Get multiple loan offers even if you have bad credit!

Citrus Loans – A loan aggregator that helps individuals from all credit scores find the loan that they need.

Advertisement

Citrus Loans is an online loan aggregator that allows individuals from all credit scores to find just the right loan for their needs. The platform matches borrowers to lenders by analyzing requests and offers, making it possible for borrowers to receive offers from multiple lenders. All that borrowers have to do is to fill out a single application form, and soon there will be lenders competing to offer them money.

Citrus Loans is an online loan aggregator that allows individuals from all credit scores to find just the right loan for their needs. The platform matches borrowers to lenders by analyzing requests and offers, making it possible for borrowers to receive offers from multiple lenders. All that borrowers have to do is to fill out a single application form, and soon there will be lenders competing to offer them money.

You will remain in the same website

Are you in need of an extra cash injection? Do you want to explore options on how to get your hands on a loan quickly and conveniently? Citrus Loans are here to help with their easy-to-use platform and flexible payment systems. Check a few of their benefits below!

You will remain in the same website

Citrus Loans is not a direct lender. It is an online loan aggregator that matches borrowers to lenders based on their credit score, income and other factors. Therefore, Citrus Loans does not have specific credit score requirements, because it is able to match borrowers to lenders who are likely to lend them the money they need.

In order to be eligible for Citrus Loans you must have a job or receive regular income from other sources. You must also be 18 years old or older, be a U.S> citizen with a valid Social Security Number and have a valid state ID or a U.S. driver’s license. Also, you must have a bank account so that your cash can be deposited there. There are also additional lender requirements which may include loan history, credit score and state of residence.

First, fill out Citrus Loans’ online loan request and submit it. Once you have done that, Citrus Loans will forward your request to lenders who will then review your information and decide whether they can provide you with a loan. If you are approved by a lender, you will receive your loan details and documents for review. Once you have reviewed it and retained a copy of the documents, you may be required to e-sign your agreement. After that, the lender will deposit your loan into your bank account within a business day or two.

If Citrus Loans sound interesting to you, you should check out our application guide. Click the link and we will show you how to do it.

How to apply for Citrus Loans?

In this Citrus Loans application guide you will learn how to easily and quickly find lenders that are willing to provide you with funds.

If you would like another offer to compare with this one, check out Upstart Personal Loans. It offers borrowers the chance to get access to loans at excellent rates even if they have imperfect credit. This is possible thanks to their nontraditional underwriting method.

Sounds interesting? Then click the link below and learn everything you need to know about this loan.

How to apply for Upstart Personal Loans

Apply for Upstart Personal Loans today for fast approval and even faster funding. Get access to funding in as little as one business day.

Trending Topics

Phone tracker apps: Accurate location tracking and safety features

Unlock a world of possibilities with a free phone tracker app as we unveil the top choices that deliver accurate tracking!

Keep Reading

HSBC Low Rate Card Review: Redefine Your Credit Experience!

Experience smart spending and flexibility with the HSBC Low Rate Card in this comprehensive review. Unlock a realm of affordability!

Keep Reading

Ink Business Cash® Credit Card application: Unbeatable Rewards!

Looking to get a cashback business card? Read this Ink Business Cash® Credit Card application guide and get yours in a few minutes.

Keep ReadingYou may also like

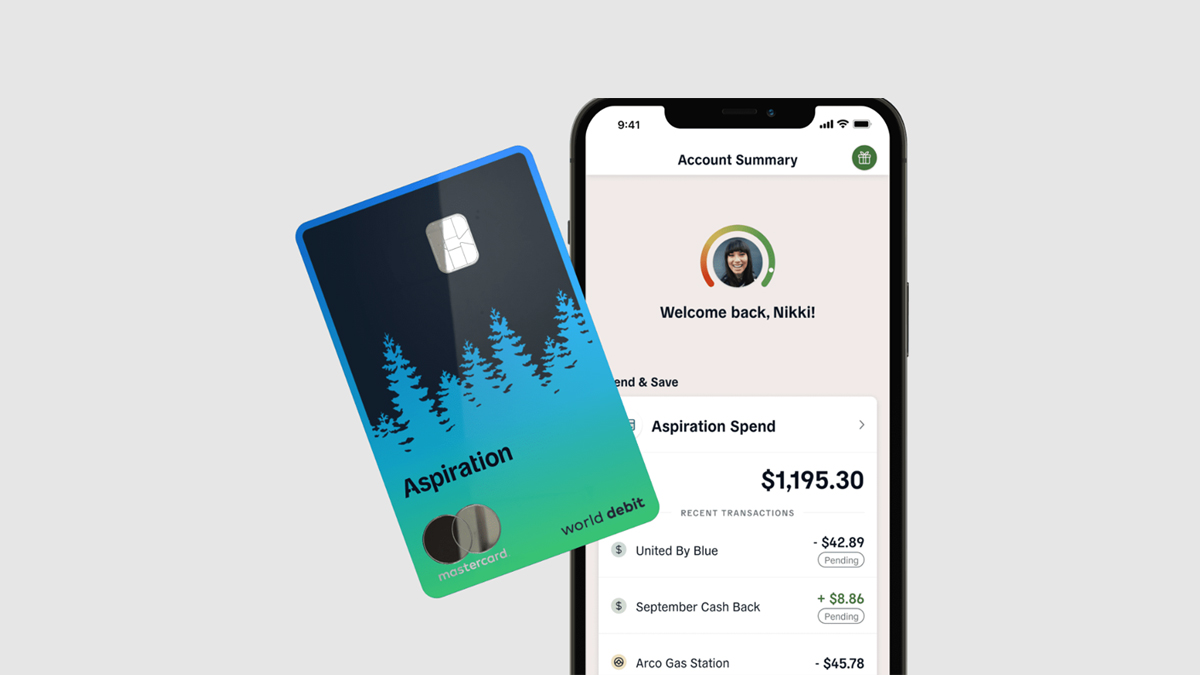

Aspiration Plus Account application

Learn everything you need to know about the Aspiration Plus Account application process and start earning interests right away!

Keep Reading

Capital One Quicksilver Student Cash Rewards Card application

Learn the easy application process for the Capital One Quicksilver Student Cash Rewards Card and start building your credit today!

Keep Reading

The difference between security token and utility token

Learn the key difference between security token and utility token, what they are used for, and which one is best suited to you.

Keep Reading