SA

Live Better App review: Loyalty Rewards & Money Management Tools at Your Fingertips

How about a tool that brings together discounts, special deals, personalized financial advice and much more? Learn about it in this Live Better App review.

Advertisement

Understanding Live Better App: Revolutionize Your Financial Health with this Personalized Wellness Program

Are you looking for a way to improve your financial wellness? In this Live Better App review, we’ll highlight its personalized insights, loyalty rewards, and budgeting tools.

How to get your Live Better App easily

Apply for this app today and get rewards for responsible financial behavior. Follow our Live Better App application.

- Fees: N/A

- APY: N/A

- Benefits: Personalized financial insights and advice, access to a range of educational content, rewards for positive financial behavior, loyalty program, discounts and special deals, a range of financial resources and tools, access to personal loans and credit.

- Investment Options: Savings Account

With this app you’ll get personalized financial insights based on your spending habits.

Also, gain access to educational resources on budgeting, saving, and investing, and rewards for positive financial behavior. Read on and learn all you need to know.

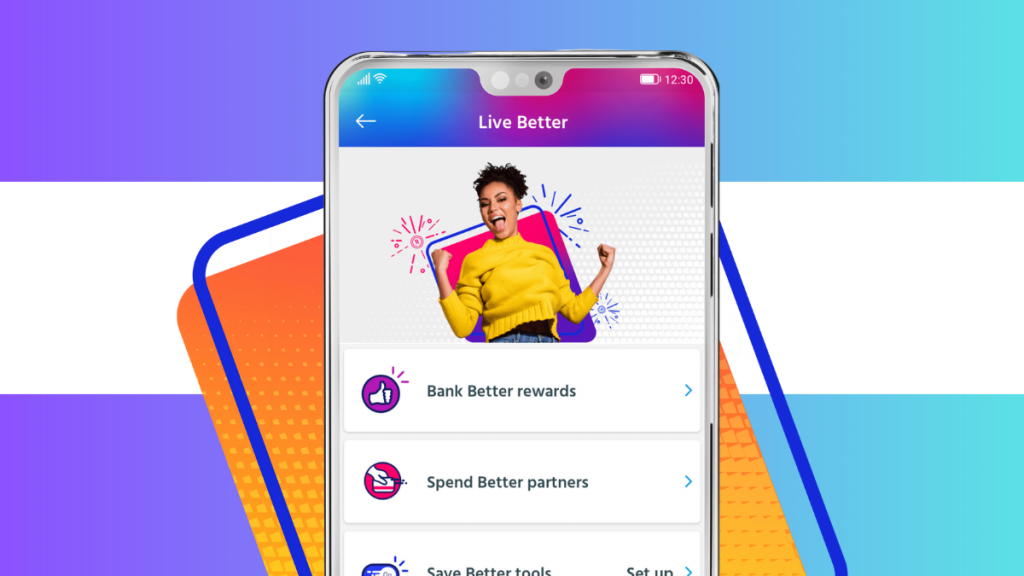

Live Better App: understand how it works

Capitec Bank’s Live Better App offers a comprehensive range of tools, resources, and educational content. These features help clients improve their financial well-being and overall health.

How about a mobile app that provides personalized financial insights and advice based on your spending habits and goals? Let’s review the Live Better App features.

You’ll get easy access to a wealth of educational content such as articles and videos on topics like budgeting, saving, and investing.

Moreover, the program features a loyalty program that rewards customers for their positive financial behavior. That means saving money and paying bills on time.

In addition, Capitec Bank offers a variety of programs to help customers manage their finances effectively and achieve their financial goals.

For example, the Bank Better rewards program incentivizes responsible financial behavior. It allows you to earn rewards points for activities such as making electronic payments and saving money.

You can then redeem those points for discounts and rewards from a range of partner retailers.

Also, the Spend Better partners program partners with retailers and service providers.

Thanks to that, you’ll get discounts and special deals on everyday purchases through the Capitec app or by using the Capitec card.

Additionally, Save Better tools give you automatic savings plans, budgeting tools, and personalized insights. All of it based on your spending and savings habits.

Finally, Capitec’s Money up program offers access to personal loans and credit through the Capitec app. That allows you to apply for loans of up to R250,000 with repayment terms of up to 84 months.

The program also provides clients with valuable insights and recommendations to help them manage their debt and improve their credit score over time.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Significant benefits and disadvantages you may find

So far in our Live Better App review we have gone deep into some of this app’s details. So let’s put the benefits and disadvantages side by side and compare them.

Benefits

- Personalized financial insights and advice.

- Educational content on budgeting, saving, and investing.

- Loyalty program rewards for positive financial behavior.

- Access to personal loans and credit.

Disadvantages

- Limited investment options.

- No physical branches for in-person support.

- No mention of security measures.

Is a good credit score required for applicants?

No, you do not need to have a good credit score to use the Live Better App. However, there may be further requirements if you wish to access their credit tools.

Learn how to apply and open a Live Better App

Ready to take control of your finances? Get the Live Better App with our helpful application guide. Click below to learn how.

How to get your Live Better App easily

Apply for this app today and get rewards for responsible financial behavior. Follow our Live Better App application.

About the author / Danilo Pereira

Trending Topics

Citrus Loans online application: Get multiple loan offers!

In this Citrus Loans application guide you will learn how to easily and quickly find lenders that are willing to provide you with funds.

Keep Reading

How to get an 800 credit score

An 800-point credit score will help you get the best credit card options and loan terms available in the market. Learn how to get there!

Keep Reading

How can you invest in Series I savings bonds?

Learn everything you need to know about Series I savings bonds, including what they are, how they work, and where to buy them.

Keep ReadingYou may also like

TD Direct Investing review: a top broker platform

Read this TD Direct Investing review and you'll understand why this is one of the top online brokerage platforms to use in Canada.

Keep Reading

LendingPoint Personal Loans review: get a loan easily

LendingPoint Personal Loans offer fast approval for applicants with less-than-perfect credit and quick access to funds. Read this review!

Keep Reading

Vast Visa Signature® College Real Rewards Card: Life Made Easier!

Discover the benefits of the Vast Visa Signature® College Real Rewards Card. Earn 1.5% cashback and build your credit effortlessly!

Keep Reading