US

Discover it® Miles review: Unlimited 1.5 Miles per Dollar

In this Discover it® Miles review you are going to learn about this card's automatic match of miles earned in the first year, and many other benefits.

Advertisement

Get 0% intro APR, a matching bonus at year-end and unlimited miles

Earn unlimited miles on every purchase, enjoy flexible redemption options and receive an intro match of all miles you’ve earned. This is our Discover it® Miles review.

How to get your Discover it® Miles

Trying to figure out how to get a nice mileage credit card? Read this Discover it® Miles application guide and learn how.

- Credit Score: Good to Excellent (670 and above)

- APR: 13.99% to 24.99% Variable

- Annual Fee: $0

- Fees: Balance transfers and cash advance fees are both 3%, with a minimum of $5.

- Welcome Bonus: N/A

- Rewards: Unlimited 1.5X miles per dollar you spend on all purchases.

The perfect credit card for travelers offers unlimited 1.5x miles per dollar spent, no annual fee, and rewards never expire.

Enjoy a miles match at the end of your first year, plus 0% intro APR on purchases and balance transfers for 14 months.

Discover it® Miles: how does it work?

Discover it® Miles is a travel credit card with a unique reward system. It offers 1.5 miles for every dollar you spend on all purchases.

You can redeem them for travel purchases or converted to cash at a rate of 1 cent per mile.

It has a $0 annual fee and a sign-up bonus that matches all miles you’ve earned in the first year.

This card is an excellent option for occasional travelers who want a low-cost, flexible card.

One of the benefits of the Discover it® Miles is its flexible redemption options.

You can redeem your miles for credit on a statement against travel purchases you’ve made within the past 180 days.

Also, you can convert your miles to cash through a direct deposit. Another benefit is the lack of a minimum redemption amount, which allows you to get reimbursements for small expenses.

The card also offers a 0% intro APR for 15 months on purchases and balance transfers, and no foreign transaction fee.

The Discover it® Miles also includes free access to FICO score and social security number monitoring service.

While this card has many pros, it requires good to excellent credit for approval. Additionally, there are no luxury perks, and acceptance is lower abroad.

The Discover it® Miles is a low-cost, flexible travel credit card that offers a unique reward system.

It gives you a sign-up bonus that matches all miles you’ve earned in the first year and no annual fee.

This is an excellent option for occasional travelers. Still, frequent fliers may get more value from a more robust travel card, especially if they travel overseas often.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Significant benefits and disadvantages you may find

So now you know pretty much everything you need to know about this card.

However, our Discover it® Miles review would be incomplete without a comparison between its pros and cons.

So, have a look at the list of benefits and disadvantages we have prepared for you below.

Benefits

- Unlimited 1.5x Miles per dollar

- No annual fee

- No foreign transaction fees

- Automatic match of miles earned first year

Disadvantages

- Average to fair credit needed

- Limited rewards options

- Higher APR compared to other cards

- No premium travel benefits.

Is a good credit score required for applicants?

The Discover it® Miles credit card requires applicants to have Good to Excellent credit in order to qualify.

This generally means a credit score of at least 670.

Learn how to apply and get a Discover it® Miles

So, what do you think? Is this the right card for you? So why don’t you click the link below and learn how to get it today? Go ahead, we will help you!

How to get your Discover it® Miles

Trying to figure out how to get a nice mileage credit card? Read this Discover it® Miles application guide and learn how.

About the author / Danilo Pereira

Trending Topics

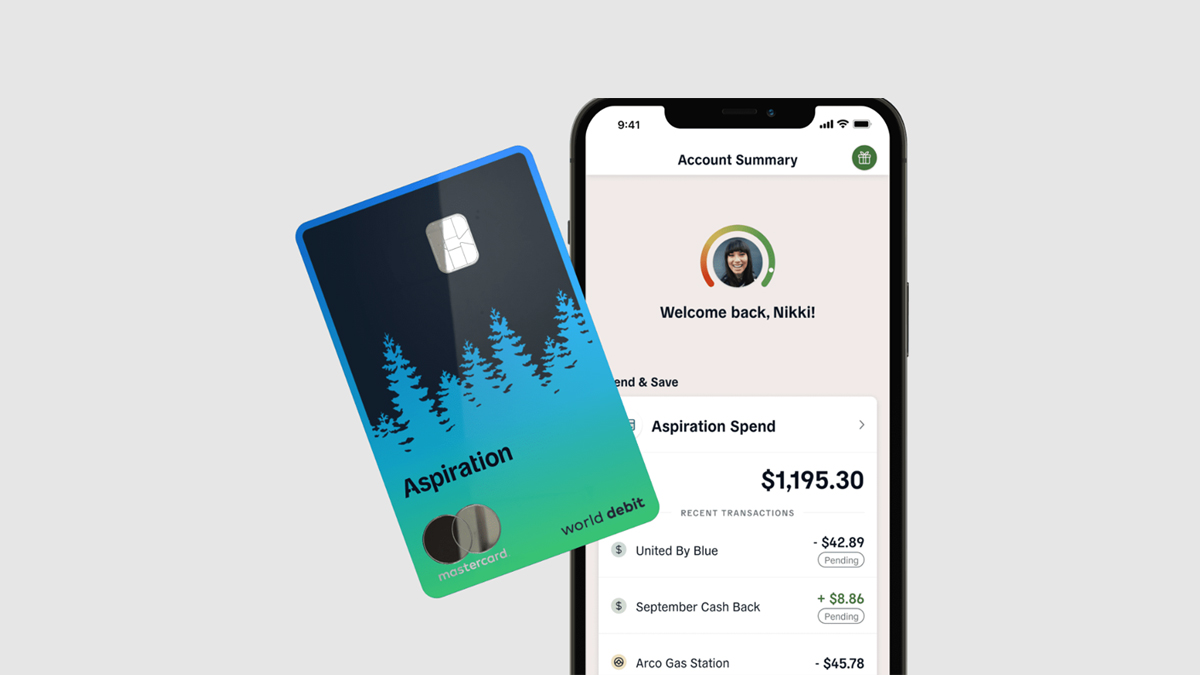

Aspiration Plus Account application

Learn everything you need to know about the Aspiration Plus Account application process and start earning interests right away!

Keep Reading

Milestone® Mastercard® Card application

Wondering how to get ahold of the Milestone® Mastercard® Card? This guide will take you through the application process step-by-step.

Keep Reading

Best cards for students: it’s better than you imagine!

The best credit cards for students have no annual fee, rewards programs, and many other benefits. Read this list to choose yours.

Keep ReadingYou may also like

How to open the Juno Checking Account? Learn how to start banking with Juno

Learn how to open a Juno Checking Account and start earning cash back at incredible rates on cash and crypto purchases.

Keep Reading

How To Use A Secured Credit Card With A $200 Limit

If you are struggling to use your low credit in an efficient way you have come to the right article. We are going to show you how to do it.

Keep Reading

Bank of America® Premium Rewards® Credit Card review

The Bank of America® Premium Rewards® Credit Card has a lot to offer but is it the right card for you? Read this review before you apply!

Keep Reading