Loans

LendKey Student Loans Review: Empower Your Education!

Transform your student loan experience with LendKey! Refinance and save with our low-rate, no-fee options or dive into affordable private student loans, complete with cosigner benefits.

Advertisement

Discover the key to smarter student financing! Refinance your student loans effortlessly, or get private loans!

When you embark on the educational journey and review a maze of financial decisions, the LendKey Student Loans step in as your guiding light. So, are you ready to understand how it works?

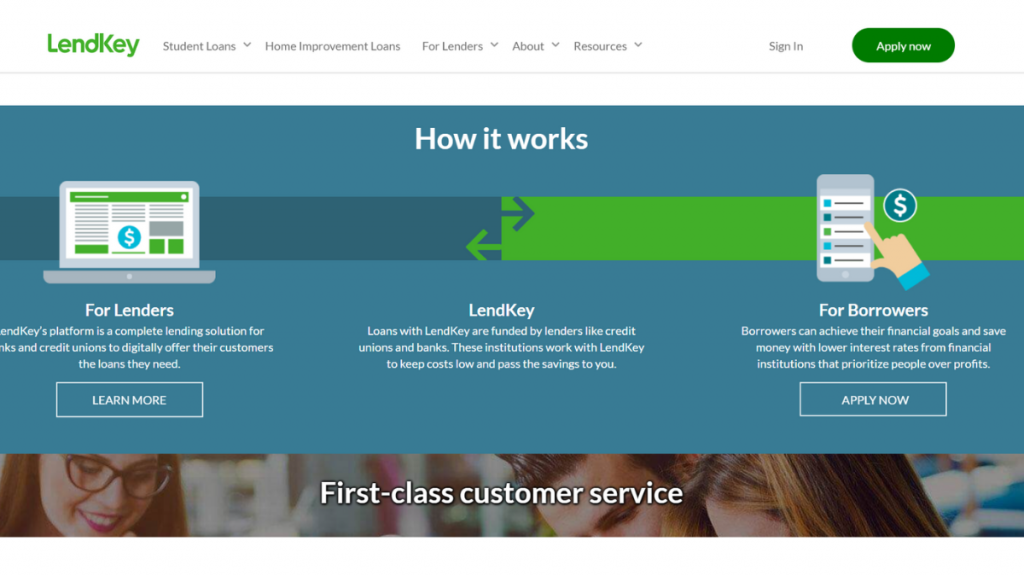

From refinancing existing student loans to securing new ones, LendKey’s digital platform connects borrowers with community banks and credit unions, offering a promise of affordability and flexibility!

- APR: 8.11% fixed APR (with AutoPay) for those considering the transformative journey of refinancing or 6.09% fixed APR (with AutoPay) for Private Student Loans.

- Loan purpose: LendKey caters to a spectrum of educational needs, offering both student loan refinancing and private student loans.

- Loan amount: N/A.

- Credit needed: N/A.

- Terms: Enjoy the freedom to choose terms ranging from 5 to 20 years.

- Origination fee: None.

- Late fee: N/A.

- Early payoff penalty: Revel in the possibility of early loan payoff without the constraints of penalties.

LendKey Student Loans: how does it work?

As you’ll find out in this review, the LendKey Student Loans meet the diverse needs of educational pursuits. Moreover, they have two primary offerings to financing that align with individual circumstances.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Private Student Loans

LendKey’s Private Student Loans extend a helping hand to those setting sail on their academic odyssey.

Designed for aspiring scholars navigating the terrain of higher education, these loans offer competitive rates, starting as low as 4.39% Fixed APR (with AutoPay) and 6.09% Variable APR.

Moreover, a creditworthy cosigner can play a pivotal role in securing not just approval but also favorable rates. Besides, the absence of application fees adds a layer of accessibility.

Student Loan Refinancing

However, if you’re already charting the seas of student loan debt, then review LendKey’s Student Loan Refinancing. This option offers a lifeline to a more manageable financial horizon.

So, by consolidating existing federal and private student loans into a single, streamlined loan, borrowers gain the advantage of potentially lower interest rates and flexible repayment terms.

Furthermore, APRs as enticing as 8.11% Fixed (with AutoPay) beckon those looking to recalibrate their financial compass.

Besides, the absence of origination fees and terms spanning from 5 to 20 years signifies a commitment to transparent financial dealings, allowing you to redirect savings back into your educational journey.

Significant benefits and disadvantages you may find

The journey to find the right educational financing often entails a review of advantages and drawbacks, and LendKey Student Loans are no exception.

So, get ready to explore the intricacies, dissecting the pros and cons to empower you with the insights needed to make informed decisions about your educational future.

Benefits

- Access enticing interest rates

- Unlock the potential for substantial savings by refinancing existing student loans

- Consolidate multiple federal and private student loans into a single, manageable loan

- Experience transparent and cost-effective lending with no origination fees

- Flexible repayment options

- In-school payments for responsible borrowing

- Dedicated customer support team

Disadvantages

- Achieving the lowest advertised rates may require a strong credit history

- Cosigner dependency

- For private student loans, variable interest rates are an option

- While refinancing offers flexible terms, the variability might be overwhelming for some borrowers

Is a good credit score required for applicants?

Yes, having a good credit score is generally beneficial when applying for LendKey Student Loans, especially for achieving the lowest and most favorable interest rates.

LendKey Student Loans application

So, if you’ve decided to embark on the quest for student financing, review this simple guide and learn to apply for the LendKey Student Loans now.

Moreover, navigating the application process seamlessly ensures that you harness the full potential of your student loan.

- Visit LendKey’s website: Firstly, visit the official website and navigate to the option that’s ideal for you. Either Refinance Student Loans or Private Student Loans.

- Start application: Next, click on “Check your rates” or “Get started,” depending on the loan type you choose. Then, follow the user-friendly interface to input the required information.

- Submit application: Once you’re done, carefully review the information provided and submit the online form. Finally, patiently await for LendKey to validate the information and give you further instructions.

- Accept offer: If satisfied with the terms, accept the loan offer. With the acceptance and finalization of your LendKey Student Loan, you’ve set sail on a journey toward educational empowerment.

What about another recommendation: ANZ Personal Loans

If you don’t need a student loan but still want some extra cash, don’t worry! We have another excellent recommendation for you!

Meet the ANZ Personal Loans! Their service brings a costumer-centric approach, and you can borrow up to $50,000 through a streamlined process!

ANZ Personal Loans review

Looking for a reliable lender? ANZ personal loans offer competitive rates and a trusted reputation. Borrow up to $50K easily!

About the author / VInicius Barbosa

Trending Topics

JetBlue Plus Card review: get yearly points bonus!

In this JetBlue Plus Card review you will see how you can earn generous rewards with this airline credit card, plus a nice welcome bonus.

Keep Reading

Honest Loans: Get multiple loan offers with one application

Learn how to use this amazing tool to find the best loan offers filling a single application at the Honest Loans website.

Keep Reading

How to get started with budgeting: 5 simple steps

Trouble keeping your finances in check? In this article, we are going to teach you how to set up and follow a budget with simple steps.

Keep ReadingYou may also like

FNB Personal Loans online application

Learn how the FNB Personal Loans application process works and request the funding you need for your next big purchase.

Keep Reading

Best Personal Loans for November 2022

Looking for the best personal loan for you? In this article we are going to tell you about the best personal loans in November 2022.

Keep Reading

Progen Lending Solutions: Ultimate Guide to Hassle-Free Borrowing

Explore Progen Lending Solutions, your trusted partner in home financing. Discover tailored mortgages, transparent terms, and much more!

Keep Reading