Loans

Evolve Home Loans review

Thinking of getting a mortgage from Evolve Home Loans? Don't sign up until you read our comprehensive review. Get all the essential information you need before making your decision!

Advertisement

Evolve Home Loans: Hassle-free application with competitive rates!

Are you looking for a home loan that will provide you with the flexibility to make changes without being stuck in lengthy contracts? Then you should read this Evolve Home Loans review.

They offer all sorts of features and benefits to your individual needs. In this review, we’ll go over why you should consider taking out an Evolve Home Loan and if it can really meet your financial requirements.

How to apply for the Evolve Home Loans

Learn how to quickly and easily apply for the Evolve Home Loans and achieve the dream of owning your perfect home!

- APR: N/A

- Loan Purpose: Purchase or Refinance Home Loans

- Loan Amount: Not disclosed. However, loan amounts vary according to each customer’s profile, creditworthiness, down payment, and home goals.

- Credit Needed: No minimum credit score is required, but Evolve recommends having a great or excellent credit score to apply for a home loan.

- Terms: Flexible terms, from 8 to 30 years

- Origination fee: Evolve Home Loans disclose having no lender fees.

- Late Fee: N/A

- Early Payoff Penalty: N/A

Evolve Home Loans: how does it work?

Looking for the right mortgage can be daunting, but thankfully, Evolve Home Loans is here to make things easier for you.

With a variety of features and benefits, it’s no wonder this company has received rave reviews. They feature an impressive 5 stars rating from most customers!

Their competitive rates, fast approval process, and flexible repayment schedules make them a top choice for anyone seeking a loan.

Additionally, Evolve Home Loans provides clients with one-on-one support from experienced professionals who can help guide them through every step of the process.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Significant benefits and disadvantages you may find

Evolve Home Loans aim to simplify the home buying process by providing personalized service and guidance to help borrowers find the right loan product for their needs.

Benefits

- Wide range of mortgage options with no fees

- You can pre-qualify to see your approval odds and receive personalized offers

- Focus on providing personalized service

- Evolve Home Loans strives to offer competitive interest rates on their loans

- Depending on the loan product, Evolve Home Loans may offer flexible loan terms

- Online mortgage application process that can save borrowers time

Disadvantages

- Smaller lenders may have higher interest rates compared to larger lenders due to their smaller loan portfolios

- Among their many positive reviews, you can find a few negatives about their customer support

Is a good credit score required for applicants?

One thing is always true when it comes to applying for a mortgage loan: you will get the best offers if you provide a credit score above 620. This is a good reason to keep improving your credit score.

However, you can still be accepted for some loan offers with Evolve Home Loans with a less-than-perfect credit score.

Learn how to apply and get a loan with Evolve Home Loans

Applying for a loan with this lender is easier than you think. If you’re tired of running in circles searching for the perfect lenders, check the following post to learn how to apply for Evolve Home Loans.

How to apply for the Evolve Home Loans

Learn how to quickly and easily apply for the Evolve Home Loans and achieve the dream of owning your perfect home!

Trending Topics

Absa Premium Banking Credit Card application: 57 days interest-free

Looking for a card with a long interest-free period? Follow our Absa Premium Banking Credit Card application guide and get yours today!

Keep Reading

FNB Premier Credit Card review: Maximize your rewards with this card

In this FNB Premier Credit Card review you will see how this credit card allows you to maximize rewards, plus convenient perks.

Keep Reading

Chime Visa® Debit Card Review: Your Key to Hassle-Free Banking!

No more banking fees! Unveil the Chime Visa® Debit Card in this review and say goodbye to hidden charges and hello to convenient banking!

Keep ReadingYou may also like

What credit score is needed to buy a car?

Wondering what credit score you need to buy a car? Well, you have come to the right place. Read on and find out!

Keep Reading

What is a penalty APR and how does it work?

A missed credit card payment can lead to a lot of trouble, and one of them is a penalty APR. Learn how it works and how you can avoid it.

Keep Reading

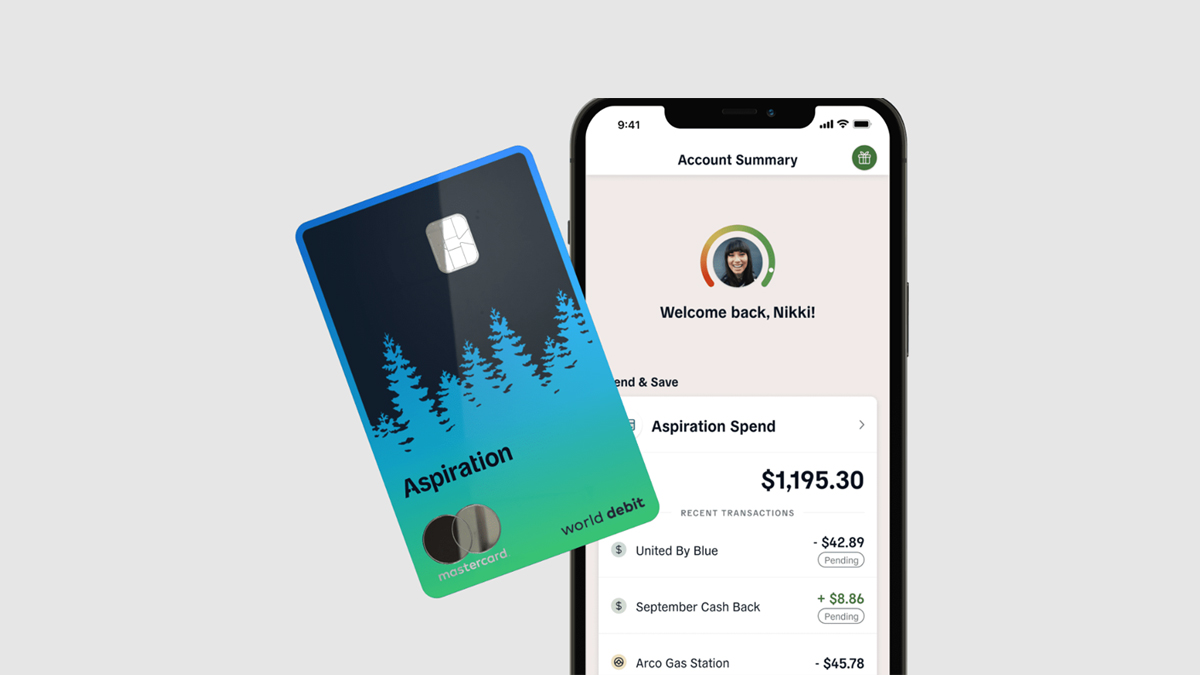

Aspiration Plus Account application

Learn everything you need to know about the Aspiration Plus Account application process and start earning interests right away!

Keep Reading