Loans

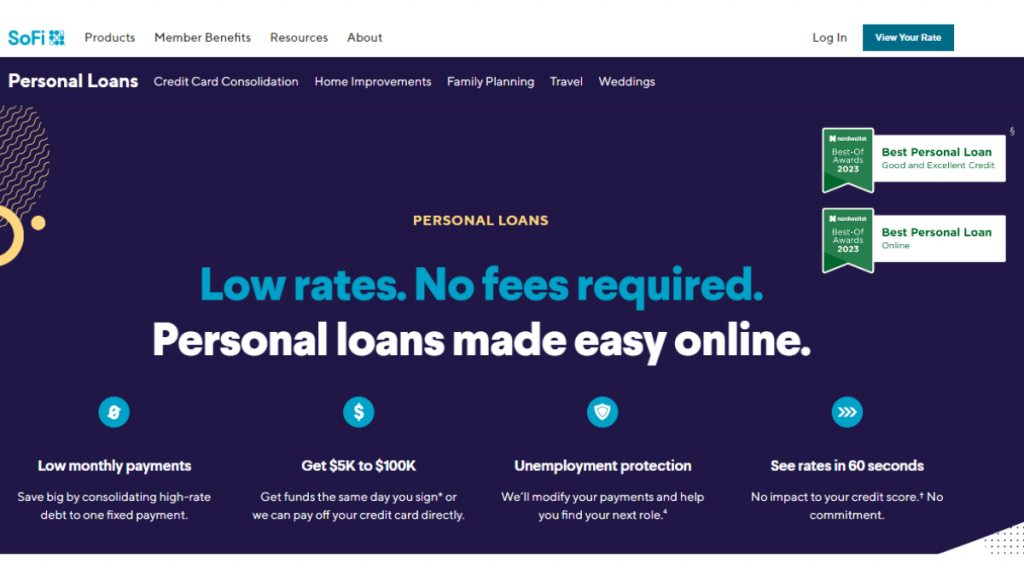

SoFi Personal Loans review

Get low, fixed rates with no hidden fees and flexible payment terms when you apply for a SoFi Personal Loans. Read our review to learn more about the benefits of this fast and easy financing option!

Advertisement

SoFi Personal Loans: Unlock your financial freedom with low rates and repayment terms of up to 7 years!

Are you in the market for a loan that’s affordable and easy to manage? Then the SoFi Personal Loans might just be the answer to your funding prayers.

Learn hwo to apply for a SoFi Personal Loan!

Get step-by-step instructions on how to apply for the SoFi Personal Loans. Learn about the eligibility requirements and more!

- APR: You’ll get personalized rates between 8.99% and 23.43%.

- Loan Purpose: From home renovations to an international cruise – use your loan for whatever purpose you may need.

- Loan Amount: SoFi allows you to borrow between $5,000 and $100,000.

- Credit Needed: There are no credit score requirements, but the higher your rating is, the better your offer will likely be.

- Terms: You can repay your loan between 2 and 7 years.

- Origination fee: SoFi charges zero origination fees.

- Late Fee: There’s no penalty for paying your loan a little late.

- Early Payoff Penalty: You can repay your loan back anytime without prepayment fees.

With modern technology and a simple application process, this popular company has become the go-to source for those searching for an efficient and convenient way to secure funding.

Keep reading as we dive deep into exploring the SoFi Personal Loans and assess whether they are the right financing option for your money needs!

SoFi Personal Loans: how does it work?

SoFi is a popular option for anyone looking to borrow money for a variety of purposes. The company offers a number of benefits for borrowers, including flexible loan terms and no origination fees.

They also offer a hardship program that can help people who experience financial difficulties during the loan term.

In addition, SoFi offers a range of tools and resources to help borrowers manage their finances and make smart borrowing decisions.

SoFi has fixed interest rates on their personal loans, and they start as low as 8.99% APR, and the maximum rate is 23.43%.

Your actual rate will depend on a number of factors, including your credit score, income, and loan amount.

Loan terms range from two to seven years, which gives you the flexibility to choose a repayment schedule that works your budget.

You can borrow anywhere from $5,000 to $100,000, depending on your needs and qualifications.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Significant benefits and disadvantages you may find

With SoFi, the process of applying for and receiving a loan can be incredibly easy compared to other financial institutions.

But does this convenience come with hidden pitfalls? Let’s take an in-depth look next.

Benefits

- Borrow from a wide range of loan amounts, up to $100,000;

- Pre-qualify online and check your loan offers with a simple soft pull;

- You can apply for a joint loan and get better rates;

- Autopay will secure a nice discount of 0.25%;

- There’s a hardship program to cover you in case of an unexpected life event.

Disadvantages

- The minimum amount you can borrow from this lender is $5,000;

- You cannot choose your payment due date to work around your payday.

Is a good credit score required for applicants?

There are no minimum credit score requirements when it comes to SoFi Personal Loans.

When you apply, the lender will assess information such as your credit history, employment history, and your cash flow to determine your terms.

Learn how to apply for the SoFi Personal Loans

Whether you’ve been thinking of starting your own business or just need some money to help with debt consolidation, now all you have to do is fill out an online form and get started right away.

In the following link, we’ll show you step-by-step how to easily apply for the SoFi Personal Loans so that you can start enjoying its many benefits as soon as possible.

Learn hwo to apply for a SoFi Personal Loan!

Get step-by-step instructions on how to apply for the SoFi Personal Loans. Learn about the eligibility requirements and more!

About the author / Aline Barbosa

Trending Topics

Wells Fargo Active Cash® Credit Card review

Are you looking for a no-annual-fee card that offers great rewards? Check out this Wells Fargo Active Cash® Card review to get yours.

Keep Reading

How to get your Crypto.com Visa Card: online application and generous perks

In this Crypto.com Visa Card application guide you will learn how to get this card so that you can use your crypto for real-world purchases.

Keep Reading

OneMain Financial review: get a personal loan easily

OneMain Financial Personal Loans to get flexible payments with low rates, even with a low credit score. Read this OneMain Financial review!

Keep ReadingYou may also like

Is investing overseas a good idea?

Thinking of investing overseas, but unsure of the risks involved? Read on and learn about the potential pros and cons for investing abroad!

Keep Reading

Evolve Home Loans review

Learn about the unique features of Evolve Home Loans with our full review and decide if this is a good fit for you.

Keep Reading

Auto Credit Express application: Get your auto loan today!

Learn how to apply with Auto Credit Express and get access to multiple lenders and car dealers with flexible payment options.

Keep Reading