Credit Cards

Ink Business Premier℠ Credit Card application

Discover how easy it is to apply for the Ink Business Premier℠ Credit Card. Find out about the benefits, eligibility requirements, and more in this comprehensive guide!

Advertisement

Ink Business Premier℠ Credit Card: Apply and get one of the most generous welcome bonuses in the market!

Are you ready to take your business finances to the next level? With the Ink Business Premier℠ Credit Card from Chase, you can unlock a world of exclusive benefits that can save you time and money.

This card works for businesses both large and small, helping them stay organized by providing convenience and flexibility when it comes to spending habits.

No matter what type of business you run, this credit card makes an excellent addition to any business wallet.

To begin with, you can earn a one-time welcome bonus of $1,000 cash back by spending $10,000 or more within the first 3 months of membership.

But it’s the ongoing rewards that make this card stand out amongst the rest.

You’ll get 2% back on all your business expenses, and you can bump that amount to 2.5% on purchases of $5,000 or more.

Plus, you’ll have access to exciting travel benefits such as 5% back through Chase Ultimate Rewards® and 0% foreign transaction fees.

The Ink Business Premier℠ Credit Card comes with a $195 annual fee and is a Pay in Full card, which means you have to pay your entire balance every month.

However, you can also pay eligible purchases over time with Chase’s Flex for Business limit, which has a variable APR between 18.74% and 26.74%.

So if you’re ready to grow your business and make it prosper, keep reading to see how easy it is to apply for the Ink Business Premier℠ Credit Card.

Learn how to get this credit card online

You can easily and quickly apply for the Ink Business Premier℠ Credit Card online through Chase’s official website. Access the bank’s homepage, click on “credit cards”, and then, “business credit cards”.

The Ink Business Premier℠ should be the first option to show up. Click on “apply now” to begin the application process.

You’ll have to fill out a standard online form with your personal and financial information, as well as your contact details.

You’ll also have to provide your business information, including its revenue and its estimated monthly spend.

Scroll down to read Chase’s Pricing and Terms as well as their Certifications. Review the information you wrote down to make sure everything is correct.

Then, check the box agreeing to their Terms and click on “submit”. Chase will review your application and give you a quick response.

If you’re approved, you’ll receive an offer with your Flex for Business APR and spending power.

Finally, sign the contract and wait for Chase to issue your new card to your address. Once you get the card, you can activate it online or using Chase’s intuitive mobile app.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

How to get this card using the app

You can also request the Ink Business Premier℠ Credit Card using Chase’s mobile app. Download it for free at your preferred app store and create your account.

Then, tap on the “credit cards” tab and begin the application process.

The entire process is very similar to the online application described on the topic above. If you find any issues, Chase offers a built-in online helper that can guide you through the process.

What about another recommendation: Spark Cash Plus Credit Card

Before signing up for a new card, it’s important to compare your options to make sure you’re getting the best possible offer.

An interesting and similar product to the Ink Business Premier℠ Credit Card, is the Spark Cash Plus Credit Card from Capital One.

With a slightly lower annual fee and unlimited cash back rewards, the Spark Cash Plus offers an interesting alternative to Chase’s new product.

To learn what it has to offer for your business and how to apply for it, check the link below!

Spark Cash Plus Credit Card application

The Spark Cash Plus Card from Capital One is a solid money management tool for your business. Learn how you can apply for it!

About the author / Aline Barbosa

Trending Topics

First Citizens Bank Rewards Review: Powerful Rewards!

If you’re looking for a credit card that transforms everyday spending into exciting rewards, review the First Citizens Bank Rewards!

Keep Reading

Journey Student Rewards from Capital One review

If you're a student, you should read this Journey Student Rewards from Capital One review to learn its benefits.

Keep Reading

Simplii Global Money Transfer review: convenient and inexpensive

Simplii Global Money Transfer review: send money anywhere in the world, using multiple currencies, and paying zero transfer fees.

Keep ReadingYou may also like

Best Egg Personal Loan review

Get the facts and insights on the Best Egg Personal Loan with our in-depth review. Learn all you need to know about their services!

Keep Reading

Tips on how to live a minimalist lifestyle

Discover how to live a simpler life with these tips for living a minimalist lifestyle. Learn the benefits of minimalism today!

Keep Reading

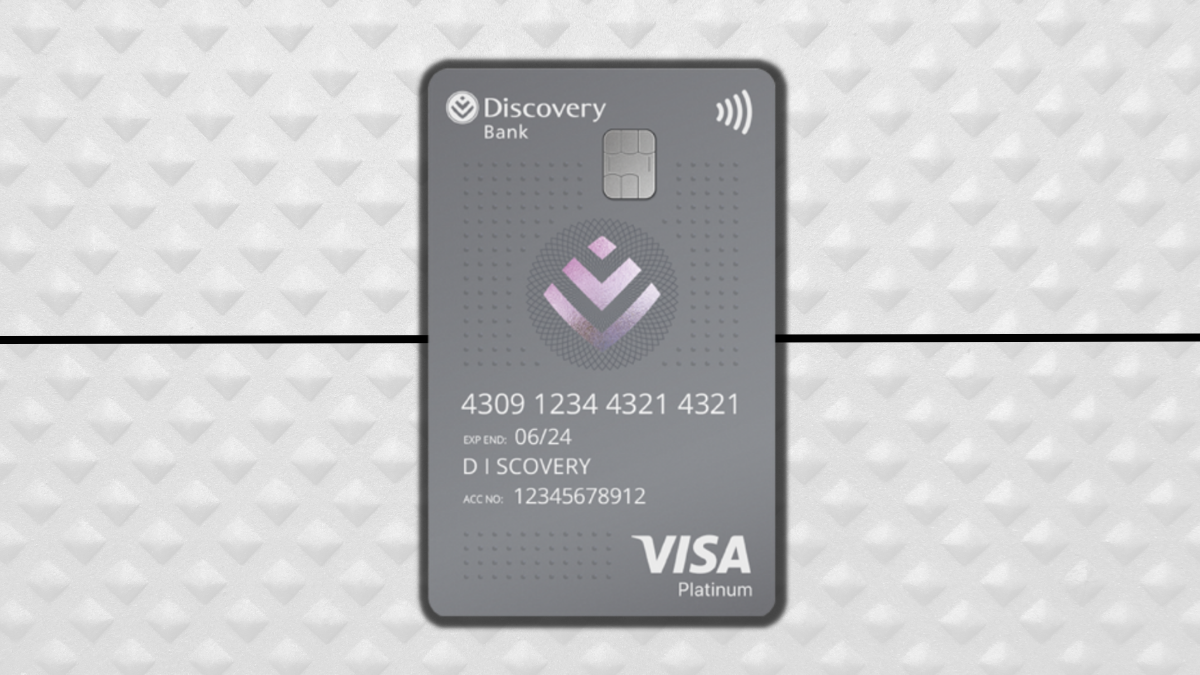

Discovery Bank Platinum Card application: Flexible credit facilities

In this Discovery Bank Platinum Card application guide you are going to learn how to get this card in just a few minutes.

Keep Reading