Credit Cards

Best cards for students: it’s better than you imagine!

Don't settle for a bad credit card. You can get one of the best credit cards for students.

Advertisement

College will get easier with a good card to give you financial support.

Did you know that you can get one of the best credit cards for students even if you’re still building your credit score?

After all, you’re at the beginning of your adult life, and you’ll have plenty of time to write your credit history. So let one of these cards help you on this journey.

As a college student, you’ll have a lot of expenses with housing, food, books, and transportation.

Wouldn’t it be great to earn some rewards on your purchases? A credit card with cash back rewards will help you save some money and optimize your income.

You’ll certainly find the best student credit card for you on this list. Keep reading to learn everything about this card category.

If you are in college, check the cards we selected for you!

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Discover It Student Cash Back

| Credit Score | Fair/Good |

| Annual Fee | $0 |

| Regular APR | The APR ranges from 13.74% up to 22.74%, variable. |

Discover It Student Cash Back Highlights

- Outstanding welcome bonus. You’ll get double cash back in the first year. No limits, you’ll get one dollar for one dollar.

- To get this card you won’t be required a good score. This can be your first contact with credit.

- The rewards program has excellent rates and makes it one of the best credit cards for students. You’ll get at least 1% cash back on every purchase, and 5% cash back on select purchases that fit the bonus categories. Places like restaurants, grocery stores, gas stations, and online purchases at Amazon.com and PayPal.

- To help you save money for college, Discover will not charge you any annual fee.

- No fee if you use your card outside the U.S., so you can take your credit card abroad on your exchange or vacation trips.

- Enjoy 0% Intro APR. You’ll have 6 months of this benefit.

Capital One SavorOne Student Cash Rewards

| Credit Score | Fair/Good/No credit score |

| Annual Fee | $0 |

| Regular APR | 15.24% to 25.24% variable |

Capital One SavorOne Student Cash Rewards Highlights

- Earning the $100 welcome bonus is easy. All you have to do is spend $100 in 90 days.

- The rewards rates are the highest among student credit cards.

- Places to earn 3% cash back: restaurants, grocery stores, selected streaming services, and entertainment events. But if you make a purchase that doesn’t fit in this category, Capital One still gives you 1% cash back.

- Buy your tickets through Capital One Entertainment to earn up to 8% cash back.

- Absolutely no fees to use this card.

Chase Freedom Student credit card

| Credit Score | No credit score requirement. |

| Annual Fee | $0 |

| Regular APR | variable 15.74% |

Chase Freedom Student card Highlights

- No annual fee to use one of the best credit cards for students. However, it charges a foreign transaction fee, so it is not the best option if you’ll study abroad.

- The welcome bonus consists of a $50 cash bonus just for making any purchase as soon as you get your card.

- Pay your bill on time every month to get a credit limit increase and a $20 cash bonus every year for five years.

- Chase will verify your student enrollment and if you’re younger than 21 years old you’ll have to prove that you’re financially independent.

Deserve EDU Mastercard for Students

| Credit Score | Average/Good/No credit score required |

| Annual Fee | $0 |

| Regular APR | 19.49% |

Deserve Edu Highlights

- Some international students can’t qualify for credit cards because they lack a Social Security Number or credit history. Don’t worry about this when you apply for this card, as this is not an eligibility requirement.

- No annual fee.

- Every purchase will give you 1% of the value back to your account as a reward.

- Your cell phone is safe with the $600 insurance coverage against theft or damage.

- Spend $500 total in your first three months to earn the amazon Prime Student subscription for free for one whole year.

Bank of America Customized Cash Rewards for Students

| Credit Score | Fair/Good |

| Annual Fee | $0 |

| Regular APR | 14.74% – 24.74% variable |

Bank of America Customized Cash Rewards Highlights

- You’ll have 3 months to spend $1,000 to earn the $200 bonus.

- Choose one bonus category to earn 3% cash back and customize your rewards program. In the grocery stores and wholesale club, you’ll get 2% cash back. On everything else, 1% cash back.

- Manage your card statement, purchases, and payments and track your credit score through the mobile app. You can also change your bonus category when you wish.

- You’ll have access to the ShopSafe service, which protects your credit card number while you shop online.

- Bank Of America charges a 3% fee on your foreign transactions, but you’ll pay $0 for the annual fee.

Bank of America Travel Rewards for Students

| Credit Score | Good/Excellent |

| Annual Fee | $0 |

| Regular APR | 14.74% to 24.74% |

Bank of America Travel Rewards Highlights

- If you’re studying abroad or enrolled in some exchange program, this card will be handy and help you travel with benefits with the best travel card for students.

- No annual fee and no foreign transaction fee.

- For every $1 spent with this card, you’ll earn 1.5 points. Collect reward points to redeem for travel benefits.

- The welcome bonus is pretty generous and super advantageous. If you spend $1,000 on the first 3 months (which means something around $350 per month) you’ll earn 25,000 points. Redeem these points for a $250 statement credit.

- 0% Intro APR for 15 months. It’s a long time to pay no interest.

Why not learn some low-risk investments to start with too?

Now that you already know how to get one of the best credit cards student, it’s time to learn how to invest the money you’re saving. The sooner you start learning about investments, the better.

Save more and earn interest on your savings with some of the best low-risk investments. Check the following content to keep learning about finances and gain control over your future.

Safe investments with the best low-risk options.

You don't need to take high risks to start investing, Pick one of these low-risk investments and you'll keep your money safe.

Trending Topics

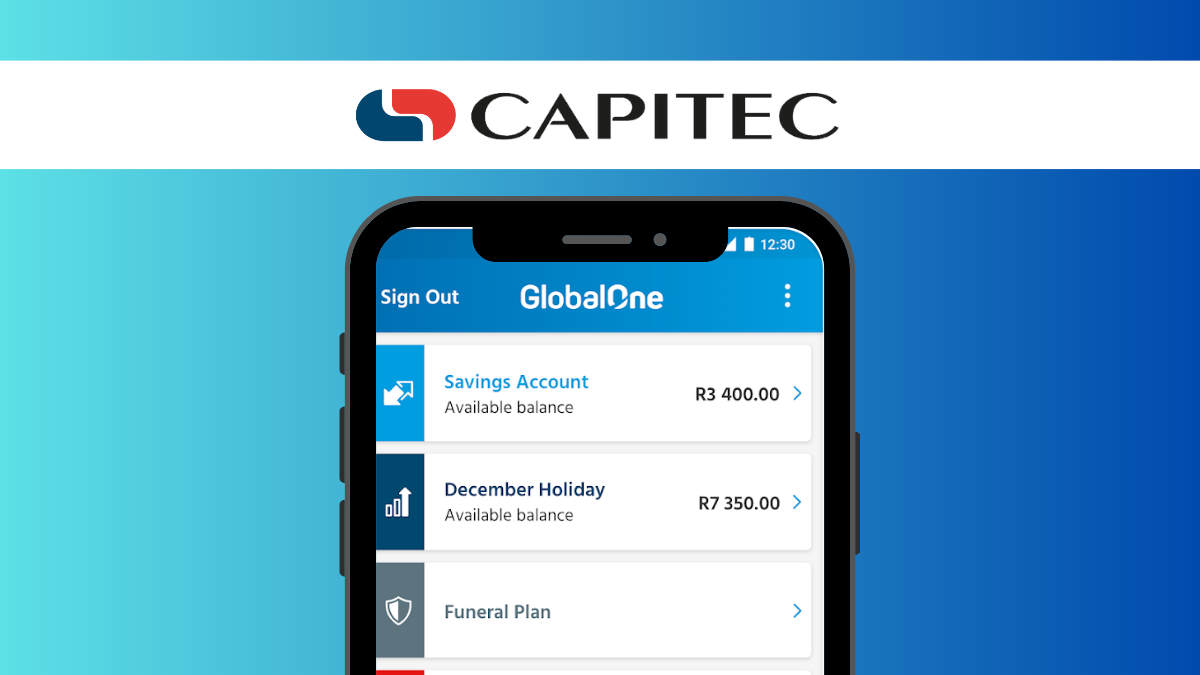

Capitec Tax-free Savings Account review: No Fees Attached

If you are looking for tax-free returns on your savings, check out this Capitec Tax-free Savings Account review.

Keep Reading

Evolve Home Loans online application guide

Looking for a home loan? Here's our guide to making the Evolve Home Loans application process smooth and simple.

Keep Reading

How many credit cards should you own?

Are you wondering how many credit cards are too many? This article will help you figure out the ideal number for your financial situation.

Keep ReadingYou may also like

SoFi Personal Loans application

Get step-by-step instructions on how to apply for the SoFi Personal Loans. Learn about the eligibility requirements and more!

Keep Reading

TymeBank Credit Card review

Get the lowdown on the TymeBank Credit Card. We review features, pros and cons to help you make an informed decision before signing up.

Keep Reading

PREMIER Bankcard® Mastercard® Card application

Apply for the PREMIER Bankcard® Mastercard® Card. You can get to build a strong credit score. If that's what you want, read this content.

Keep Reading