Get all the benefits of a secured credit card with simple rewards structure!

Bank of America® Unlimited Cash Rewards Secured: Simple rewards structure, potential to graduate, free FICO score.

Advertisement

Bank of America® Unlimited Cash Rewards Secured is an excellent choice for people who want to build credit while earning rewards. This card has a simple rewards program that earns you 1.5% cashback on all purchases, with no spending caps or category restrictions. The annual fee is $0, and you can access your FICO credit score for free.

Bank of America® Unlimited Cash Rewards Secured is an excellent choice for people who want to build credit while earning rewards. This card has a simple rewards program that earns you 1.5% cashback on all purchases, with no spending caps or category restrictions. The annual fee is $0, and you can access your FICO credit score for free.

You will remain in the same website

Are you looking for a way to optimize your finances and get the most out of your credit card? Consider the Bank of America® Unlimited Cash Rewards Secured card! Meet some of its perks below.

You will remain in the same website

Bank of America® Unlimited Cash Rewards Secured helps people build credit by reporting their credit usage and payment behavior to the three major credit bureaus. With responsible use, cardholders can establish a positive credit history and improve their credit score over time.

No, there are no limits to the amount of rewards you can earn with Bank of America® Unlimited Cash Rewards Secured. You can earn unlimited 1.5% cashback on all purchases.

Bank of America® Unlimited Cash Rewards Secured has an annual fee of $0. This means you can enjoy the benefits of the card without paying an annual fee.

Yes, Bank of America® Unlimited Cash Rewards Secured provides cardholders with free access to their FICO credit score. You can access your score through your online account or the Bank of America mobile app.

Yes, there is a foreign transaction fee of 3% of the U.S. dollar amount of each transaction. If you plan to travel outside of the United States, you may want to consider a different card with no foreign transaction fees to avoid these additional charges.

Looking to build credit and earn rewards? Learn how to get the Bank of America® Unlimited Cash Rewards Secured in just a few minutes with our application guide.

How to get your BofA Unlimited Secured card?

If you want to start earning 1.5% cashback on all purchases, our Bank of America® Unlimited Cash Rewards Secured application guide is for you.

Interested in exploring other secured cards? We suggest the Platinum Secured Credit Card from Capital One.

It’s a great option for building or rebuilding credit, with no annual or hidden fees. Perfect for beginners or those looking to improve their credit score.

Want to learn more? Click the link below and we will tell you all you need to know.

Platinum Secured Card from Capital One application

Learn how the Platinum Secured Card from Capital One application process works and take the first step towards a life of better credit!

Trending Topics

PenFed Credit Union Personal Loan review

This PenFed Credit Union Personal Loan review wll show you everything you need to know to get this loan easily.

Keep Reading

A Comprehensive Guide to Understand Frontier Airlines Flights!

Find a guide to booking, canceling, and understanding Frontier Airlines Flights! Read on to learn more about this airline - flight from $39!

Keep Reading

Bank of America® Customized Cash Rewards Secured application

With this Bank of America® Customized Cash Rewards Secured application guide you will get this card in just a few minutes.

Keep ReadingYou may also like

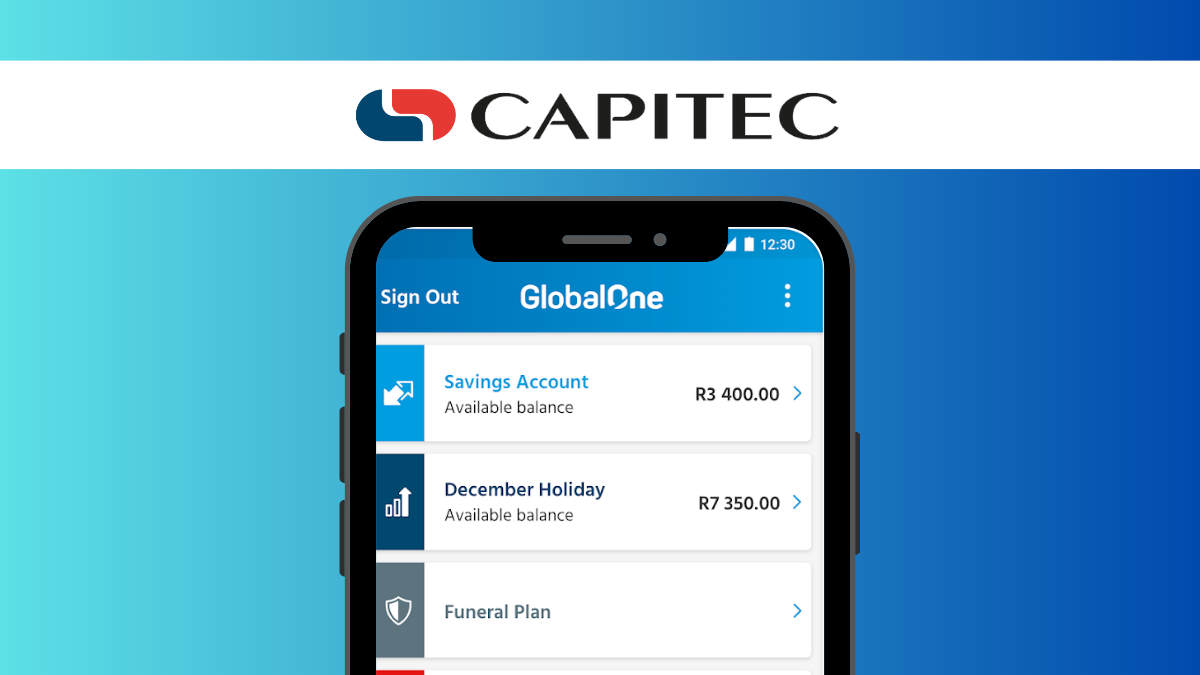

Capitec Tax-free Savings Account review: No Fees Attached

If you are looking for tax-free returns on your savings, check out this Capitec Tax-free Savings Account review.

Keep Reading

What are the best Chase credit cards?

Compare the best Chase credit cards and find the right one for your specific financial needs. Get great rewards and bonuses with these cards!

Keep Reading

Reverse mortgages can help you save money!

Reverse mortgages have been increasing in popularity for future retirees who don’t want to experience stock market volatility.

Keep Reading