Credit Cards

First Citizens Bank Rewards Review: Powerful Rewards!

Maximize your rewards with the First Citizens Bank Rewards Card! From groceries to streaming, earn points effortlessly. Benefit from a competitive APR and exclusive redemption options.

Advertisement

Earn points on groceries, streaming services, and more!

In this review, you’ll learn that the First Citizens Bank Rewards Card is your key to a more rewarding lifestyle. You can earn points effortlessly on daily expenses and begin your journey to smarter spending!

So, are you ready to make the most out of your everyday spending? Then keep reading to learn more about the features, benefits, and drawbacks of the First Citizens Bank Rewards Credit Card!

- Credit Score: Good to excellent range in order to be approved.

- Annual Fee: Zero.

- Intro offer: For the first 12 months of card usage, take advantage of a 0% APR on balance transfers.

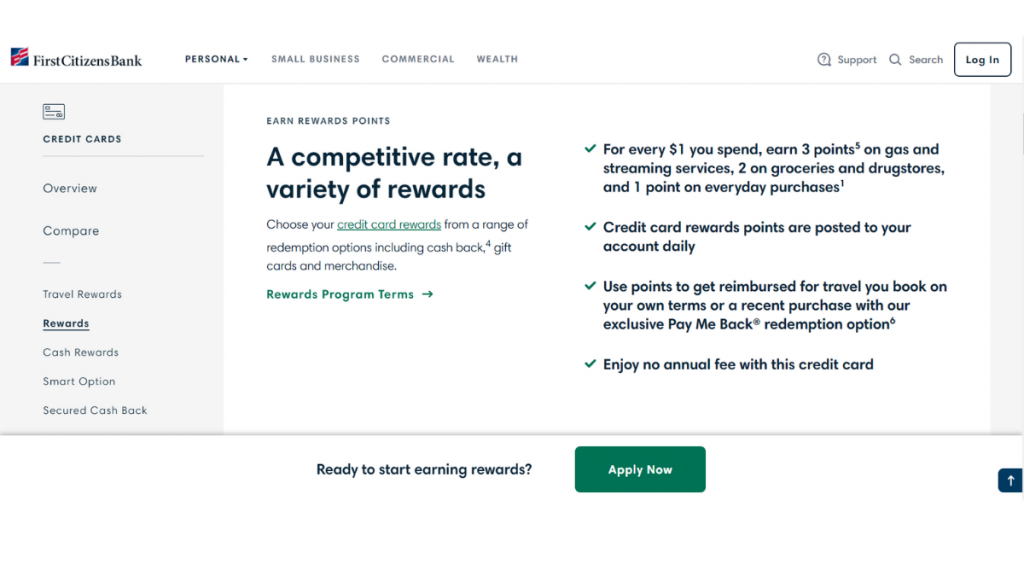

- Rewards: The Rewards Program for this card is very useful for your everyday spending. For example, gas and streaming can give you up to 3x points. When buying groceries or drugstore products you get 2x points. Other purchases give you 1 point.

- APR: 18.24% to 27.24%.

- Other Fees: While the First Citizens Bank Rewards Card has no annual fee, be aware of a 3% foreign transaction fee for each transaction.

First Citizens Bank Rewards: how does it work?

Designed to enhance your everyday spending, the First Citizens Bank Rewards offers a seamless balance between convenience and benefits, so let’s review some of its main features now.

Firstly, you can earn points effortlessly on your daily purchases. With a generous rewards structure, it encompasses a 3x points system for purchases related to fuel and streaming services.

Besides, you get more points on groceries and drugstores, up to 2x points. And all other purchases also give you rewards, 1x point.

Moreover, the absence of an annual fee ensures that you enjoy the perks without the financial burden. New cardholders take advantage of the enticing 0% introductory APR.

However, that benefit lasts for only the first 12 months. Furthermore, the First Citizens Bank Rewards Card not only provides financial flexibility but also offers a variety of redemption options.

This includes cash back, merchandise, and more. And you can experience the added layer of security with contactless payments, making transactions quick and secure.

So, get ready to unlock a credit card that seamlessly integrates into your lifestyle, being a companion on your path to financial well-being.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Significant benefits and disadvantages you may find

This review wouldn’t be complete without exploring the advantages and drawbacks of the First Citizens Bank Rewards Card.

This way, you can make an informed financial decision. So check out below!

Benefits

- Robust rewards structure;

- No annual fee burden;

- Strategic introductory offer;

- Wide range of redemption options;

- Secure and convenient transactions.

Disadvantages

- Fee associated with transactions conducted outside the domestic borders;

- Limited introductory APR duration.

Is a good credit score required for applicants?

Yes, having a solid credit history is indeed beneficial for applicants seeking approval for the First Citizens Bank Rewards Card.

Learn how to apply and get the First Citizens Bank Rewards Card

If you’re looking to secure the First Citizens Bank Rewards Card, then review a simple guide to learn how the application process works.

Learn how to get this credit card online

Whether you’re drawn to the enticing rewards program or the prospect of a cost-effective credit card, understanding the application journey is the first step toward making this financial tool work for you.

- Visit the bank’s website: Firstly, visit the official website of First Citizens Bank and click on “Personal”, then on “Credit Cards”. Scroll down to find the First Citizens Bank Rewards Card and click to review the terms.

- Application process: Find the “Apply Now” button and click to fill out the form. You’ll need to provide details such as your name, address, employment information, income details, and Social Security number.

- Review and submit: Before submitting your application, carefully review all the information provided. Once you’ve completed all required fields and reviewed the terms, submit your application.

- Approval: If your application is approved, you will receive your First Citizens Bank Rewards Card through the mail.

What about another recommendation: US Bank Shopper Cash Rewards®!

If you’re not yet convinced the First Citizens Bank Rewards Card is the right financial tool for you, it’s time to review another great alternative. Then, meet the US Bank Shopper Cash Rewards® card.

Crafted to cater to your shopping habits, this card seamlessly combines cash back benefits with an array of enticing features. Learn more features and explore benefits and drawbacks by clicking below!

US Bank Shopper Cash Rewards® Visa Signature®

Your key to personalized rewards and financial freedom starts in this US Bank Shopper Cash Rewards® Visa Signature® Card review!

About the author / VInicius Barbosa

Trending Topics

Citi® Secured Mastercard® Credit Card application

The Citi® Secured Mastercard® Card is a great option for people looking to build or rebuild their credit history. See how to apply!

Keep Reading

Platinum Secured Credit Card from Capital One review

Check out our Platinum Secured Credit Card from Capital One review and learn how you can achieve a prosper financial future for yourself.

Keep Reading

Discover it® Secured or Discover it® Cash Back? Choose the best!

Read this comparison to find out which card offers more benefits to your daily life: the Discover it® Secured or Discover it® Cash Back.

Keep ReadingYou may also like

Next Day Personal Loan review

Read our Next Day Personal Loan review to learn how you can find the perfect personal loan for you, with the best rates and terms!

Keep Reading

Vast Platinum Credit Card Review for My Unique Outlet Shoppers

Discover the power of the Vast Platinum Credit Card in our review! Explore exclusive benefits at My Unique Outlet and more!

Keep Reading

Aspiration Plus Account application

Learn everything you need to know about the Aspiration Plus Account application process and start earning interests right away!

Keep Reading