Loans

Exchange Bank Unsecured Personal Loan application

If you’re looking for an unsecured personal loan, the Exchange Bank of California has you covered. You can apply online and borrow up to $100,000. Read on to learn more about the process.

Advertisement

Exchange Bank Unsecured Personal Loan: Get the funds you need with an easy and online application!

The Exchange Bank Unsecured Personal Loan application process is simple and straightforward.

EB offers personal loans to qualified applicants who may use the loan for almost any purpose, like making large purchases or consolidating debt.

Exchange Bank offers an unsecured personal loan, which does not require collateral, such as a car or home, to secure it.

You can borrow any amount between $1,500 and $100,000 with fixed rates and monthly payments.

To qualify for an Exchange Bank personal loan, you must have at least a fair credit score and meet the bank’s income requirements. Exchange Bank personal loans are a great way to get the funds you need.

You can follow through with the Exchange Bank Unsecured Personal Loan application process in a number of ways. However, they provide the convenience of an online application as well.

To learn more details on how to apply, keep reading the content below.

Learn how to apply online

The Exchange Bank Unsecured Personal Loan online application process is quite simple. First, you need to access the site, locate the unsecured option and click on “apply here”.

There are five stages until funding, and the first one is to get your consent to check your credit score and credit history.

Then, you’ll need to provide some basic information about yourself and your finances, including your Social Security number, annual income, and estimated credit score.

Exchange Bank will then use this information to determine your loan eligibility and terms.

If you’re approved for a loan, you’ll be able to choose from a variety of repayment options and terms, all of which will be clearly explained to you before you make your final decision.

Once you sign-up for the deal, you should receive the funds in your checking account within a couple of days.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Learn how to apply using the app

Unfortunately, you can’t follow through with the Exchange Bank Unsecured Personal Loan application via mobile app.

However, other than the online application, you can apply via phone by calling 800.995.4066.

You can also apply for an Exchange Bank Unsecured Personal Loan at a physical branch.

Just make sure to call ahead and inquire about the documentation you’ll need to take with you.

What about another recommendation: Upstart Personal Loans

If you are unsure about applying for an EB Unsecured Personal Loan, there are plenty of other options available.

One of those options is the Upstart Personal Loans. With Upstart, you can borrow up to $50,000 with flexible terms and very competitive rates.

Upstart also allows all new applicants to check for pre-qualification before applying, which very few lenders do.

If you want to learn more about the loan, follow the link below for our comprehensive review.

Upstart Personal Loans review: get a loan easily

Apply for Upstart Personal Loans , get approved extremely fast, and access to funding in one business day.

About the author / Aline Barbosa

Trending Topics

Best Mastercard Credit Cards: find the one for you!

Interested in what the best Mastercard credit cards would be? Check our Mastercard credit card reviews to know about the very best of them!

Keep Reading

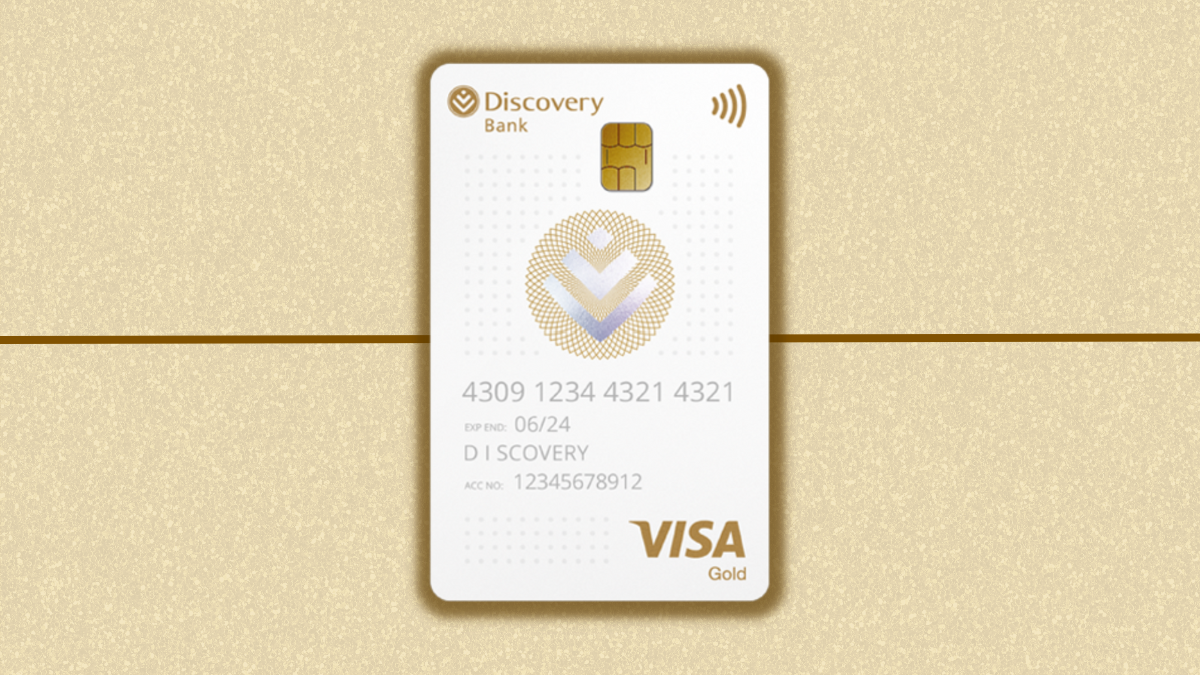

How to get your Discovery Bank Gold Card: online application

In this Discovery Bank Gold Card application guide you will learn how to get this awesome rewards card in just a few minutes.

Keep Reading

Rev Up Your Car Buying Experience: Capital One Auto Financing review!

Buckle up for our Capital One Auto Financing review! We'll show you how this trusted lender can simplify your journey to the perfect car!

Keep ReadingYou may also like

Woolworths Gold credit card review: Get cash back, discounts, and more

In this Woolworths Gold credit card review you will learn about this card's exclusive perks and its cash back rewards.

Keep Reading

Citi Custom Cash℠ credit card review: earn 5% cash back in your top spending category

If you're looking for a credit card with 5% cash back on convenient categories and a $200 welcome bonus, read this Citi Custom Cash℠ review!

Keep Reading

How to join and start banking with Discover Bank?

You can easily apply online for your account at Discover Bank. Just read this post to see the eligibility requirements and apply for it.

Keep Reading