Loans

US Bank Personal Loan Review: Quick Online Applications!

Take control of your finances with a personal loan from US Bank. From debt consolidation to dream vacations, enjoy fixed APRs as low as 8.24%. Discover a hassle-free application!

Advertisement

Enjoy no origination fees and fast access to funds to fund home projects, cover unexpected expenses, and more!

Want to pay for your dream wedding? Or what about covering moving expenses? Then review the Personal Loan from US Bank and explore everything it has to offer!

With fixed APRs, no collateral required, and a simple application process, the Personal Loan from US Bank can help you achieve your financial goals!

Whether it’s debt consolidation or a dream vacation, you can borrow confidently with fixed rates and no hidden fees. Learn more about this personal loan and find out if it fits your financial needs!

- APR: It varies from 8.24%% to 22.50%.

- Loan purpose: Borrowers can utilize funds for various purposes, including debt consolidation, home projects, wedding expenses, vacations, moving costs, and unforeseen emergencies.

- Loan amount: Customers with qualifying US Bank checking accounts have the opportunity to secure loans reaching a maximum of $50,000. For those without an existing banking relationship with US Bank, the loan offering extends to amounts of up to $25,000.

- Credit needed: N/A.

- Terms: Ranges from 12 to 84 months.

- Origination fee: No.

- Late fee: N/A.

- Early payoff penalty: Doesn’t apply.

US Bank Personal Loan: how does it work?

When opting for a Personal Loan from US Bank, it’s essential to review all the features in order to make the right financial decision.

However, borrowers can anticipate a flexible and accessible financial solution tailored to their unique needs with US Bank. The loan process begins with a straightforward online application.

Qualifying customers with US Bank checking accounts have the option to obtain funds of up to $50,000.

However, individuals without a pre-existing customer relationship with the bank can avail themselves of loans reaching a maximum of $25,000.

Moreover, one distinctive feature is the competitive Annual Percentage Rate, ranging from 8.24% to 24.99%.

The stability provided by this fixed-rate arrangement guarantees a consistent and foreseeable financial landscape over the entire duration of the loan.

Unlike some lending institutions, US Bank distinguishes itself by not charging origination fees, offering borrowers the advantage of obtaining their personal loans without incurring additional upfront costs.

Finally, throughout the loan process, applicants can benefit from a quick approval system, with status notifications typically provided in less than a minute. Once approved, you may close your loans online.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Significant benefits and disadvantages you may find

Whether consolidating debts, planning a dream vacation, or addressing unexpected expenses, a personal loan can be the right call to achieve your life goals.

However, it’s important to review the advantages and weigh the drawbacks the US Bank Personal Loan can present. So, keep reading to find out more.

Benefits

- Compelling range of competitive APRs;

- Personalized loan amounts;

- Exemption from origination fees on personal loans;

- The application process is streamlined;

- Expedited access to funds.

Disadvantages

- Approval is contingent upon credit evaluation;

- The availability of loan programs may vary across states;

- Borrowing amounts are restricted to individuals without a US Bank affiliation.

Is a good credit score required for applicants?

Yes, credit approval is one of the factors considered in the application process. Typically, personal loans with competitive interest rates often require a good to excellent credit score for favorable terms.

US Bank Personal Loan application

So, now that you’ve learned more about the US Bank Personal Loan, it’s time to review an easy guide to apply online and reach your financial goals. But don’t worry, this is a hassle-free process.

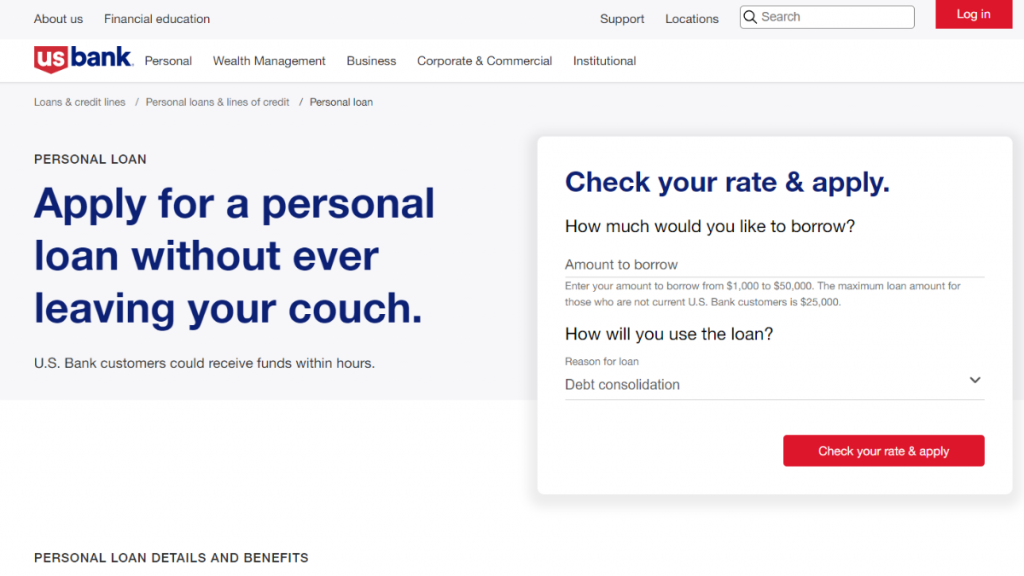

- Visit US Bank website: Firstly, access the official website and click on the “Personal” tab on the menu. Then, select the option “Personal loans & lines” and click to see the loans available.

- Check your rate: When the page loads, click to learn more about the US Bank Personal Loan and review benefits and terms. Then, click to check your rates. This involves a soft credit check, which does not impact your credit score.

- Application form: Once you’ve reviewed your personalized rates and are ready to proceed, initiate the application. You’ll be prompted to provide essential information, including your social security number, home address, employment details, and other relevant data.

- Submit the form: When you’re done, review and submit your application. Typically, US Bank aims to provide applicants with their loan approval status in less than a minute.

- Approval: If your loan application is approved, you can proceed to close your loan online.

What about another recommendation: PNC Bank Personal Loans!

So, if you still want to review other options as good as the personal loan from US Bank, what about PNC Bank Personal Loans? PNC Bank provides borrowers with the financial flexibility they need.

Indeed, with competitive interest rates and a range of loan amounts, PNC Bank is a viable alternative to the US Bank. If you want to learn more about features, benefits, and drawbacks, access a complete review below!

PNC Bank Personal Loans Review

If you want financial freedom, discover the PNC Bank Personal Loans in this review. No collateral is required and you get competitive rates!

About the author / VInicius Barbosa

Trending Topics

Australia Post Travel Platinum Mastercard® review: Unlock travel perks!

Save money traveling around Australia! Check out our Australia Post Travel Platinum Mastercard® review and learn how.

Keep Reading

Does paying car insurance help your credit score?

If you are wondering whether paying car insurance helps your credit score, read this article and we will tell you what you need to know.

Keep Reading

Find the Best Apps for Learning Languages!

Looking for ways to learn the language you want or need easily? If so, read on to find the best apps for learning languages!

Keep ReadingYou may also like

Amazon Prime Rewards Visa Card application

Learn how the Amazon Prime Rewards Visa Card application process works and make the most of your Prime Membership with great rewards!

Keep Reading

American Express® Serve® Cash Back card application

Read this American Express® Serve® Cash Back card application guide and learn how to get this convenient prepaid card today.

Keep Reading

Cryware: the malware that’s targeting crypto hot wallets

There’s a new malware targeting crypto hot wallets. The Cryware info-stealing strategy can cause irreversible damage to investors’ funds.

Keep Reading