Credit Cards

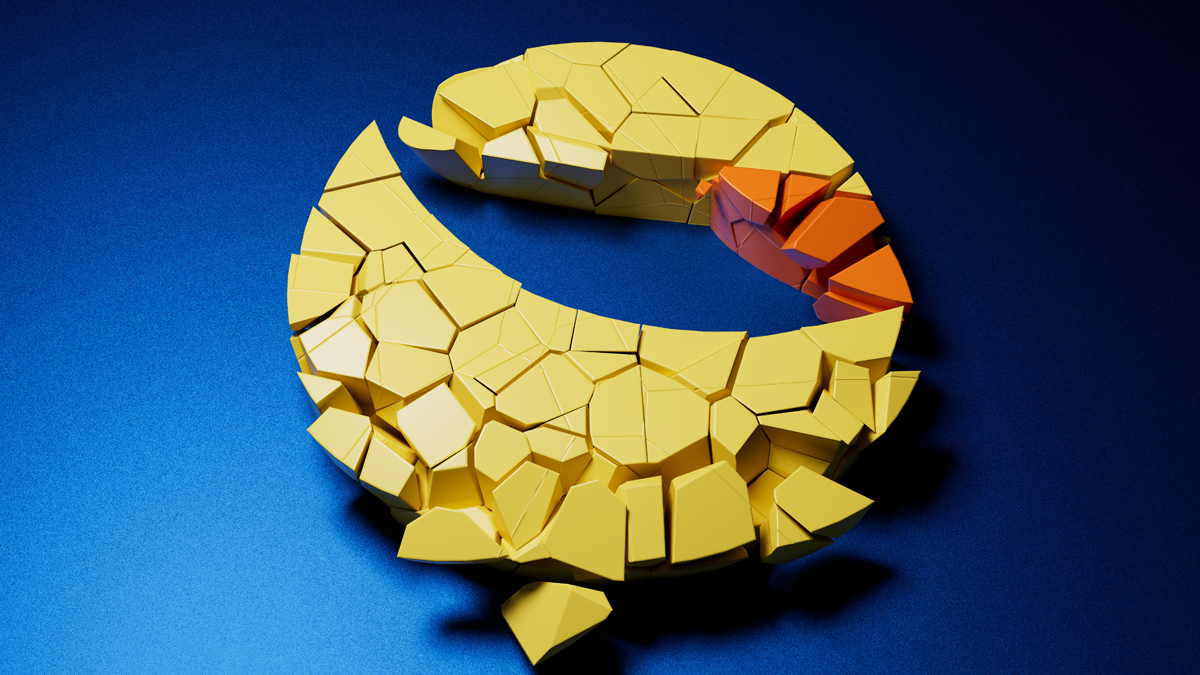

Crypto.com Visa Card review: spend your crypto assets

Read this Crypto.com Visa Card review and find out about how this card gives you easy access to your crypto assets for real-world spending.

Advertisement

Convert your funds to a prepaid debit card and avoid lead times of several days

With this card, you will gain easy and quick access to your crypto assets so that you can use them for real-world spending. Find out how in this Crypto.com Visa Card review.

How to get your Crypto.com Visa Card

In this Crypto.com Visa Card application guide you will learn how to get this card so that you can use your crypto for real-world purchases.

- Credit Score: N/A

- APR: N/A

- Annual Fee: $0

- Fees: ATM fees apply with different requirements for different staking profiles.

- Welcome bonus: N/A

- Rewards: 1% to 5% cash back depending on staking profile.

With more and more people holding digital currencies, it has become increasingly evident that some form of accessing assets other than speculative trading is necessary.

This card works as a prepaid card that allows you to quickly convert crypto into fiat to make purchases.

Crypto.com Visa Card: how does it work?

The Crypto.com Visa Card is not just one card. It is a series of cards divided in levels of staking. The more you stake, the more perks and benefits it gives you access to.

The card makes it possible for cardmembers to earn cash back in the form of Crypto.com’s own cryptocurrency token known as CRO.

You can then convert your CROs into other digital coins or fiat currency.

Each level of staking unlocks a different level of cash back rewards, perks and benefits, and gives you access to a different card.

If you stake $0 you get the Midnight Blue card. This card earns no cash back and if you make withdrawals that exceed $200 a month at ATMs there will be a fee.

With the Ruby Steel card, the second in line, has a $400 staking requirement. With it you get 6 months of monthly reimbursement for Spotify subscriptions.

You will also earn 1% cash back while you have money at stake. Also, the fee-free ATM limit is $500 per month.

The Royal Indigo and the Jade Green cards are third in line. The staking requirement for both is $4,000 and they earn 2% cash back, plus CRO rewards (up to $50) on spending.

Other perks for the Royal Indigo and Jade Green cards include 6 months of monthly reimbursement for Spotify and Netflix subscriptions. Also, the fee-free ATM withdrawal limit is $800 a month.

The Frosted Rose Gold and Icy White cards are the second highest ones. The staking requirement for both is $40,000.

They offer monthly reimbursement on Spotify, Amazon Prime and Netflix subscriptions.

Both cards earn 3% cash back if you stake your crypto, and 1% if you don’t.

Both offer CRO rewards on spending, and the monthly ATM withdrawal limit is $1,000.

Finally, the highest card, Obsidian, has a $400,000 staking requirement. It earns 5% cash back if you stake your crypto and 2% if you don’t.

The Obsidian card also offers monthly reimbursements on Spotify, Amazon Prime and Netflix subscriptions, and the monthly ATM withdrawal limit is $1,000.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Significant benefits and disadvantages you may find

Now that you know about all of these cards, how about a comparison between its pros and cons? Our Crypto.com Visa Card review would not be complete without it. Check it out.

Benefits

- $0 annual fee

- No credit pull

- Instant access to funds

- Potentially high cash back earnings

Disadvantages

- High staking requirements

- Low monthly ATM limits

- No welcome bonus

- Volatility of crypto

Is a good credit score required for applicants?

The Crypto.com Visa Card is a prepaid card. As such, it does not require applicants to have good credit.

Learn how to apply and get a Crypto.com Visa Card

If you like what you have seen in this Crypto.com Visa Card review, you might want to apply for this card. If that is the case, click the link below and we will show you exactly how to do it.

How to get your Crypto.com Visa Card

In this Crypto.com Visa Card application guide you will learn how to get this card so that you can use your crypto for real-world purchases.

About the author / Danilo Pereira

Trending Topics

What credit score do you need to buy a house?

Trying to figure out the right credit score to buy a house? Well, you have come to the right place. Read our article and find out!

Keep Reading

Lowe’s Advantage Card application

Learn about the Lowe’s Advantage Card application process and see how it can save you money on your next home improvement project.

Keep Reading

Oportun® Visa® Credit Card application

Learn about the simple application process for the Oportun® Visa® Card - a card that helps people build a credit history with affordability.

Keep ReadingYou may also like

Get your ABSA Flexi Core Credit Card: online application

In this ABSA Flexi Core Credit Card application guide, you will learn how to get this card to start enjoying its amazing benefits.

Keep Reading

LUNA 2.0 price drops 67% hours after its launch

The LUNA 2.0 price correction hours after its launch has the crypto market wondering if Terraform Labs will recover after LUNA’s collapse.

Keep Reading

US Bank Shopper Cash Rewards® Visa Signature® Review: Earn More!

Your key to personalized rewards and financial freedom starts in this US Bank Shopper Cash Rewards® Visa Signature® Card review!

Keep Reading