Credit Cards

Virgin Australia Velocity Flyer Review: Unleash Your Wanderlust!

Take off with the Virgin Australia Velocity Flyer! Earn Velocity Points, get a yearly gift voucher, and experience a credit card designed for travel enthusiasts. Unlock your wanderlust!

Advertisement

Accumulate Velocity Points with every card swipe and transform your day-to-day spending into unforgettable travel adventures!

As you set your sights on acquiring the Virgin Australia Velocity Flyer credit card, you’re entering a realm of comprehensive travel rewards you’ll explore in this review.

Discover how the Virgin Australia Velocity Flyer can become the key that unlocks the gateway to remarkable journeys. Set forth on your odyssey to harness your financial resources while you explore the world.

- Credit Score: Typically, having a solid credit score is a key requirement for eligibility;

- Annual Fee: $0 annual fee in the 1st year. Beyond that, from the second year onward, you can expect a customary annual fee of $129;

- Intro offer: 0% p.a. for 24 months on balance transfers;

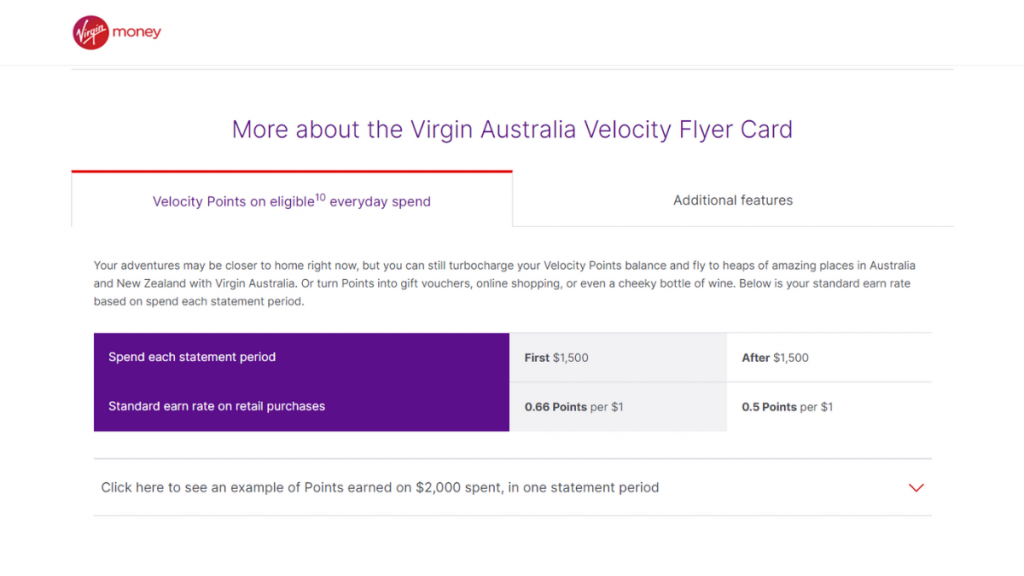

- Rewards: Cardholders have the privilege of harvesting Velocity Points on every eligible transaction. The standard rate usually stands at 0.66 Velocity Points for every dollar spent within a statement period, up to $1,500. For expenses exceeding this limit, the rate typically scales down to 0.5 Points per dollar. Additionally, an annual $129 Virgin Australia Gift Voucher graces their journey.

- P.A.: 20.74% p.a.

- Other Fees: In addition to the annual fee and purchase rate, it’s crucial to consider potential additional fees connected to this card. Among these, a $39 annual additional cardholder fee often lurks.

Virgin Australia Velocity Flyer: how does it work?

Explore the Virgin Australia Velocity Flyer credit card in this review and find out how this financial tool is a gateway to travel rewards and unique benefits.

Firstly, the credit card functions by enabling its cardholders to accumulate Velocity Points, the exclusive currency of Virgin Australia’s Velocity Frequent Flyer program, with each qualifying purchase they conduct.

It typically offers a favorable earn rate, often established at 0.66 Velocity Points for every $1 spent within each statement period, up to a cap of $1,500 in expenditures.

Furthermore, for spending beyond this threshold, it typically extends a rate of 0.5 Points for every $1 spent. This way, your daily expenditures become a rewarding journey.

Moreover, a standout feature of this card is the annual $129 Virgin Australia Gift Voucher. In addition to earning Velocity Points and the yearly gift voucher, enjoy a new annual fee structure.

Cardholders can enjoy no annual fee in the first year, which is a compelling feature for those who want to explore the card’s benefits without the initial cost.

Besides its core attributes, the Virgin Australia Velocity Flyer credit card boasts defenses such as Fraudshield® and Visa’s Zero Liability policy.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Significant benefits and disadvantages you may find

In summary, the Virgin Australia Velocity Flyer credit card emerges as a financial instrument crafted to enhance your travel adventures! Explore some of the advantages and drawbacks outlined below.

Benefits

- Accumulate Velocity Points with every qualifying purchase;

- Cardholders are graced with an annual $129 Virgin Australia Gift Voucher;

- This card provides a valuable 0% p.a. balance transfer offer for 24 months;

- Security with Fraudshield®.

Disadvantages

- The yearly cost post the introductory year;

- The standard purchase rate for this card is 20.74% p.a., which can be relatively high;

- Eligibility requirements;

- Overseas transaction fees.

Is a good credit score required for applicants?

While specific requirements can vary, a higher credit score improves your approval chances and can lead to more favorable terms.

Moreover, applicants need to meet a minimum income requirement, which is often set at around $35,000 per year.

It’s important to review the specific information before applying for the Virgin Australia Velocity Flyer.

Learn how to apply and get the Virgin Australia Velocity Flyer

Getting the Virgin Australia Velocity Flyer online is a convenient and straightforward process that you can review below. Make sure you meet the eligibility criteria to improve your chances of approval!

Learn how to get this credit card online

So, are you ready to earn points and enjoy premium travel experiences? Here’s a step-by-step guide to help you secure your ticket to travel rewards!

- Visit the website: Go to the official website of Virgin Money to access the credit card section on the main menu. Subsequently, make your selection by opting for the Virgin Australia Velocity Flyer.

- Application form: When you’ve made your decision to proceed with the application for this card, click on the “Apply now” option. Then, provide your personal information, which includes your name, contact details, date of birth, and address.

- Submit your application: Once you’ve filled in all the required information and reviewed your application, submit it electronically.

- Verification and approval: If approved, you’ll receive a formal offer, and the card will be mailed to your provided address. It’s that easy!

What about another recommendation: Westpac Lite Credit Card!

While the Virgin Australia Velocity Flyer caters to travel enthusiasts, the Westpac Lite Credit Card focuses on providing a straightforward and cost-effective credit solution, so want to review its key features?

With a competitive interest rate and minimal fees, it’s an option for those who prefer a no-fuss approach to credit. Explore the Westpac Lite Credit Card and discover if it aligns with your financial goals!

Westpac Lite Credit Card review: Low Fees

If you’re considering the Westpac Lite Credit Card, this review breaks down its rewards and eligibility requirements to help you decide!

About the author / VInicius Barbosa

Trending Topics

FNB Aspire credit card review: Earn cashback in eBucks rewards!

If you're on the look out for a card that offers rewards on purchases, check out this FNB Aspire credit card review.

Keep Reading

CreditFresh Review: Enhance Your Credit Profile!

If you want to borrow responsibly, build your credit, and access funds whenever you need them, review CreditFresh Line of Credit!

Keep Reading

Applied Bank® Secured Visa® Gold Preferred® Card application

Learn all you need to know about the Applied Bank® Secured Visa® Gold Preferred® Card application process and get your score up!

Keep ReadingYou may also like

Curadebt review

In this Curadebt review, we’ll take a closer look at a company that can help you find a smart and easy solution to assist you on your debt.

Keep Reading

College Ave Student Loans review

Read our College Ave Student Loans review to learn how you can get the funding you need for college with fair and flexible repayment terms.

Keep Reading

FNB Gold Business Credit Card review

Get an in-depth review of the FNB Gold Business Credit Card and learn about the features and benefits you can get with this card.

Keep Reading