SA

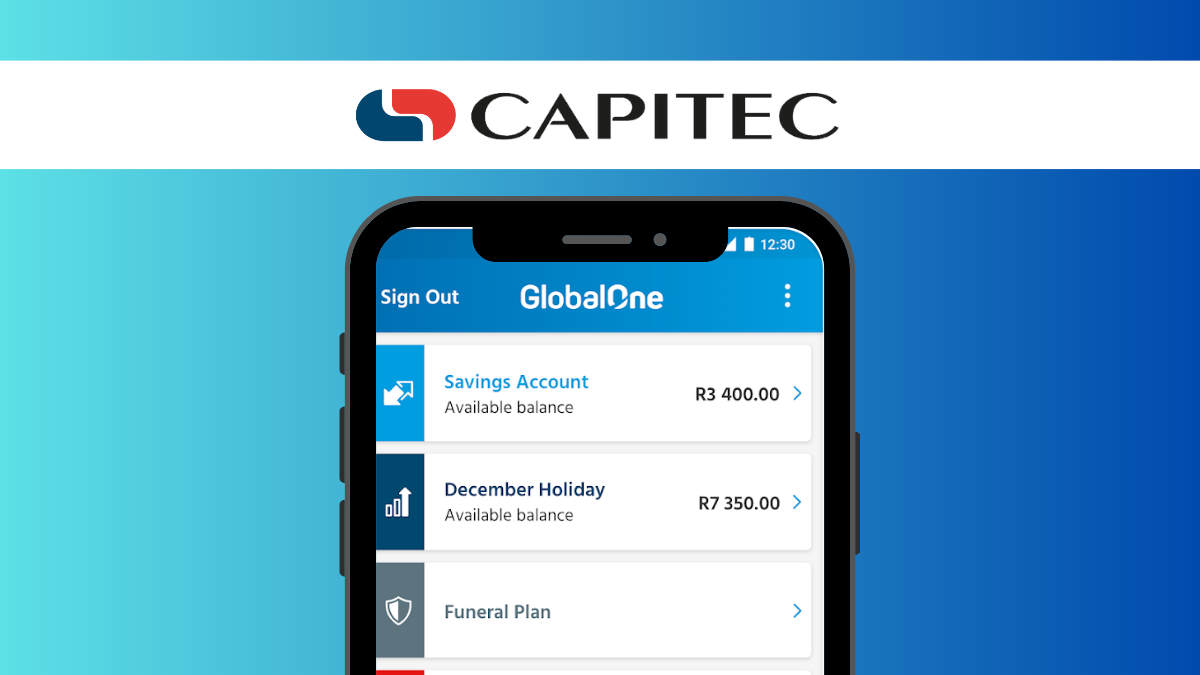

Capitec Tax-free Savings Account review: No Fees Attached

Read this Capitec Tax-free Savings Account review and learn about this account's flexible investment terms and savings options.

Advertisement

Understanding Capitec Tax-free Savings Account: Tax-Free Investment Options and Flexible Investment Terms

In Capitec Tax-free Savings Account account review, we will explore its tax-free investment options, flexible investment terms, and high interest rates.

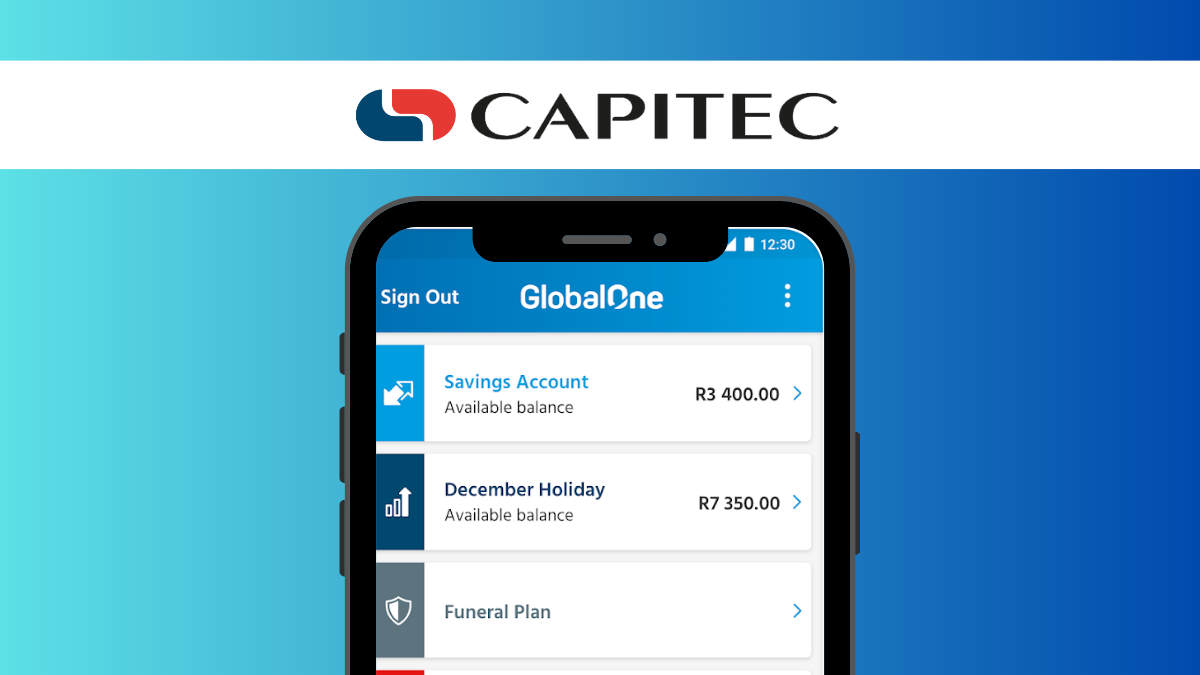

How to open your Capitec Tax-free Savings Account

Earn tax-free returns and get flexible investment terms by following our Capitec Tax-free Savings Account application guide.

- Fees: Early withdrawal fee of R300.00

- Interest: Balance amounts from R0 to R24.999 earn 3.50%, from R25.000 to R74.999 earn 4.00%, from R75.000 to R149.999 earn 5.25%, R150.000 or more earn 6.25%.

- Benefits: Tax-free investment options, no minimum balance requirement

- Investment Options: Fixed-term investment plan and Flexible investment plan.

This account is also ideal for individuals looking to grow their savings tax-free with flexible investment options and competitive interest rates. Feel like learning more about it? Just keep reading!

Capitec Tax-free Savings Account: understand how it works

The Capitec Tax-Free Savings Account is a good option for individuals looking to invest and earn interest tax-free.

Firstly, the account requires a minimum investment of R1.00 and offers fixed interest rates for a 12-month investment period. Interest rates range from 3.50% to 8.05%, depending on the amount invested.

Also, opening the account is easy and can be done through a Capitec branch, the banking app, or internet banking.

Further, proof of identification and residential address are required. Additionally, Interest is calculated on a daily basis and paid out monthly, with the interest rate determined by the account balance.

Furthermore, the Capitec Tax-Free Savings Account offers several advantages, including various savings options.

You also have the ability to save using a transactional account, no fees, and the option to choose between a fixed-term or flexible account.

However, early withdrawals from fixed deposit accounts come with a fee. Also, some savings options require a high investment amount to earn high returns.

So the Capitec Tax-Free Savings Account is a versatile option for those looking to save for short or long-term goals.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Significant benefits and disadvantages you may find

Now that you are familiar with this account’s details, it’s time to have a closer look at its pros and cons. Our Capitec Tax-free Savings Account review would be incomplete without it.

So have a look at the list of benefits and disadvantages below.

Benefits

- Tax-free returns.

- Competitive interest rates.

- Flexible investment terms.

- Multiple savings options.

Disadvantages

- High investment for top rates.

- Early withdrawal fees.

- Limited investment period.

- Fixed term plan only available for single deposit.

Is a good credit score required for applicants?

Capitec does not specify whether you must or not have a good credit score in order to apply for this account. We advise you to check with the institution before applying for an account.

Learn how to apply and open a Capitec Tax-free Savings Account

Looking for a tax-free savings option with competitive rates? Apply for a Capitec Tax-Free Savings Account today with the help of our application guide. Click the link below.

How to open your Capitec Tax-free Savings Account

Earn tax-free returns and get flexible investment terms by following our Capitec Tax-free Savings Account application guide.

About the author / Danilo Pereira

Trending Topics

7 Reasons Why You Should Own Multiple Savings Accounts

Don't keep all of your eggs in one basket. Learn about 7 reasons for you to have multiple savings accounts.

Keep Reading

Private retirement plan: is it a good idea?

Looking into the future makes you wonder about retirement? Then check out this article and find out more about private retirement plans.

Keep Reading

Royal Caribbean® Visa Signature® Credit Card review

Take your travels to new heights with the Royal Caribbean® Visa Signature® Credit Card. Read on to learn about its features, and more!

Keep ReadingYou may also like

How to get your Merrick Bank Double Your Line™ Platinum Visa®: online application

In this Merrick Bank Double Your Line™ Platinum Visa® application guide, we will show you how to apply for this card.

Keep Reading

10 best rewards credit cards 2022

Find out what the best rewards credit cards are for 2022. Our list contains a number of options for different purchasing needs.

Keep Reading

Ally Invest application

Learn all about the Ally Invest online application and how you can easily open an account to start trading immediately.

Keep Reading