Reviews

Upgrade Visa with Cash Rewards credit card review

Upgrade will give you a better way to pay your card balance. One that gives you more control over your finances. This review will explain more about this card's features.

Advertisement

Understanding Upgrade Visa with Cash Rewards credit card: is it a credit card or a personal loan?

This Upgrade Visa with Cash Rewards credit card review will clarify some doubts you may have about it. After all, is it really a credit card? How can it have such a unique payment program, unlike any other credit card?

How to get your Upgrade Visa Cash Rewards card?

You can get your Upgrade Visa with Cash Rewards credit card to enjoy cash back rewards and special payment conditions for your card's balance. Learn how to apply.

- Sign-up bonus: No welcome bonus on this card, just for de Upgrade checking account with a debit card.

- Annual fee: No annual or any other kind of maintenance fee.

- Rewards: 1.5% cashback when you pay your monthly bill.

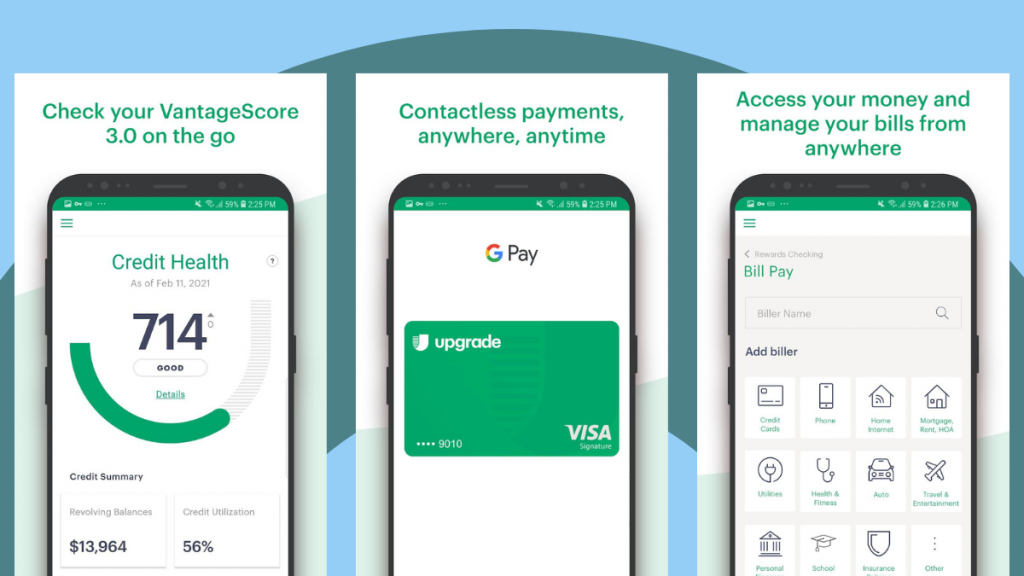

- Other perks: Contactless card technology, mobile app, fixed-rate monthly payments.

- APR: 8.99% to 29.99% APR

If you need to make a big purchase, you can opt for the Upgrade Cash Rewards instead of a personal loan. This card is easy to get and you’ll get cash back as a reward. If you like what you’re reading, stay ‘till the end of this post to see Upgrade’s features.

Upgrade Visa with Cash Rewards credit card: is it a good card?

The Upgrade credit card will give you a new approach to how you deal with your credit card balance. It gives you the opportunity of full control over your budget. Now, when you make a big purchase on your card, you’ll know exactly how much this purchase will cost you if you split it into fixed-rate installments.

The credit limit range from $500 to $50,000, but most people with a good or excellent credit score will get $25,000. This credit card looks like a personal loan but is way more simple. You can even pre-apply to check your offer before you make any check on your credit score.

To get just a little better, every time you pay your credit card bill you’ll get 1.5% cash back of the amount paid. And what about the annual fee? Don’t worry, you won’t pay any fee to use this card.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Upgrade Visa with Cash Rewards credit card: should you get one?

Benefits

- Fixed-rate monthly payment to help you stick to your budget and avoid paying too much interest on your balance.

- Cash back on every purchase. Earn 1.5% of your expenses back.

- Easy to apply and you can check your offer with no hard inquiry on your credit score.

- Mobile app to manage your account, virtual card, and contactless card technology.

Disadvantages

- To get the lower APR you’ll be required to present an excellent credit score and to put your payments on autopay. In other cases, the APR can be higher.

- There is no sign-up bonus or Intro APR.

What is the required credit score?

To get the Upgrade Visa with Cash Rewards you’ll need a good or excellent credit score. If you have an average score you’ll get offered another Upgrade card or a secured one.

Upgrade Visa with Cash Rewards credit card application

If you’d like to enjoy the benefits that Upgrade Visa with Cash Rewards credit card has to offer as you’ve seen in this review, read the following content and apply for this card. You’ll be able to start using it right away with your virtual card.

How to get your Upgrade Visa Cash Rewards card?

You can get your Upgrade Visa with Cash Rewards credit card to enjoy cash back rewards and special payment conditions for your card's balance. Learn how to apply.

Trending Topics

How to open your Bask Bank Mileage Savings account

In this article, we will show you how you can easily open your Bask Bank Mileage Savings account and start saving.

Keep Reading

FNB Gold Business Credit Card review

Get an in-depth review of the FNB Gold Business Credit Card and learn about the features and benefits you can get with this card.

Keep Reading

8 Ways to Protect Your Money During a Recession

Get the right tips that will help protect your money during an economic recession. Learn how to create a financial plan that works for you!

Keep ReadingYou may also like

Get your ABSA Flexi Core Credit Card: online application

In this ABSA Flexi Core Credit Card application guide, you will learn how to get this card to start enjoying its amazing benefits.

Keep Reading

What is a student loan and how do they work?

If you’ve ever wondered what a student loan is and how they work, we’ve got you covered. Read on to learn all you need to know!

Keep Reading

What is generational wealth and how does it work?

Learn everything you need to know about generational wealth, from what it is to how you can start building one for your family.

Keep Reading