Loans

CreditFresh Review: Enhance Your Credit Profile!

CreditFresh is your pathway to financial resilience. Explore a Line of Credit, receive quick approvals, and benefit from a transparent credit solution tailored to your needs! Learn more!

Advertisement

Enjoy a Line of Credit that offers flexibility, transparent terms, and a chance to build your credit history!

Want a safety net for the unexpected and a pathway to credit evolution? Then don’t miss out on this review of the CreditFresh Lines of Credit and discover a unique solution when it comes to money.

Crafted for those seeking more than just a borrowing tool, CreditFresh is about tailored flexibility, transparent terms, and potential credit growth!

Imagine having the freedom to request draws online, quick access to funds, and a clear pathway to improving your credit score. In this review, you’ll discover a platform that goes beyond the conventional!

- APR: Variable according to your selected loan amount, terms, and creditworthiness;

- Loan purpose: Borrowers have the autonomy to determine the purpose of their loan, whether it’s for managing unexpected expenses, covering medical bills, handling car repairs and more;

- Loan amount: Ranges between $500 and $5,000;

- Credit needed: N/A;

- Terms: Specific details are provided during the application and approval process;

- Origination fee: None;

- Late fee: N/A;

- Early payoff penalty: None.

CreditFresh: how does it work?

When looking for a personalized borrowing experience, it’s essential to review the features CreditFresh can offer. After all, this is not just financial assistance but a customized approach to your borrowing needs.

CreditFresh distinguishes itself by offering a line of credit, allowing users to make draws, repay, and redraw. All within their specified credit limit.

This unique structure means that your borrowing experience is adaptable. Moreover, you can access funds between $500 and $5,000.

And as CreditFresh sets a high standard for transparency, this ensures that you can navigate your financial commitments with absolute clarity. So, bid farewell to obscure financial terms and hidden charges.

Besides, by reporting account statuses to TransUnion, CreditFresh provides users with an opportunity to influence their credit history over time positively.

So, anticipate a borrowing process that is both efficient and accessible. Whether you’re making draws online or need prompt access to funds, CreditFresh aims for a hassle-free experience.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Significant benefits and disadvantages you may find

When it comes to financial tools like CreditFresh Lines of Credit, you should weigh potential drawbacks in order to be sure you’re making the right choice for your financial profile.

So, if you want a borrowing experience that values your time, explore some advantages and disadvantages of CreditFresh before you decide to apply.

Benefits

- Adaptability and flexibility when it comes to borrowing;

- Opportunity to positively impact your credit history;

- Transparent terms and a clear understanding;

- A process designed for efficiency;

- Competitive credit limit.

Disadvantages

- Interest charges apply;

- Credit lines may be limited for individuals with higher financial requirements;

- Has specific eligibility criteria;

- Users need to be attentive to Billing Cycle Charges;

- Not be available to all individuals.

Is a good credit score required for applicants?

While CreditFresh considers various factors during the application process, including credit history, the requirement for an excellent credit score is not explicitly stated.

CreditFresh application

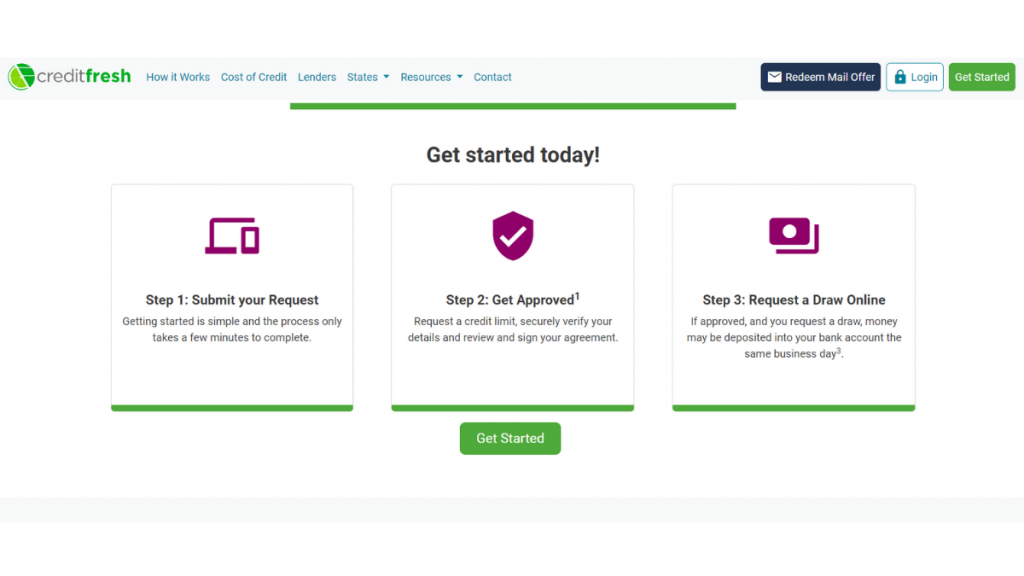

So, now that you’ve explored features, benefits, and possible drawbacks, how about a complete review of the CreditFresh application process? Check out an easy guide!

- Visit CreditFresh website: Firstly, access the official website and familiarize yourself with the user-friendly interface. Moreover, make sure you meet CreditFresh’s eligibility criteria. This typically includes being of legal age in your state of residence, U.S. citizenship or permanent residency, an active bank account, a regular source of income, and valid contact information.

- Start application process: Once you’re ready, click on “Get Started” and provide the basic information and details required for the application process.

- Getting approved: Upon submitting your request, CreditFresh will assess your information to determine eligibility and approve your application. Once approved, you can request your credit limit.

- Get funds: With your approved credit limit, you have the freedom to request a draw online whenever you need funds. Upon requesting a draw and approval, CreditFresh aims to deposit the funds into your bank account on the same business day.

What about another recommendation: U.S. Bank Personal Loan!

So, if you want to review alternatives to CreditFresh, the US Bank Personal Loan presents itself as a compelling option. Unlike a line of credit, the US Bank Personal Loan is a traditional installment loan.

This means it provides borrowers with a lump sum amount that is repaid over a fixed term. Additionally, you can use the loan for various purposes! If you prefer a clear repayment plan, check out this option!

US Bank Personal Loan Review

Explore the convenience of the US Bank Personal Loan in this review. Borrow up to $50,000 for your one-time financing needs!

About the author / VInicius Barbosa

Trending Topics

FNB Gold Business Credit Card application

See how easy it is to apply for an FNB Gold Business Card and take advantage of the many benefits that come with being a cardholder.

Keep Reading

Eloan review: get a loan easily

In this Eloan review you will see how you can get fast approval and fast funding with this convenient lender.

Keep Reading

Merrick Bank Double Your Line™ Platinum Visa® review

In this Merrick Bank Double Your Line™ Platinum Visa® review you will see how even users with bad credit can double their credit limit.

Keep ReadingYou may also like

Discovery Bank Platinum Card application: Flexible credit facilities

In this Discovery Bank Platinum Card application guide you are going to learn how to get this card in just a few minutes.

Keep Reading

Amex EveryDay® Credit Card online application

Learn everything you need to know about applying for the Amex EveryDay® Card, from eligibility requirements to what you can expect.

Keep Reading

Bank of America® Unlimited Cash Rewards review

Read our Bank of America® Unlimited Cash Rewards review to learn if the features and benefits of this card are what you’re looking for.

Keep Reading