Account (US)

Aspiration Plus Account review

Find out if the Aspiration Plus account is a good fit for you. Get details on the benefits of the account and how to earn interest and cash back while helping the planet.

Advertisement

Aspiration Plus Account: Earn up to 5.00% APY on your savings!

Nowadays, it’s more important than ever to worry about the environment and choose different products with a positive impact on the planet. In this Aspiration Plus account review, you’ll learn everything you need to know about a financial product with an impressive mission to make the world a better place.

Not only does the account come with a great APY rating, it also offers cash back rewards and easy management through a very intuitive app. So keep reading our Aspiration Plus Account review to see how you can earn interests while being part of a crucial environmental program.

How to get the Aspiration Plus Account?

Check our easy guide for you to open your Aspiration Plus Account today!

- APY: Up to 5%.

- Fees: $7.99 per month or $5.99 if you pay annually.

- Advantages: Up to 10% cash back on selected merchants, free ATM reimbursements.

Aspiration Plus Account: is it a good account?

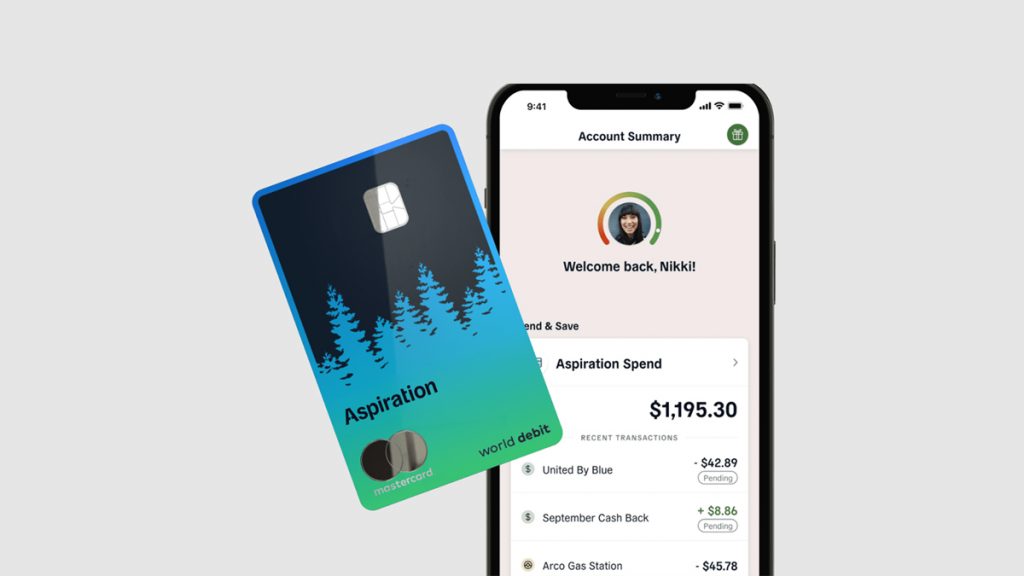

Aspiration is an online banking service that works more like a cash management account than a traditional bank. The institution offers two different types of accounts: Aspiration and Aspiration Plus.

With the Aspiration Plus account, you can earn up to 5% APY in the first $10,000 in your savings account. However, there’s a spending requirement of at least $1,000 a month to reach that percentage. All clients can also earn a whopping 10% cash back on purchases at Conscience Coalition partners.

To subscribe to the Plus alternative, you’ll have to pay a low monthly fee of $7,99 or $5,99 if you pay annually once you sign up to the account. The institution requires a minimum $10 deposit to open the account. Aspiration guarantees that any deposit made won’t fund fossil fuel exploration or fossil production, which is step one in their environmental program to protect the planet.

The account also comes with many perks like the option to plant a tree every time you use the card. You can also offset the negative impact of owning a car with their Planet Protection program. With the Aspiration Plus Account, you’ll get one out-of-network ATM reimbursement per month, and you can withdraw your money in over 55,000 free in-network ATMs all over the country.

There are a couple of setbacks, like no physical branches or cash deposits. But overall, you can benefit greatly from having this account and still help the planet while earning impressive rewards.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Aspiration Plus Account: should you get one?

While this account has many benefits to its name, it also has a couple of disadvantages you should know about before subscribing to it. Learn what they are next in our Aspiration Plus Account review.

Benefits

- APY up to 5% by spending $1,000 monthly

- Up to 10% cash back on selected merchants;

- Purchase Assurance;

- FDIC insured;

- Offsets negative environment impact;

- Out-of-network ATM reimbursements.

Disadvantages

- No physical branches;

- No cash deposits allowed.

What is the required credit score?

You won’t have to worry about your credit score with this account. The only requirement is that you are a U.S. resident with a valid address and social security number over the age of 18. You’ll also need to have a U.S. bank or Credit Union account to be able to fund your Aspiration Plus account.

Aspiration Plus Account application

If reading our Aspiration Plus Account review got you interested in opening an account, we can help. Follow the link below for more details of the application process and how you can start earning high interest rates while helping the planet.

How to get the Aspiration Plus Account?

Check our easy guide for you to open your Aspiration Plus Account today!

About the author / Aline Barbosa

Trending Topics

First Progress Platinum Select Mastercard® Secured Credit Card application

See how easy and quick the First Progress Platinum Select Mastercard® Secured Credit Card application is and learn how to apply!

Keep Reading

Which debt should you pay off first?

If you are trying to figure out which debt to pay off first, we are going to give you some tips on how to go about doing this.

Keep Reading

ABSA Visa Signature Card online application

Applying for the ABSA Visa Signature Card is easy! Follow these simple steps and you’ll enjoy all the benefits of this card in no time.

Keep ReadingYou may also like

Delta SkyMiles® Blue American Express Card review

Looking for a great travel rewards card? Check out our review of the Delta SkyMiles® Blue American Express Card and see if it’s worth it.

Keep Reading

How to get your World of Hyatt credit card with an online application

In this World of Hyatt Credit Card application guide, you'll learn how to get this card to earn rich rewards and a substantial welcome bonus.

Keep Reading

BankAmericard® credit card review: enjoy a 0% intro APR!

In this BankAmericard® credit card review you will see how this card can help you reduce or eliminate debt with a long 0% APR period.

Keep Reading