Credit Cards

Indigo® Mastercard® Credit Card review

The Indigo® Mastercard® Credit Card is a solid unsecured credit card for those with bad credit. You can get a $300+ credit limit without having to put down a security deposit. Read our review to learn more!

Advertisement

Indigo® Mastercard® Credit Card: Get a $300+ credit limit.

Do you want a credit card that can help improve your financial future? The Indigo® Mastercard® Credit Card could be the perfect choice for you.

With this card, you’ll enjoy access to helpful features and benefits that can make it easier to manage your money and build your credit score.

Plus, there are plenty of ways to use your Indigo® Mastercard®, so you can choose the option that best meets your needs.

Ready to learn more? Keep reading our review for more information about this card and how it can help you reach your financial goals.

How to get the Indigo® Mastercard® Card?

Learn how to apply for the Indigo® Mastercard® Credit Card and start your parth on a a better financial future.

- Sign-up bonus: This card doesn’t offer a sign-up bonus.

- Annual fee: $0, $59 or $75 during the first year and $99 after that, based on creditworthiness.

- Rewards: There are no rewards.

- Other perks: Helps repair damaged credit ratings.

- APR: 24.9% on purchases and 29.9% on cash advance.

Indigo® Mastercard® Credit Card: is it a good card?

The Indigo® Mastercard® Credit Card is an unsecured card designed to help people with a bad credit score to get their finances back on track.

Issued by Celtic Bank, the card does not require a security deposit and provides an initial credit line of $300+ based on creditworthiness. This card charges an annual fee that is also based on creditworthiness and can vary from $0 to $99.

Indigo’s main purpose is to assist its customers to improve their credit scores. So while this card doesn’t offer rewards on purchases, it does a good job at reporting all payments to the major credit bureaus in the country.

People with a bad credit score are welcome to apply, and the company performs a soft pull on all pre-qualifications. That means you can check your chances of approval without harming your credit score.

The card’s APR is a solid 24.9% on purchases and 29.9% on cash advance. To have better chances at improving your score faster, it’s important to not carry a balance and pay your bill in full and on time on a monthly basis.

By acquiring an Indigo® Mastercard® Credit Card, you’ll get fraud protection and free access to your account with their mobile app.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Indigo® Mastercard® Credit Card: should you get one?

The Indigo® Mastercard® Credit Card is a great option for people with bad credit scores who want to improve their financial future.

The card has some great benefits, but there are also a few downsides to consider before applying. Here’s what you need to know about the pros and cons of this product.

Benefits

- Does not require a security deposit;

- Performs a soft pull on pre-qualifications;

- Initial credit limit of $300+;

- Provides fraud protection;

- Reports account history to the three major U.S. credit bureaus.

Disadvantages

- There are membership fees;

- High APR;

- No sign-up bonus or rewards.

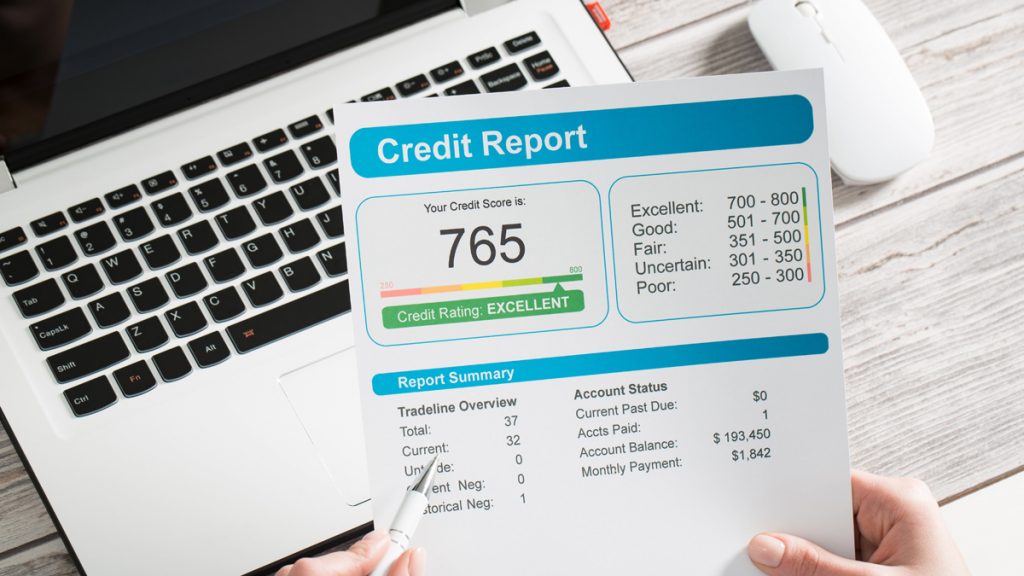

What is the required credit score?

When it comes to getting a credit card, you may be wondering if you need a good credit score in order to apply. The answer is: not necessarily!

While having a good credit score will certainly help your chances of being approved for any credit card, there are some cards that are designed specifically for people who have less-than-perfect credit scores.

The Indigo® Mastercard® Credit Card is one such card. Therefore, you can apply even if you have a bad credit history.

Indigo® Mastercard® Credit Card application

Get the financial freedom you deserve and start your path on a healthier financial future today with Indigo.

Getting your finances in check might be easier than you’d believe, and this product can be your ally on the journey to a better credit score.

Check the link below to learn more about the application process and what you need to do to pre-qualify for this card.

How to get the Indigo® Mastercard® Card?

Learn how to apply for the Indigo® Mastercard® Credit Card and start your parth on a a better financial future.

About the author / Aline Barbosa

Trending Topics

What is a student loan and how do they work?

If you’ve ever wondered what a student loan is and how they work, we’ve got you covered. Read on to learn all you need to know!

Keep Reading

Petal® 1 Visa® or Petal® 2 Visa®: which card is better?

Unsure if you should get a Petal® 1 Visa® or Petal® 2 Visa®? Check out this comparison to help make your decision.

Keep Reading

Tax mistakes that could get you audited by the IRS

Avoid making these common tax mistakes that could get you audited by the IRS. Read on to learn more about what to watch out for!

Keep ReadingYou may also like

Red Arrow Loans review: get a loan easily

In this Red Arrow Loans review you will see how this marketplace with multiple lenders can help you get the loan you need.

Keep Reading

Credit card safety: 8 tips to help keep you safe

Worried about your credit card safety? Here are 8 applicable tips that will help you stay safe and secure your credit card.

Keep Reading

PREMIER Bankcard® Mastercard® Credit Card review

Are you looking for a product to help you fix your score? Then look at what the PREMIER Bankcard® Mastercard® Credit Card has to offer.

Keep Reading