Loans

ANZ Personal Loans review: Your Key to Turning Dreams into Reality

Take control of your finances with ANZ personal loans. Access funds for debt consolidation, home renovations, or your dream vacation. This review will tell you everything about this loan to help you achieve your goals.

Advertisement

The Flexible Solution for Your Borrowing Needs: ANZ Personal Loans

Are you seeking financial support to fulfill your dreams or manage unexpected expenses? Look no further than our ANZ Personal Loans full review!

Next, we’ll dive into the world of ANZ personal loans, exploring how they work, their benefits, and the essential details you need to know. So keep reading to learn about it.

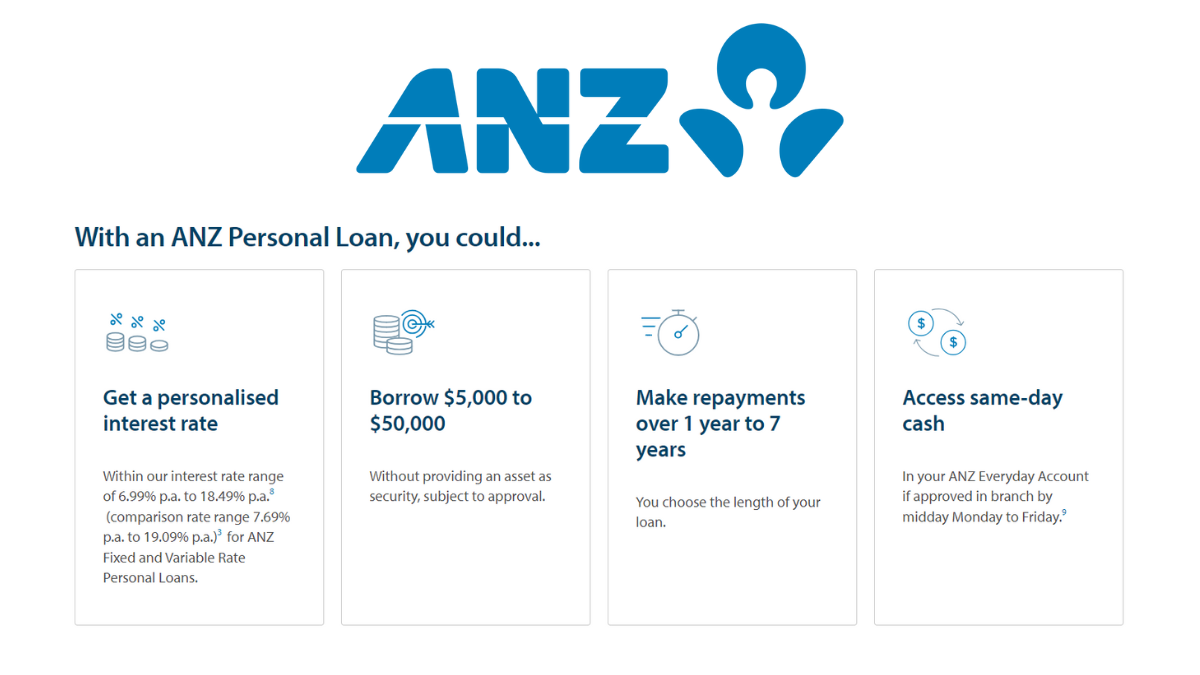

- APR: 6.99% p.a. to 18.49% p.a;

- Loan Purpose: You can use personal loans for many purposes, from making a big purchase, buying a car, planning a trip, or paying for unexpected expenses;

- Loan Amount: From $5,000 up to $50,000;

- Credit Needed: ANZ recommends you improve your credit score to its best shape to get better interest rates for your loan offer;

- Terms: from 12 months up to 7 years;

- Origination fee: You’ll be charged a Loan Initiation fee of $150;

- Late Fee: ANZ will apply a fee if you delay your payments, and the rates will be disclosed in your loan agreement;

- Early Payoff Penalty: Not disclosed.

How do ANZ Personal Loans work?

ANZ Personal Loans is a reliable and convenient way to access funds for a variety of purposes.

Whether you’re planning a dream vacation, consolidating debt, or embarking on a home renovation project, ANZ has got you covered.

Therefore, these loans can be tailored to suit your needs with flexible repayment terms, loan amounts, and interest rates.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Significant benefits and disadvantages you may find

Before we dive into the specifics, let’s take a quick look at the significant benefits and potential disadvantages of ANZ Personal Loans.

By understanding both sides of the coin, you’ll have valuable insights to make an informed decision.

So, without further ado, let’s review the advantages and considerations associated with ANZ Personal Loans.

Benefits

- The best Interest Rates for you: ANZ strives to provide attractive interest rates, ensuring that your loan is affordable and manageable;

- Flexibility in Loan Amounts: ANZ offers a wide range of loan amounts, empowering you to borrow the funds you require, whether it’s a small sum or a larger investment;

- Convenient Repayment Options: With ANZ Personal Loans, you have the freedom to choose repayment terms that align with your financial goals and budget, ensuring a stress-free repayment journey;

- Potential to Improve Credit Score: Responsible repayment of your ANZ Personal Loan can positively impact your credit history, opening doors to better financial opportunities in the future.

Disadvantages

- Eligibility Criteria: ANZ has specific eligibility requirements, which may include factors such as income, credit history, and employment status. It’s crucial to review and ensure you meet these criteria before applying;

- Potential Fees: Keep in mind that there may be associated fees and charges with ANZ Personal Loans, such as application fees, late payment fees, or early repayment fees. Be sure to review and understand the fee structure before proceeding;

- Negative reviews: Some customers have expressed complaints related to issues such as occasional difficulties in customer service. However, it’s important to note that these complaints are not universal.

What are the eligibility requirements for ANZ Personal Loans?

To qualify for an ANZ Personal Loan, you must meet certain criteria. These include being at least 18 years old and having a stable income.

Also, you must be an Australian citizen or permanent resident and have a good credit history.

ANZ may also consider other factors, such as existing debts and financial commitments.

How can I apply for an ANZ Personal Loan?

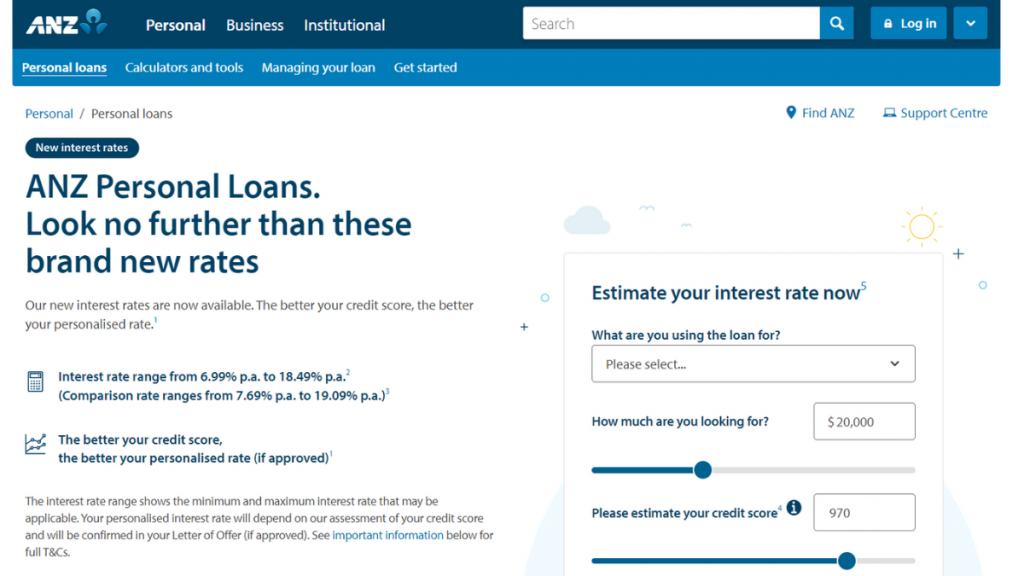

ANZ has made the application process simple, offering multiple avenues to apply. You can apply both online on their website or via a mobile app on the go.

Learn how to get this loan online

Getting an ANZ Personal Loan online is a breeze. Just visit the ANZ website, select the personal loans section, and follow these simple steps:

- Explore Loan Options: Review the available loan options and select the one that aligns with your financial needs.

- Use the Loan Calculator: Utilize ANZ’s loan calculator to estimate your potential repayments, ensuring they fit within your budget.

- Complete the Online Application: Fill out the application form with your personal details, loan requirements, and any supporting documents, as requested.

- Verification and Approval: ANZ will review your application and, upon successful verification, provide an approval decision.

- Loan Disbursement: As soon as ANZ approve your loan, they will transfer the loan amount to your nominated account, allowing you to embark on your financial journey.

How to get this loan using the app

If you’re an existing ANZ customer, follow these steps to apply for an ANZ Personal Loan using the mobile app:

- Log in to Your Account: Open the ANZ mobile app and log in using your credentials;

- Navigate to Personal Loans: Access the personal loan section within the app.

- Start Your Application: Follow the prompts to begin your application, providing the necessary information and requirements;

- Review and Submit: Double-check all the details, ensuring accuracy, and submit your application;

- Application Processing: ANZ will review your application and notify you of the decision, typically within a few business days;

- Funds Disbursed: If approved, the funds will be transferred to your designated account, ready to use according to your financial needs.

What about another recommendation: CashnGo Loans

If you’re exploring alternative options to ANZ personal loans in Australia, one option worth considering is Cashn Go.

Cashn Go is a reputable lender that offers short-term personal loans, often referred to as payday loans or cash advance loans.

The loan amounts are usually smaller if you compare them to traditional personal loans, and the repayment terms are generally shorter, often aligned with the borrower’s next payday.

In summary, ANZ personal loans provide more options, flexibility, and competitive interest rates but require a more thorough application process.

Cashn Go offers quick access to smaller amounts of money with simpler applications but comes with higher interest rates and shorter repayment terms.

Ultimately, the best choice depends on your specific financial needs, credit history, and preferences.

To make an informed decision, read our full review of CashnGo Loans features on the following link.

CashnGo Loans review

Read our in-depth CashnGo Loans review to discover how this fast cash lending service provides quick access to funds and transparent fees.

Trending Topics

CashUSA loans application

If you have a couple of minutes, check out the cashUSA loans application process. It is entirely online and you'll get the money fast.

Keep Reading

Exchange Bank Unsecured Personal Loan application

Learn everything about how the Exchange Bank Unsecured Personal Loan application process works and how you can apply.

Keep Reading

PCB Secured Visa® review: helps you build a credit score

Read this PCB Secured Visa® review to see how this easy credit card will get your score back on track and give you a brighter future.

Keep ReadingYou may also like

PenFed Credit Union Personal Loan review

This PenFed Credit Union Personal Loan review wll show you everything you need to know to get this loan easily.

Keep Reading

Blue Business® Plus card American Express® review

In this Blue Business® Plus card American Express® review you will see how this card offers excellent rewards for no annual fee.

Keep Reading

Cash Magnet app review: is it legit? We’ll tell you!

The Cash Magnet app promises to give you money while your phone work alone and will show you in this review if it's true.

Keep Reading