Credit Cards

American Express® Velocity Business Card Review: Earn more

Unlock a world of rewards with the American Express® Velocity Business Card. Earn Velocity Points on business expenses and enjoy a 12-month Gold Membership.

Advertisement

Secure 150,000 bonus Velocity Points and savor exclusive advantages! Take your business to new heights!

If you’re a forward-thinking business leader striving to elevate your ventures, you’ll discover this review of the American Express® Velocity Business Card highly illuminating. Take flight into the world of business travel rewards!

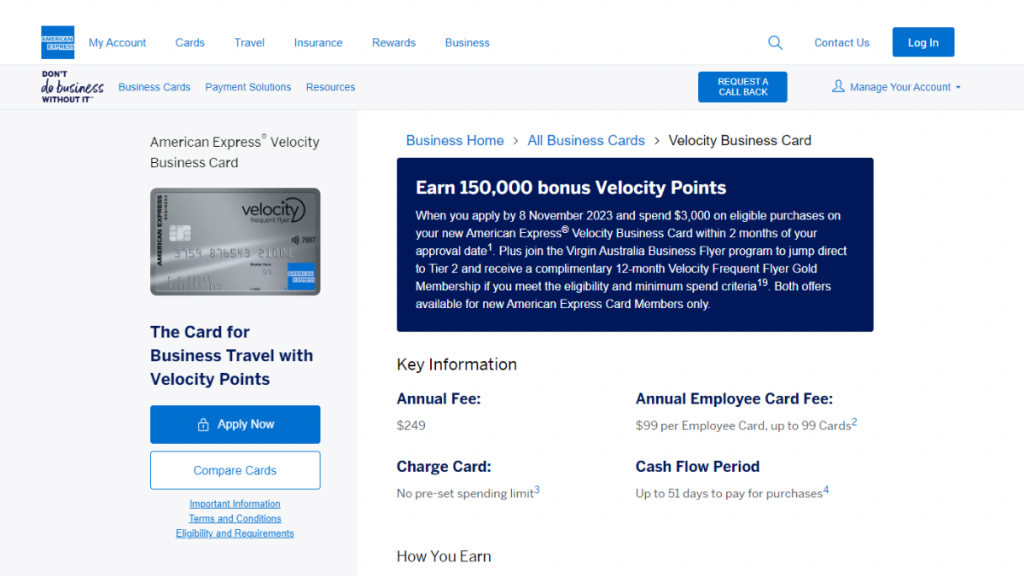

From its impressive introductory offer of 150,000 bonus Velocity Points to its flexible spending options and exclusive lounge access, find out why this card stands out in the world of corporate travel.

- Credit Score: Not disclosed;

- Annual Fee: $249;

- Intro offer: Initiate your business travel journey with a touch of sophistication. The American Express Velocity Business Card welcomes new cardholders with an impressive offering of 150,000 bonus Velocity Points;

- Rewards: Accumulate 2 Velocity Points for each $1 dedicated to nurturing your business’s expansion via Virgin Australia travel. Routine expenses reward you with 1 Point for every $1 spent, and even government expenditures transform into a point-generating opportunity, yielding 0.5 Points per $1;

- P.A.: N/A;

- Other Fees: While the annual fee stands at $249, there’s also the flexibility to incorporate employee cards at a fee of $99 per card, with the potential to include up to 99 cards.

American Express® Velocity Business Card: how does it work?

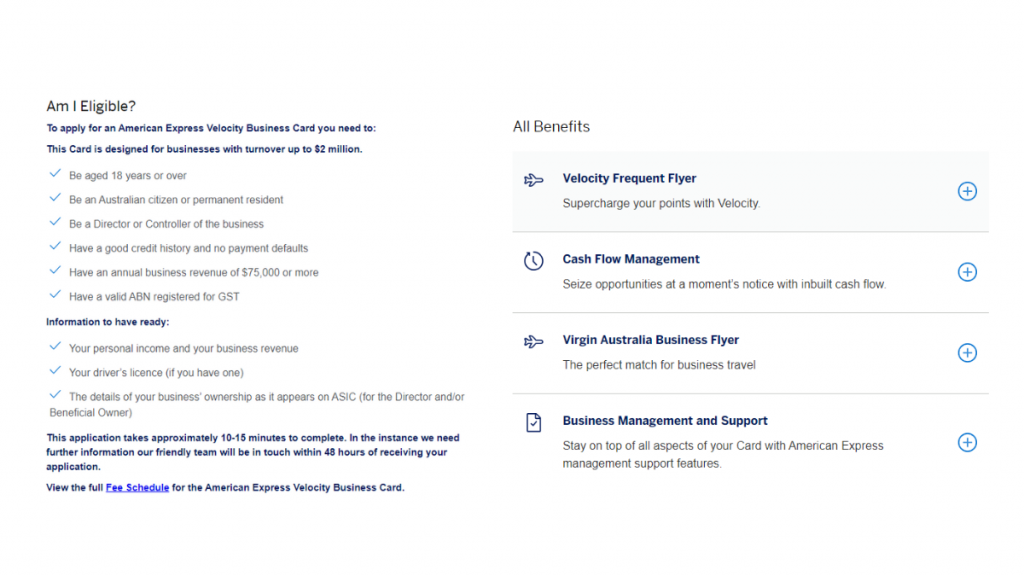

As evident in this comprehensive review, the American Express® Velocity Business Card caters to entrepreneurs and businesses boasting annual revenues of $75,000 or higher.

This card allows you to accumulate Velocity Points in a flexible and rewarding manner. You’ll earn 2 Velocity Points for every $1 spent on Virgin Australia travel, making it an ideal choice for frequent flyers.

Besides, you’ll earn 1 point per $1 on everyday business expenses, ensuring that even routine transactions contribute to your rewards. Lastly, it extends 0.5 Velocity Points for every $1 spent on government outlays.

Moreover, serving as a remarkably enticing incentive, this card introduces a promotional deal of 150,000 bonus Velocity Points. Indeed, this considerable bonus injects significant vitality into your Velocity Points balance.

Cardholders have the privilege to indulge in exclusive benefits, encompassing complimentary access to the Virgin Australia lounge and complimentary travel insurance.

But it’s worth noting that this card is associated with a substantial annual fee.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Significant benefits and disadvantages you may find

Whether you’re a frequent traveler or simply looking to maximize your business spending, this card has the potential to elevate your business ventures.

Nevertheless, it’s imperative to review both the advantages and constraints before reaching a conclusion regarding the American Express® Velocity Business Card.

Benefits

- Rewarding points program;

- Enjoy complimentary passes to the Virgin Australia lounge on an annual basis;

- Travel Insurance;

- Employee cards;

- Enjoy up to 6% savings on great-value fares for eligible flights;

- Liability coverage.

Disadvantages

- Although the card presents attractive rewards and privileges, it does come with an annual fee of $249;

- Businesses must uphold an annual business revenue of $75,000 or beyond;

- Employee card fees;

- Focused on Virgin Australia Travel;

- Yearly cost for supplementary employee cards.

Is a good credit score required for applicants?

So, following this review, are you prepared to submit your application for the American Express® Velocity Business Card? Then, be sure to have a good credit score since it’s an important factor.

While other elements like business revenue also matter, a strong credit score showcases your financial responsibility and can increase your chances of card approval.

Learn how to apply and get the American Express® Velocity Business Card

Accessing the full potential of the American Express® Velocity Business Card is just a few clicks away. Check out the straightforward process of applying for this powerful financial tool online!

Learn how to get this credit card online

Regardless of whether you’re an experienced entrepreneur or a burgeoning business owner, this card provides an entryway to travel incentives and financial effectiveness!

- Prepare your documentation: Firstly, gather the necessary documents to complete your application, including your business’s financial information and your personal identification details.

- Online application form: Head to the American Express® website and find the Velocity Business Card to conduct a comprehensive review of the Terms and Conditions. Then, begin the online application by filling out the required information. This includes your personal details, business information, and financial data.

- Review and submit: Carefully review the information you’ve provided in the application.

- Receive your card: Once your application is approved, you will receive your Velocity Business Card at the address you provided.

What about another recommendation: Virgin Australia Velocity Flyer Card!

Beyond the American Express® Velocity Business Card, there’s another rewarding avenue to review, the Virgin Australia Velocity Flyer Card. This card is tailored for frequent flyers and travel enthusiasts.

So, are you curious to learn more? Then, check out an in-depth analysis that will provide you with valuable insights into this card’s features, benefits, and rewards to help you make an informed decision!

Virgin Australia Velocity Flyer Review

Explore this review of the Virgin Australia Velocity Flyer Credit Card! Enjoy exclusive perks, and pay no annual fee for the first year!

About the author / VInicius Barbosa

Trending Topics

FB&T Personal Loan review

If you’re an Oklahoma resident in need of some extra cash to cover expenses, this FB&T Personal Loan review was made for you.

Keep Reading

Does Capital One offer student incentives?

Learn about Capital One's student incentives and take advantage of excellent benefits and perks their credit cards offer.

Keep Reading

US Bank Cash+® Visa® Secured or US Bank Altitude® Go Visa® Secured

Check this comparison to learn which is better: The US Bank Cash+® Visa® Secured Card or the US Bank Altitude® Go Visa® Secured Card.

Keep ReadingYou may also like

Pelican Pledge Visa Card Review: Leverage Your Savings!

Unlock financial possibilities with the Pelican Pledge Visa, and review a secured credit card designed to build your credit.

Keep Reading

Walmart MoneyCard application

Learn about the eligibility requirements and how the Walmart MoneyCard application process works so you can request your card today!

Keep Reading

SavorOne Rewards for Good Credit credit card review

Excellent rewards should also come with good credit. Check out this SavorOne Rewards for Good Credit Credit Card review to learn more!

Keep Reading