Loans

Rocket Loans review – Get same day funding!

If you need money for home improvement, to pay your car expenses or just want to make that dream vacation come true, read our Rocket Loans review and see how this company can help you!

Advertisement

Rocket Loans: Get the vacation you’ve always wanted!

If you’re in need of a loan, Rocket Loans may be the perfect option for you. With a variety of loans to choose from, the process is simple and straightforward so you can get the funding you need. In this Rocket Loans review we’ll cover all the features so you can see if it fits your financial needs.

How to apply for Rocket Loans?

Learn how to apply for Rocket Loans and get the funding you need to make your dreams come true!

With Rocket Loans, there are no application fees or prepayment penalties. You can pre-qualify within seconds and even get same-day funding. Check some of its main features below and keep reading for our full Rocket Loans review.

- APR: Ranges from 6.72% to 29.99% with a discount for autopay.

- Loan Purpose: Home improvement, auto repair, travel or vacation and debt consolidation. However, Rocket Loans does not pay creditors directly.

- Loan Amounts: $2,000 – $ 45,000.

- Credit Needed: You’ll need a score of at least 580 to become eligible for a loan.

- Terms: 36 or 60 months.

- Origination Fee: Between 1% and 6%.

- Late Fee: $15 for each payment cycle for late payments.

- Early Payoff Penalty: There are no early penalty fees.

Rocket Loans: how does it work?

Rocket Loans stands out because it’s one of the few lenders that offers unsecured personal loans for people with fair credit scores.

You can apply for any amount ranging from $2,000 to $45,000 choose between 36 or 60 months to pay down your debt. The pre-qualification is fast and you can find out your rate and offer in just a few seconds.

The company offers same-day approval and you can even get same-day funding if the entire process is done before 1 p.m. on business days. Rocket Loans does not charge an early payoff fee and you can get a rate discount with autopay.

Loan purposes can be from repairing your house to debt consolidation. Though it must be said that Rocket Loans does not pay any creditor directly.

The origination fee ranges from 1% to 6% based on your rate and is deducted from the borrowed amount upon approval. APR is based on creditworthiness and is a variable between 5.92% and 29,99%.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Rocket Loans: should you get one?

Taking out a loan can be a daunting task, but with the right information it can be a little bit easier. Next in our Rocket Loans review, we’ll analyze the pros and cons of using Rocket Loans, one of the most popular online lenders. That way you can see if this is the right choice for your needs.

Benefits

- Pre-qualification with a soft pull on your credit score;

- Same-day approval;

- Possible same-day funding;

- Good value range;

- Accepts autopay;

- May accept applicants with a fair credit score;

- Doesn’t impose early payoff penalties.

Disadvantages

- Doesn’t allow co-signers;

- Limited repayment plans;

- Charges origination and late fees;

- Does not pay creditors directly for debt consolidation.

What is the required credit score?

Rocket Loans stands out amongst online lenders because it offers loans for people with fair credit scores. So if you have a FICO score above 580, you might be eligible for a loan. However, it’s important to note that the company takes more than credit scores into consideration for approval.

Rocket Loans application

If reading our Rocket Loans review got you interested in applying, follow the link below. In it, you’ll learn every step of the easy application process to get the funding you need.

So whether you’re in need of emergency funds or want to take out a larger loan for a home or car repair, read on to learn how to apply.

How to apply for Rocket Loans?

Learn how to apply for Rocket Loans and get the funding you need to make your dreams come true!

About the author / Aline Barbosa

Trending Topics

Watch UFC live online on your smartphone or tablet!

Want to watch UFC fights anytime, anywhere? Our blog post highlights the must-have mobile apps to watch UFC online on mobile apps!

Keep Reading

BlueVine Business Checking Account review: perfect for Small Business Owners

In this BlueVine Business Checking Account review you will see how this is an excellent choice for small business owners.

Keep Reading

How to get your Marriott Bonvoy Boundless® credit card: online application

Ready to earn points on hotel, dining, grocery purchases, and more? This Marriott Bonvoy Boundless® credit card application guide is for you!

Keep ReadingYou may also like

Bask Bank Mileage Savings account review: Earn American Airlines miles

In this Bask Bank Mileage Savings account review you will see how this account allows you to earn American Airlines miles with no fees.

Keep Reading

Learn how to take a pregnancy test online

Confidential and hassle-free: Dive into the world of pregnancy test apps online, offering discreet ways to check your pregnancy status

Keep Reading

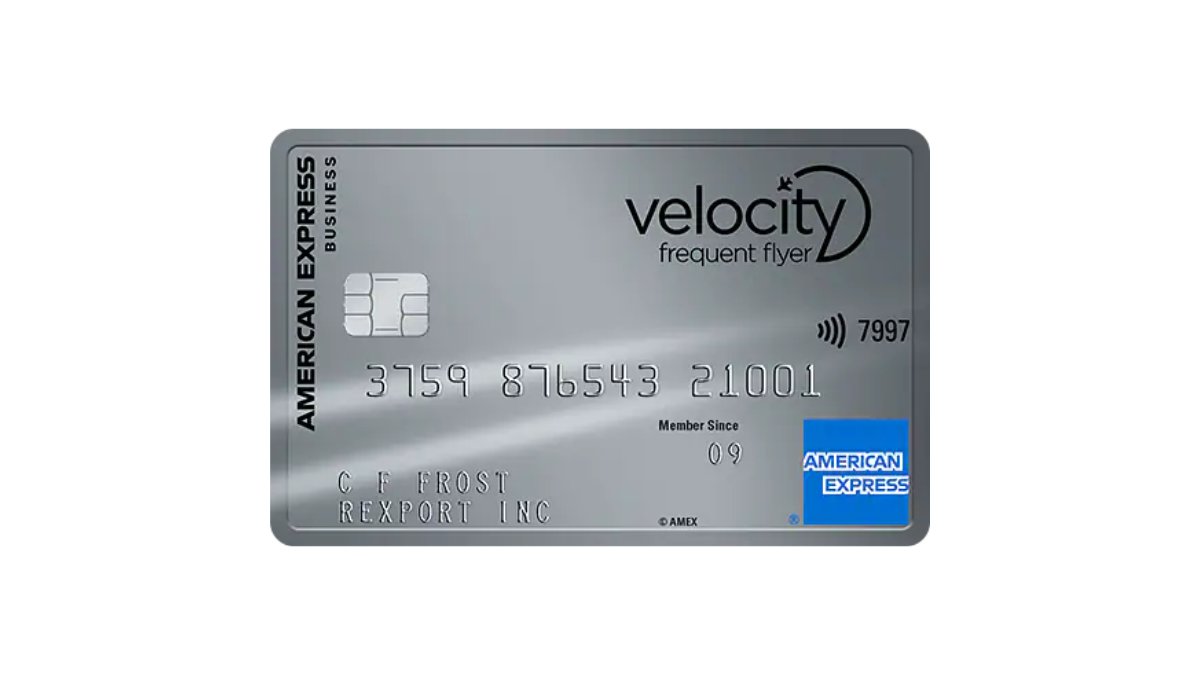

American Express® Velocity Business Card Review: Earn more

Soar into the world of business travel! Explore every feature of the American Express® Velocity Business Card in this review. Earn points!

Keep Reading