Credit Cards

HSBC Low Rate Card Review: Redefine Your Credit Experience!

Uncover how the HSBC Low Rate Card goes beyond expectations, providing you with a key to seamless and cost-effective financial management. Enjoy remarkably low-interest rate and 0% p.a. on Balance Transfers!

Advertisement

Discover a world of convenience and savings in every transaction with this credit card!

Beyond a mere financial tool, this HSBC Low Rate Card review aims to unravel the layers of benefits that make this card a standout choice in the competitive landscape of credit options.

So, navigate through the features that distinguish this card, from the enticing low-interest rate to the convenience of fee-free international transactions. Discover how it could redefine your financial journey.

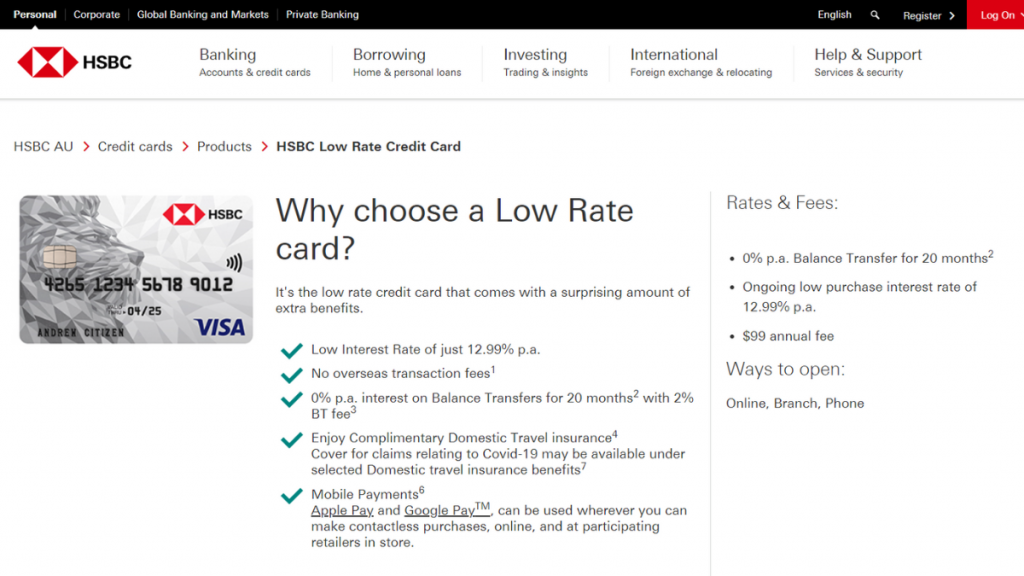

- Credit Score: Good to excellent.

- Annual Fee: Gain access to an array of benefits with an annual fee of $99.

- Intro offer: Immerse yourself in a compelling introductory offer with 0% p.a. interest on Balance Transfers for a generous 20 months.

- Rewards: N/A

- P.A.: Purchase interest rate of 12.99% p.a.

- Other Fees: Beyond the annual fee, consider the 2% fee associated with Balance Transfers. For cash advances, be aware of the higher of 3% or $4.

HSBC Low Rate Card: how does it work?

Discovering the HSBC Low Rate Card through this review unveils a credit solution that places a premium on both convenience and financial efficiency.

Firstly, embrace the modern era of transactions as this card seamlessly integrates with mobile payments through Apple Pay and Google PayTM.

This feature transforms every transaction into a secure and effortlessly convenient experience.

Moreover, the allure extends with an enticing 0% p.a. interest on Balance Transfers, spanning an impressive 20 months.

Beyond geographical confines, the card liberates users with the absence of overseas transaction fees, enhancing its utility for international transactions.

But one the highlight features is its remarkable 12.99% p.a. interest rate. This card not only stands as a testament to affordability but also lays the foundation for a strategic borrowing approach.

While acknowledging the presence of an annual fee, the HSBC Low Rate Card extends an invitation to potential users with a commitment to low rates and a spectrum of valuable perks.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Significant benefits and disadvantages you may find

Get ready to review and dissect the HSBC Low Rate Card, exploring the distinctive advantages and potential drawbacks that shape the credit landscape!

Moreover, informed decisions lead to a credit experience tailored to your financial goals. So, keep reading to find out if the HSBC Low Rate Card is really the best option for you!

Benefits

- Generous introductory offer;

- Exceptionally competitive interest rate;

- Option to acquire multiple additional cards without additional charges;

- Freedom from overseas transaction fees;

- Mobile payments.

Disadvantages

- 2% fee tied to the balance transfer offer;

- A yearly commitment of $99;

- Prerequisite for individuals to maintain a minimum annual income of $40,000;

- Elevated interest rate for cash advances;

- Lack of a rewards program.

Is a good credit score required for applicants?

While specific credit score requirements can vary, the HSBC Low Rate Card generally caters to individuals with a solid to excellent credit history.

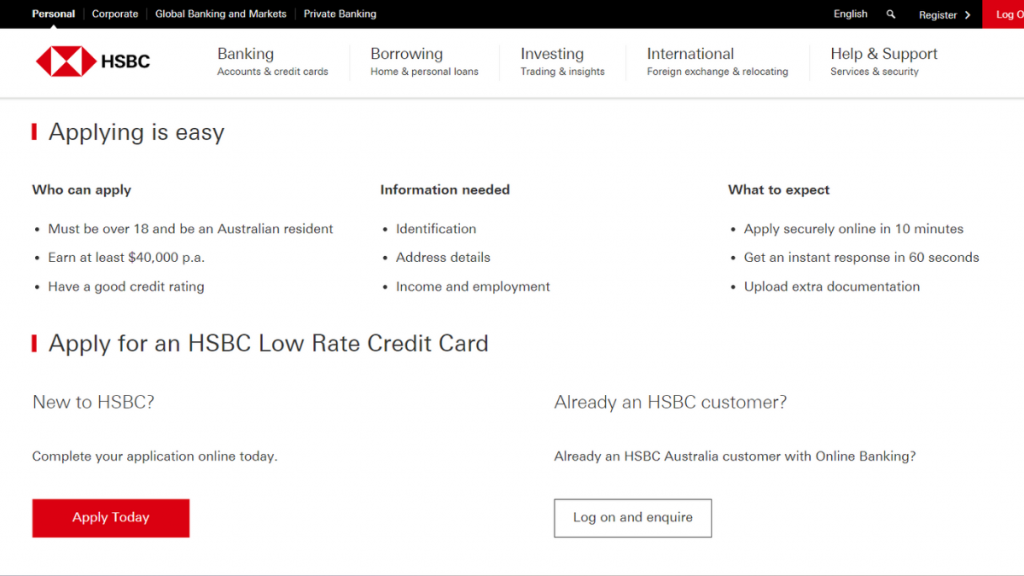

Learn how to apply and get the HSBC Low Rate Card

Feeling ready to review the guide and apply for the HSBC Low Rate Credit Card? The process is straightforward, and you can do it in minutes using your smartphone!

So, discover this exploration, combining practicality with a touch of financial wisdom, and navigate the steps to secure your HSBC Low Rate Credit Card!

Learn how to get this credit card online

As mentioned before, the journey to get this credit card is seamless and convenient. Moreover, it’ll take about 10 minutes to fill out the application.

- Visit the official website: Once you access the HSBC page, locate the “Credit Cards” option and proceed to explore the available cards. Then, find the HSBC Low Rate Card and click on “Apply Today”.

- Start the application process: You’ll be prompted to furnish essential personal details. Precision in these details is paramount, laying the groundwork for your application.

- Review and submit: Upon completion, conduct a thorough review of the provided information before submitting your application. In approximately 60 seconds, anticipate swift feedback regarding the status of your application.

- Approval: If approved, HSBC will seamlessly progress to the issuance of your coveted HSBC Low Rate Credit Card. It’s that easy!

What about another recommendation: Check out the St. George Vertigo Card!

If you want to consider other alternatives to the HSBC Low Rate Card, review the features and drawbacks of the St. George Vertigo Card. This worthy contender promises simplicity and valuable perks!

So, experience the freedom of an up to 55-day interest-free period on purchases, providing ample time for strategic financial management. Intrigued? Discover how it could align with your financial goals!

St. George Vertigo Card Review

Explore this St. George Vertigo Card review and learn how this credit card blends low fees, cashback rewards, and security features.

About the author / VInicius Barbosa

Trending Topics

Vast Visa Signature® College Real Rewards Card: Life Made Easier!

Discover the benefits of the Vast Visa Signature® College Real Rewards Card. Earn 1.5% cashback and build your credit effortlessly!

Keep Reading

Norwegian Cruise Line® World Mastercard® review

Looking for high rewards on travel purchases? Check out this Norwegian Cruise Line® World Mastercard® review!

Keep Reading

Plain Green Loans review

If you’re looking for a quick loan to cover unexpected emergencies, check out this Plain Green Loans review to see how it can help you.

Keep ReadingYou may also like

5 New Year’s financial resolutions you can keep

2023 is almost here, so how about planning your new year's financial resolutions? Here are a few important things to consider.

Keep Reading

Discover Bank review: is it trustworthy?

You will understand why so many people love this online bank after you read this Discover Bank review with all of its pros and cons.

Keep Reading

How to get your OppFi® card: online application

In this OppFi® card application guide you will learn how to get this card with no security deposit even if you have bad credit.

Keep Reading