Credit Cards

Milestone® Mastercard® Credit Card review

In this Milestone® Mastercard® Credit Card review, we’ll highlight its advantages, disadvantages and whether it's a good card for you. Read on to find out more about what this card has to offer.

Advertisement

Milestone® Mastercard® Credit Card: Get a credit card with no security deposit.

Are you looking for a card that offers purchasing power and a real shot at getting a better credit score? Then check out the Milestone® Mastercard® Credit Card.

With this card, you won’t have to put down a security deposit to get an initial credit limit. You’ll be able to enjoy all the benefits offered by Mastercard while your credit rating goes up.

Don’t let a less-than-perfect score keep you from getting what you want. This credit card’s easy and fast pre-qualification process combined with its perks and features can be a helpful tool on your path to financial freedom.

Read on for our full review and see why this might be the perfect card for you.

How to get the Milestone® Mastercard® Card?

Learn everything about the application process for the Milestone® Mastercard® Card and get your finances back on track today!

- Sign-up bonus: There is no welcome bonus.

- Annual fee: $35 – $75 during the first year, $99 after that.

- Rewards: There are no rewards for purchases.

- Other perks: Does not require a security deposit.

- APR: 24.9%.

Milestone® Mastercard® Credit Card: is it a good card?

The Milestone® Mastercard® Credit Card is a solid option for people with low credit scores who want to repair their credit rating without putting down a security deposit.

Issued by The Bank of Missouri with Genesis FS Card Services, the card has a Mastercard and nationwide acceptance.

Milestone provides all new cardholders with a $300 initial spending limit. The annual fee is deducted upon account opening and varies based on creditworthiness.

It has a fixed 24.9% APR, which is relatively low in comparison to other cards in the same segment. The bank reports all payments to the main U.S. credit bureaus, which allows a faster build up on credit scores.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Milestone® Mastercard® Credit Card: should you get one?

The Milestone® Mastercard® Credit Card is a popular credit card option for people with bad credit scores. But is it the right choice for you?

Next, we’ll discuss the pros and cons of this card so that you can make an informed decision. Read on to learn more about it.

Benefits

- All credit levels are welcome to apply, even after bankruptcy;

- Report account history payments to credit bureaus;

- Relatively low APR;

- No monthly or processing fees;

- Doesn’t require a security deposit.

Disadvantages

- Provides a limited spending power;

- Charges membership fees;

- There are no rewards for purchases or welcoming bonus;

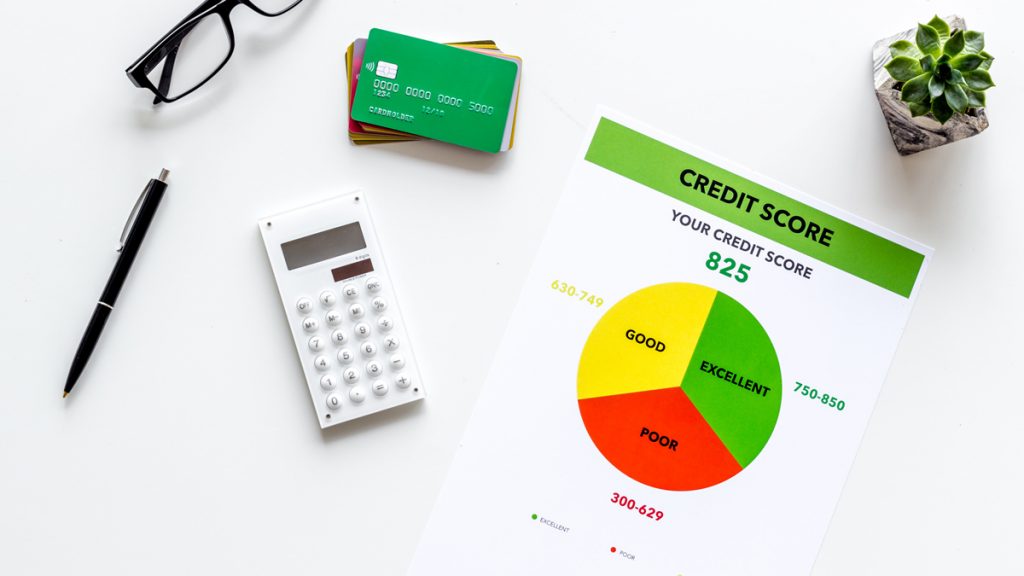

What is the required credit score?

Even though there is no minimum credit score required for a Milestone approval, all new applicants must pre-qualify before applying for it. Having a bad credit score doesn’t mean you’ll be denied.

However, your income, outstanding debt and credit history are important factors as to whether the bank will approve your request.

The good news is that pre-qualification performs only a soft pull on your score. Therefore, if for any reason this card is not available to you, you still get to know where you stand without hurting your credit rating.

Milestone® Mastercard® Credit Card application

If you have a bad credit score, it can be difficult to find a credit card that is right for you. However, the Milestone® Mastercard® Credit Card may be just what you are looking for.

This card is designed specifically for people with bad credit, and it comes with a number of features that can help you improve your credit rating.

By using it responsibly, this unsecured credit card can help you achieve financial freedom in no time. The pre-qualification process takes only a minute and it’s super easy.

So, to learn more details on how to apply, follow the link below.

How to get the Milestone® Mastercard® Card?

Learn everything about the application process for the Milestone® Mastercard® Card and get your finances back on track today!

About the author / Aline Barbosa

Trending Topics

Home Depot® Consumer Credit Card application

The application process for the Home Depot® Consumer Card is simple and you can request yours online in a few minutes. Read on for more!

Keep Reading

Learn how to take a pregnancy test online

Confidential and hassle-free: Dive into the world of pregnancy test apps online, offering discreet ways to check your pregnancy status

Keep Reading

JetBlue Plus Card review: get yearly points bonus!

In this JetBlue Plus Card review you will see how you can earn generous rewards with this airline credit card, plus a nice welcome bonus.

Keep ReadingYou may also like

Absa Premium Banking Credit Card application: 57 days interest-free

Looking for a card with a long interest-free period? Follow our Absa Premium Banking Credit Card application guide and get yours today!

Keep Reading

Best Apps for Reading Books: Top 10 options!

If you love to read and want to use technology to your favor, you can read our post to see the best apps for reading books!

Keep Reading

Sallie Mae Student Loan review

Check our Sallie Mae Student Loan review and learn more about its interest rates, repayment options, terms and more.

Keep Reading