your finances back on track starting today.

Keep ReadingYou may also like

AMEX SimplyCash™ Preferred credit card review

You can get a card with a $400 potential welcome bonus. Read this AMEX SimplyCash™ Preferred review to see how it works.

Keep Reading

What is an NFT? Find out once and for all!

It's past time for you to learn what an NFT is, and this post will tell you all about it. Read this content to update yourself on this topic.

Keep Reading

CreditSoup Consumer Connect review

In this CreditSoup Consumer Connect review you will learn about the pros and cons of this excellent financial services aggregator!

Keep Reading