Loans

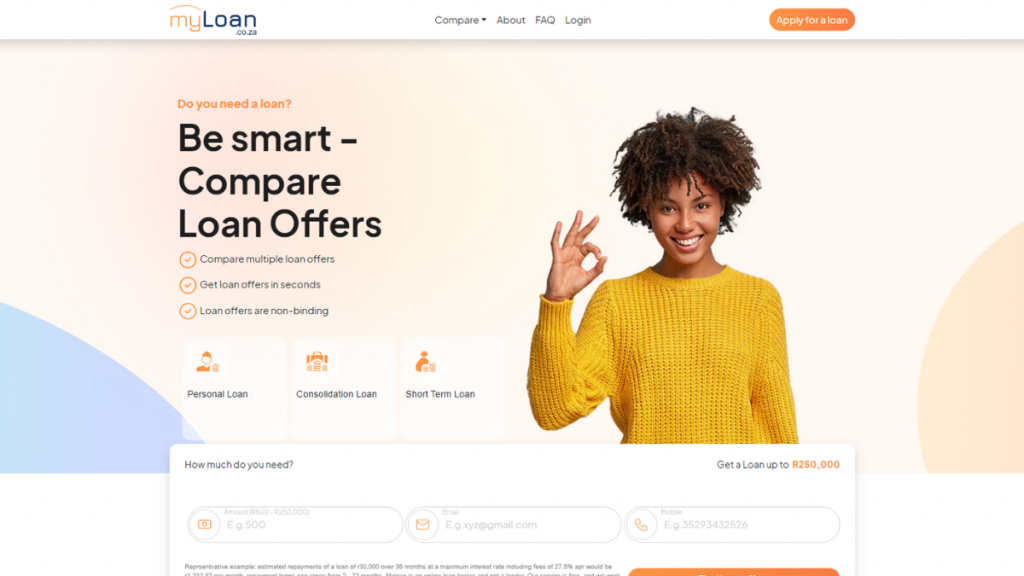

MyLoan review: Up to R250,000!

Are you looking for a loan with good terms and up to R250,000 in loan amounts? If so, read our MyLoan Co review to learn how you can find one through this platform!

Advertisement

MyLoan review: Exploring the Seamless Convenience and Accessibility

This MyLoan review delves into the remarkable services offered by MyLoan Co.! Therefore, you can read on to learn more and see the pros and cons!

Also, this lending platform has taken the financial world by storm with its commitment to convenience and accessibility. So, keep reading!

- APR: As low as 20%;

- Loan Purpose: Personal loans, consolidation loans, short-term loans, solar loans, Mashonisa loans, Payday loans, and cash loans;

- Loan Amount: From R500 to R250,000;

- Credit Needed: All types of credit for different types of loans, amounts, and terms;

- Terms: From 2 to 72 months;

- Origination fee: It varies;

- Late Fee: There can be a late fee if you don’t make your payments on time;

- Early Payoff Penalty: Depending on the lender, there can be an early payoff penalty.

MyLoan: How does it work?

To help South African clients, MyLoan was created. Also, using MyLoan, you may search for and compare the best loans that are available online.

Moreover, your temporary cash requirement will be satisfied thanks to their service’s support in linking you with their credit provider partners.

In addition, you can get a loan amount of up to R250,000, depending on your finances. Therefore, you’ll need to go through an application process to see if you qualify for the loan.

Moreover, there are many loan purposes with this lending platform.

For example, you can get a loan for home deposits, vehicle purchases, medical expenses, debt consolidation, and other personal loan purposes.

However, you should know that the platform itself doesn’t provide loans. This way, only the lenders registered through the platform can borrow money.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

How much will I pay in monthly installments?

How much your monthly installment will be depends on the loan amount and terms and the lender.

Therefore, if you get the same loan amount with two different lenders, you’ll get two deals with monthly repayments.

Moreover, MyLoan Co. will only help you understand your loan needs to find the best lender.

So, you’ll still need to check the terms and conditions and see if the loan can be a safe and smart option for your finances.

Is MyLoan Co. legit?

As we mentioned, you may contrast the terms and interest rates of numerous loans from multiple providers using the MyLoan Co. lending platform.

Moreover, you can be sure that the platform is safe to use and to give your personal information.

However, we still recommend you check who your lender is and read the terms and conditions carefully before you get your loan or apply for it!

Significant benefits and disadvantages you may find

Even though MyLoan Co is a safe platform, there can be some downsides to using a platform such as MyLoan Co.

Therefore, you can check out the benefits and disadvantages of using this platform!

Benefits

One of the best benefits of using MyLoan Co. is that you can get many options for borrowers with no or very poor credit scores.

Moreover, you can make a faster decision to get our loan funds. Also, this can be different from other lending institutions.

Also, you’ll be able to get loans of up to R250,000! Moreover, you’ll be able to get all your loan information online and manage your loan from anywhere!

Disadvantages

As for some of the disadvantages of getting a loan through this platform, you can find that you may be required to pay extra expenses on top of the interest rate for the loan.

Moreover, you can be obliged to pay an interest rate that is higher than what most lenders give if you have a poor credit rating.

In addition, you could not even be qualified for a peer-to-peer loan if your financial profile is very poor.

Is a good credit score required for applicants?

Unfortunately, you’ll need at least a good credit score to get a good loan with good terms through the MyLoan lending platform.

However, you may find some options for those with lower credit scores. But you’ll need to remember that you may not get the best loan terms and rates if you have a lower credit score.

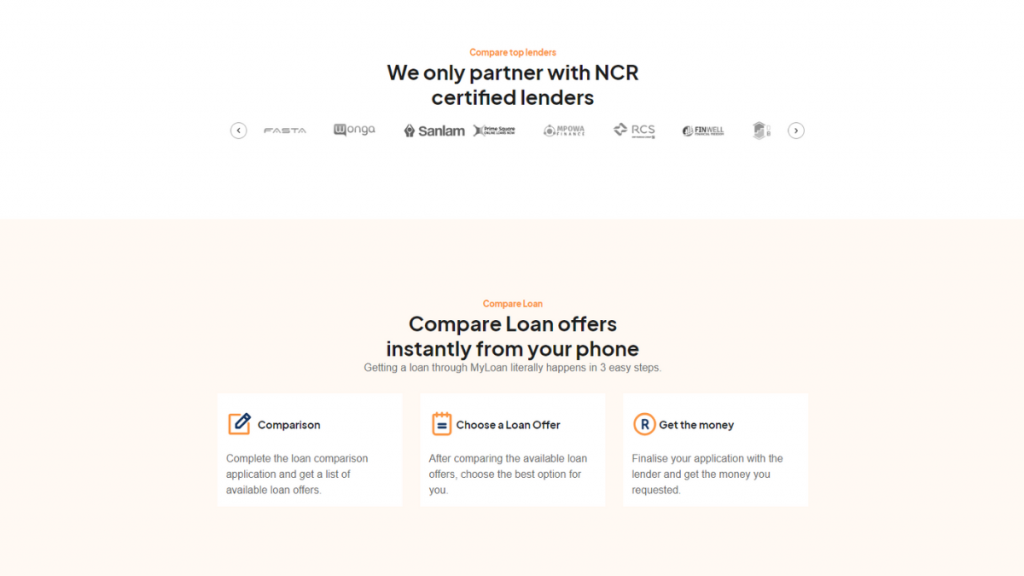

Learn how to apply for and get a loan with MyLoan

Before you start your MyLoan application, you’ll need to compare loan options with different lenders.

Moreover, you’ll need to get your login and provide the personal information required to complete the application process.

Also, you’ll be able to get a loan offer in just seconds after you provide your personal information.

However, you’ll need to know what type of loan and how much you need before applying for a loan like this.

Moreover, you’ll need to make sure you can make the payments on time before you get your loan funds!

Apply online

To apply online for a loan with this lender, you’ll only need to go to their official website and provide the personal information required before you apply.

Then, you can compare lenders and get an offer quickly. After that, you can just read the terms and complete the application for the lender that best suits your needs!

See if you can apply through the mobile app

You can use the MyLoan Co. mobile app to manage your loan options and funds after you get them.

Moreover, applying through the website is the only way to complete the application.

Another great option: African Bank Personal Loan

Now, if you’re looking for a different type of loan that you can get through a bank, you can try applying for a loan through African Bank!

Moreover, you can get incredibly flexible terms and fast approval with this bank.

Also, you’ll be able to find loan amounts that go up to R350,000, depending on your finances.

In addition, this bank offers loans of all types, including personal loan options for all types of finances!

How to apply African Bank Personal Loan

The application process for the African Bank Personal Loan is quick, easy, and can get you the funds you need when you need them.

About the author / Victória Lourenço

Trending Topics

What are the most profitable businesses in 2023?

Want to know which are the most profitable businesses in 2023? Look no further! This post covers everything you need to know.

Keep Reading

LendingPoint Personal Loans review: get a loan easily

LendingPoint Personal Loans offer fast approval for applicants with less-than-perfect credit and quick access to funds. Read this review!

Keep Reading

Credit card safety: 8 tips to help keep you safe

Worried about your credit card safety? Here are 8 applicable tips that will help you stay safe and secure your credit card.

Keep ReadingYou may also like

CashUSA loans application

If you have a couple of minutes, check out the cashUSA loans application process. It is entirely online and you'll get the money fast.

Keep Reading

Standard Bank Blue Credit Card review: Affordable Credit Card with Benefits

In this Standard Bank Blue Credit Card review you will see how you can earn UCount Rewards, Travel Insurance, and more with this card!

Keep Reading

Choose the best savings account for you

If you are looking for the best savings account for you, we might just have what you are looking for. Read on and find out!

Keep Reading