Credit Cards

Vast Visa Signature® College Real Rewards Card: Life Made Easier!

Find out how the Vast Visa Signature® College Real Rewards Card can make college life more rewarding and financially savvy. Plus, get 0% introductory APR on purchases for the first 6 billing cycles!

Advertisement

Smart money moves: learn how this card is the perfect companion for people seeking financial independence!

Navigating the financial landscape can be both exciting and challenging, but the Vast Visa Signature® College Real Rewards Card is here to help manage your finances more effectively.

Whether you’re looking to earn rewards on your everyday purchases, build a strong credit foundation, or manage your finances more effectively, this card offers a host of benefits!

So, get ready to embark on a journey towards financial empowerment and discover how the Vast Visa Signature® College Real Rewards Card can be your key to a brighter financial future.

- Credit Score: Tailored for those new to credit-building.

- Annual Fee: Enjoy the benefits of this card without any annual charges.

- Intro offer: None.

- Rewards: Cardholders can earn 1.5% cashback on all eligible purchases, Zero Fraud Liability and Travel Assistance.

- APRs: Experience a special 0% APR for the opening 6 billing cycles, 19.74% – 29.74% variable after.

- Other Fees: Expect a 3% fee for Foreign Transactions and balance transfers with this card, as well as a $41 charge for late payments.

Vast Visa Signature® College Real Rewards Card: how does it work?

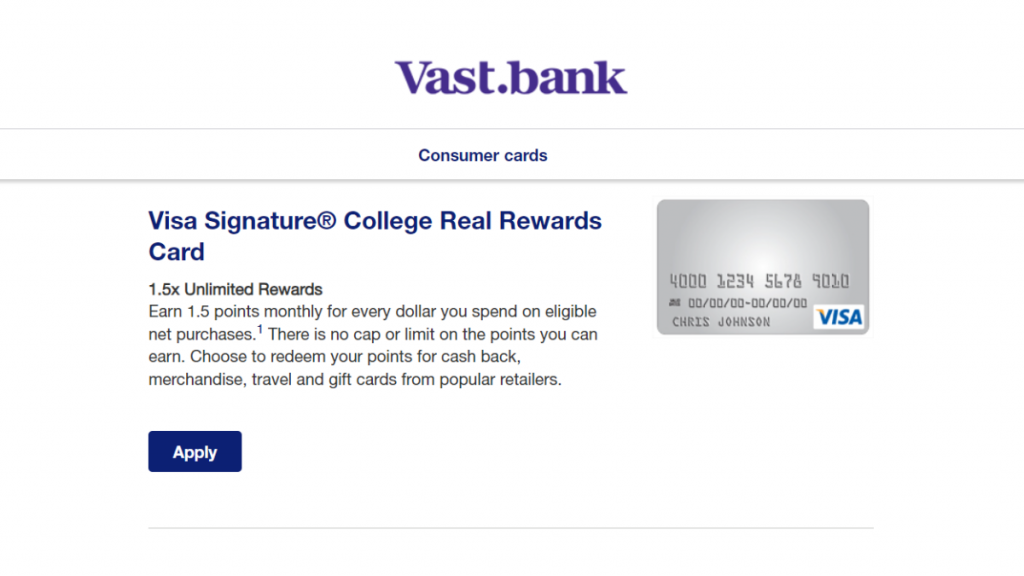

The Vast Visa Signature® College Real Rewards Card is a versatile financial tool for individuals looking to manage their finances! One of the standout features of this card is its cashback rewards program.

Moreover, cardholders can earn a flat 1.5% cashback on every eligible purchase. The absence of an annual fee is another significant advantage. Additionally, the card typically offers a 0% introductory APR.

However, this card imposes a 3% fee on foreign transactions, which can add to the cost of using the card for international purchases. If you’re a frequent traveler, this might not be the best option for you.

In conclusion, this credit card offers a compelling package of benefits for individuals looking to manage their finances. But, you should carefully assess your financial needs to determine whether this card aligns with your goals.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Significant benefits and disadvantages you may find

Exploring the world of credit cards often involves weighing the pros and cons of each option. So, prepare to delve into the benefits and drawbacks of the Vast Visa Signature® College Real Rewards Card!

From cashback rewards and credit-building opportunities to fees and limitations, find out the key factors that can impact your experience with this credit card. Check below to see if this card is the right fit!

Benefits

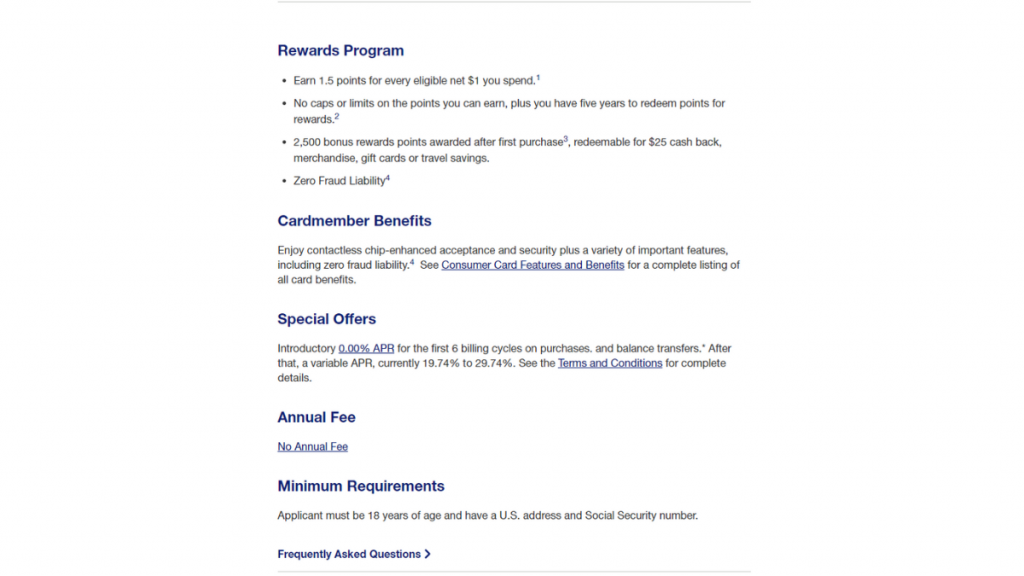

One of the main positive features of this card is the 0% introductory APR offer on purchases and balance transfers for the first six billing cycles. Besides, you get 2,500 points on your first purchase!

Plus, cardholders have access to online account management, allowing them to monitor their transactions easily. Some other benefits this card has to offer include:

- 1,5% cashback for every dollar spent on eligible purchases

- Flexible redemption options

- $0 annual fee

- Zero Fraud Liability

- 24/7 service

- Travel Assistance

Disadvantages

Just like every credit card out there, the Vast Visa Signature® College Real Rewards has some drawbacks that you should take into consideration before applying. For example, the variable APR.

Although the intro offer of 0% APR is quite compelling, after the 6 billing cycles, the variable APR is 19.74% to 29.74%, depending on your creditworthiness. Other important cons to consider include:

- Foreign transaction fee

- Limited travel benefits

- Flat cashback rewards

Is a good credit score required for applicants?

While a good credit score can enhance your chances of approval and potentially qualify you for better terms, this credit card is typically designed to cater to individuals who may have limited or no credit history!

However, it’s essential to keep in mind that Vast Bank will still assess your creditworthiness during the application process. They may consider factors beyond just your credit score, such as your income and financial stability.

Learn how to apply and get the Vast Visa Signature® College Real Rewards Card

As you can see, the Vast Visa Signature® College Real Rewards Card could be the key to your financial empowerment. This card offers a wealth of benefits tailored to your unique everyday needs!

So, are you ready to start earning cashback rewards, building credit, and enjoying a 0% introductory APR? Then see below how to secure this invaluable financial tool and apply for this credit card today!

Learn how to get this credit card online

Firstly, start by visiting the Vast Bank official website. Then, find the “Personal” option on the main menu and click to find the “Credit Cards” button. Click to access all the credit card options available.

Now, scroll down until you see the Vast Visa Signature® College Real Rewards Card, and click on “Apply now”. You’ll be directed to an online application form to fill in your personal information.

This may include your name, contact details, social security number, date of birth, and income details. Once you’re done, submit your application electronically and wait for the bank to review it.

Finally, if approved, you will receive your card in the mail within a few weeks. Once you receive your credit card, follow the provided instructions to activate it.

How to get this card using the app

Start by downloading the Vast Bank mobile app on your smartphone. Then, if you’re not already a user of the app, you’ll need to create an account. When you’re done, log in to your account.

Within the app, navigate to the credit card section or even go to Customer Support if you need any help finding or applying for the card.

Once you find the Vast Visa Signature® College Real Rewards Card, click to apply and fill out the application form through the app. Ensure that all the information is accurate and up-to-date.

When you’re satisfied with the information provided, submit the application. If approved, you will receive further instructions, including when to expect your physical card in the mail. It’s that easy!

What about another recommendation: BankAmericard® for Students!

Now that you know the Vast Visa Signature® College Real Rewards Card is an enticing credit card to take control of your finances, how about another good option? Meet the BankAmericard® for Students!

This is an alternative that brings its own set of perks to the table. With competitive interest rates and no annual fee, it’s a straightforward choice for students who value simplicity in their finances.

So, explore our comprehensive review of the BankAmericard® for Students and discover if this card aligns better with your financial goals and college journey. Make an informed choice for your future!

How to get your BankAmericard® for Students

In this BankAmericard® for Students application guide you will learn how to get this card in just a few minutes!

About the author / VInicius Barbosa

Trending Topics

Altitude® Go Visa Signature® Card application

The US Bank Altitude® Go Visa Signature® Card application process is simple and straightforward. Learn how to request yours today!

Keep Reading

Absa Premium Banking Credit Card application: 57 days interest-free

Looking for a card with a long interest-free period? Follow our Absa Premium Banking Credit Card application guide and get yours today!

Keep Reading

BankAmericard® for Students review: 0% Intro APR and No Annual Fee

Build your credit with this credit card and pay no annual fee. Learn all you need to know in this BankAmericard® for Students review!

Keep ReadingYou may also like

How to apply for Merrick Bank Personal Loan easily

Apply for the Merrick Bank Personal Loan today and get approved quickly even if you do not have perfect credit.

Keep Reading

Members 1st Federal Credit Union Personal Loans review

In this Members 1st Federal Credit Union Personal Loans review you will learn about this loan's super-long payment terms and more!

Keep Reading

Aspire® Cash Back Reward Card review

Learn how you can earn generous cash back rewards on your daily purchases in our complete Aspire® Cash Back Reward Card review.

Keep Reading