Credit Cards

First Latitude Platinum Mastercard® Secured Credit Card application

The First Latitude Platinum Mastercard® Secured Card application process is as simple as using the card, and you can do it online. Read on to learn more details about it!

Advertisement

First Latitude Platinum Mastercard® Secured Credit Card: People of all credit levels are welcome to apply!

The First Latitude Platinum Mastercard® Secured Card is a great option to help you reestablish your credit score.

If you have a low rating or are new to credit, you’re still welcome to apply and have access to this international product covered by Mastercard.

Synovus Bank, the card’s issuer, lets you start with a low security deposit of just $100, but you can choose to go as high as $2,000.

The deposit works as your spending limit and provides purchasing power for you to use it as you’d like.

There is a modest annual fee of $25 during the first year, along with a one-time $19.95 activation fee. During the second year, you’ll have to pay $35 annually to keep the card.

This card doesn’t have a rewards program but it works very well as a credit builder.

Low credit utilization and responsible use will help you increase your score since the bank reports all account activities to the credit bureaus.

If you’re interested in applying for this card, keep reading the content below, and we’ll give you a complete walkthrough of the process.

Learn how to apply online for the First Latitude Platinum Mastercard® Secured Card

Applying online for the First Latitude Platinum Mastercard® Secured Card is quite simple.

The first step is to access the website and read up on all the card’s info to make sure you’re completely informed. Then, click on “apply now”.

To get the card, you’ll need to go through five stages total. The first one is an online form you’ll need to fill with your name and address. Check the box below, read their full disclosure and click “next”.

After that, you’ll need to provide more details about yourself, like your Social Security Number and address.

Then, you’ll also need to inform them of your current financial status. Once you do that, you’ll need to link an active bank account in your name.

Read up on the card’s agreements and fund your security deposit. After doing so, pay the one-time activation fee and you’re set.

The First Latitude Platinum should come via mail within a few business days.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Learn how to apply using the app

Unfortunately, you cannot apply for the First Latitude Platinum Mastercard® Secured Card via mobile app.

Synovus Bank offers an app for Android users, but only for account management. For applications, you must use a web browser.

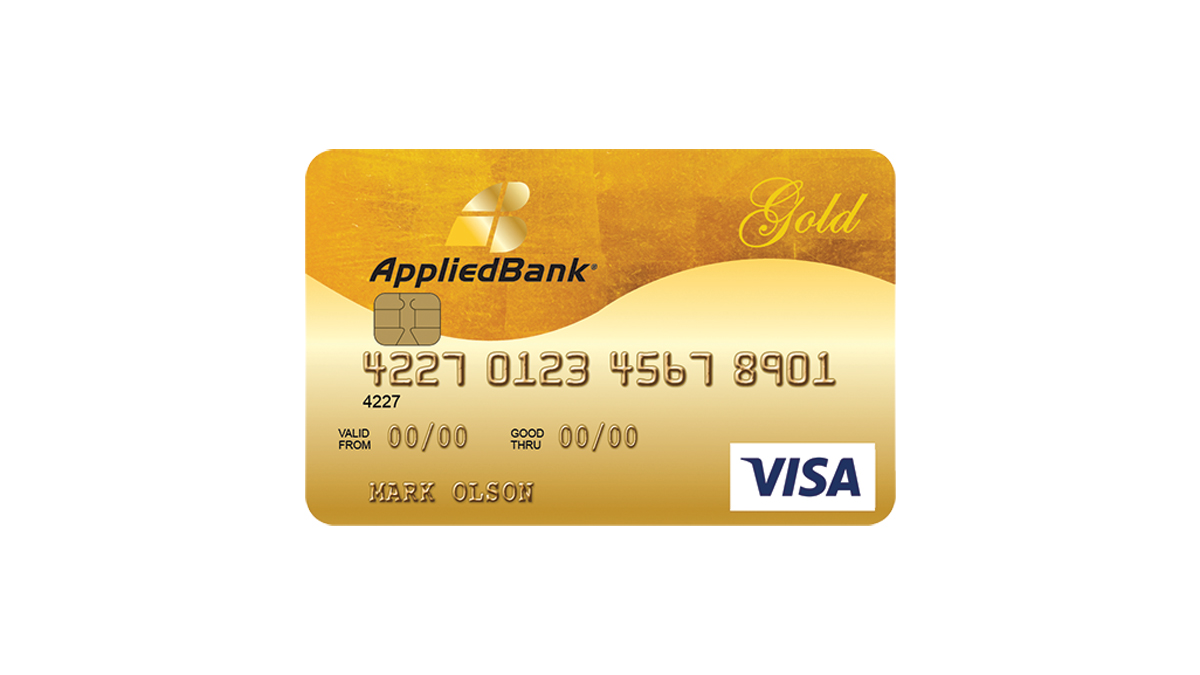

What about another recommendation: Applied Bank® Secured Visa® Gold Preferred® Credit Card

If you’re looking for other alternatives before applying for a credit card, we can help.

Other than the First Latitude Platinum Mastercard® Secured Card, you can also try the Applied Bank® Secured Visa® Gold Preferred® Credit Card.

To learn more details about the card, follow the link below.

Applied Bank® Secured Visa® Gold Preferred® card

Learn how to use your Applied Bank® Secured Visa® Gold Preferred® Credit Card responsibly and build or rebuild your credit score!

About the author / Aline Barbosa

Trending Topics

Manor Park Funding review: get a loan easily

In this Manor Park Funding review you will learn about an easy way to get the short-term loan you need. Read on and find out!

Keep Reading

Start saving for retirement: 6 things to avoid

Avoid the mistakes that catch so many people unaware. Read this article and learn the dont's to start saving for retirement.

Keep Reading

Wise Debit Card application

Check this walkthrough of the Wise Debit Card application process and learn how to easily request your multi-currency card online.

Keep ReadingYou may also like

Bank of America® Unlimited Cash Rewards card application

The Bank of America® Unlimited Cash Rewards Card application process is simple and we will show you how it works so you can request yours.

Keep Reading

Absa Student Credit Card review: exceptional rewards

Build your credit! Read this Absa Student Credit Card review and learn how this card can help you do that.

Keep Reading

Progen Lending Solutions: Ultimate Guide to Hassle-Free Borrowing

Explore Progen Lending Solutions, your trusted partner in home financing. Discover tailored mortgages, transparent terms, and much more!

Keep Reading