US

Axos Rewards Checking account review: earns interest like a savings account

Read this Axos Rewards Checking account review and learn how this checking account earns interest with no fees and more!

Advertisement

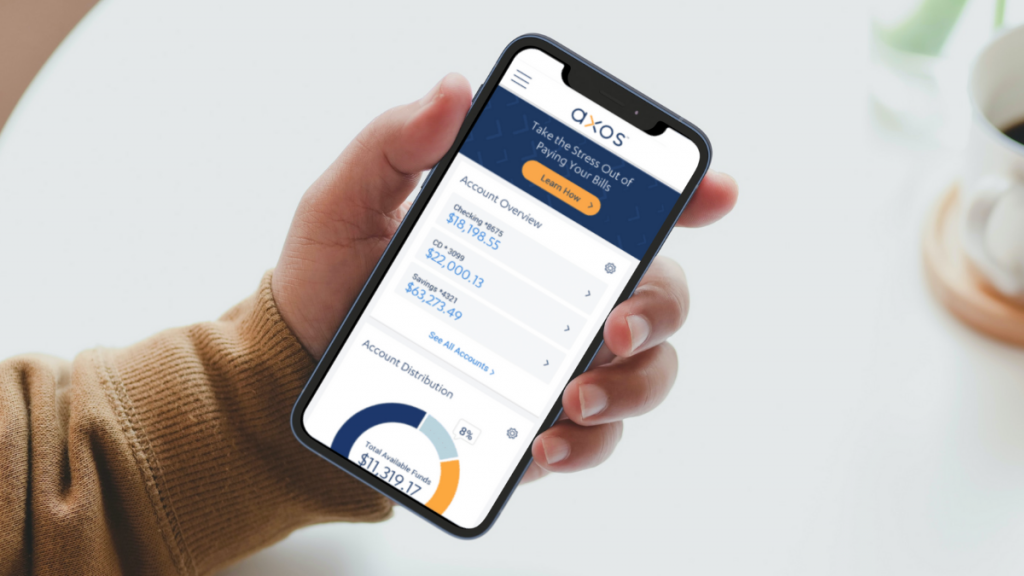

Understanding Axos Rewards Checking account: No minimum balance requirements

Discover the Axos Bank Rewards Checking Account, with a maximum APY that beats even the top savings accounts. Learn about its perks in our Axos Rewards Checking account review.

How to open your Axos Rewards Checking account

In this Axos Rewards Checking account application guide we are going to show you how you can open an account in just a few minutes.

- Fees: Stop Payment Fee: Online: $10, Assisted: $35. Insufficient Funds Fee: $0 – $25, $25 per item max $75/day.

- APY: Maximum APY of 1.25% (tiered rate)

- Benefits: Unlimited domestic ATM fee reimbursements, unlimited free mobile deposits, limited-time welcome offer of $100 bonus.

- Investment Options: Axos Managed Portfolio Account, Axos Self Directed Trading Account.

With the Axos Rewards Checking account you have unlimited domestic ATM fee reimbursements. It also has no minimum balance requirements, unlimited free mobile deposits, and a limited-time welcome offer. Read on and learn all about it.

Axos Rewards Checking account: understand how it works

The Axos Bank Rewards Checking Account is a high-yielding checking account that offers a maximum APY of 1.25%. However, this is a tiered rate and not everyone will qualify for it.

To earn the maximum APY, account holders must meet all the requirements for all tiers. The requirements include receiving monthly direct deposits of $1,500 or more.

You must also use the Axos Visa® Debit Card for a total of 10 transactions per month. It also requires that you sign up for Account Aggregation/Personal Finance Manager in Online Banking.

Plus, you must maintain an average daily balance of $2,500 per month in an Axos Managed Portfolios Account. Additionally, you have to maintain an average daily balance of $2,500 per month in an Axos Self Directed Trading Account.

Finally, you must use the Rewards Checking account to make the full monthly Axos consumer loan payment.

The account also offers unlimited free mobile deposits. This is ideal for people who still get paid with physical checks and don’t want to run to a branch location or incur extra fees for doing so.

The account is FDIC insured and covers you for up to $250,000 per depositor, per institution, in the event of a bank failure. Additionally, it charges no monthly maintenance fees, no ATM withdrawal fees, and no overdraft fees.

However, it does charge stop payment fees and insufficient funds fees.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Significant benefits and disadvantages you may find

Now that you are familiar with this account, let’s have a look at its main benefits and disadvantages. Our Axos Rewards Checking account review would not be complete without it.

Benefits

- High APY

- Unlimited ATM reimbursements

- No minimum balance

- Unlimited mobile deposits

Disadvantages

- Tiered APY system

- ATM fees abroad

- Stop payment fees

- Insufficient funds fees

Is a good credit score required?

The Axos Rewards Checking account does not have any specific credit score requirements for people who wish to open an account. So no need to worry about that.

Learn how to apply and open a Axos Rewards Checking account

If you like what you have seen in this Axos Rewards Checking account review, you might want to take the next step and apply for this account.

If that is the case, click the link below and we are going to show you how to do it.

How to open your Axos Rewards Checking account

In this Axos Rewards Checking account application guide we are going to show you how you can open an account in just a few minutes.

About the author / Danilo Pereira

Trending Topics

ABSA Gold Credit Card review: Get 57 days interest-free credit

In this ABSA Gold Credit Card review you are going to learn about this card's interest-free period, travel benefits and more!

Keep Reading

Learn how to start your own emergency fund fast

Are you trying to start your emergency fund, but don't know how? This article will show you how to start with easy tips. Keep reading.

Keep Reading

Rise Credit Review: A Reliable Lending Solution!

If you want a smarter borrowing experience, review the flexible terms only Rise Credit can offer! You can apply online in a few easy steps!

Keep ReadingYou may also like

Choose the best zero APR credit card for your needs

Explore all your options for finding a zero APR credit card and come away with the best deal that suits your financial needs and lifestyle!

Keep Reading

First National Bank eStyle Checking account review

In this First National Bank eStyle Checking account review you will learn how this account protects you from overdraft fees.

Keep Reading

FNB Aspire credit card application: Flexible Payment Terms and No Transaction Fees

Earn high rewards on spending with this credit card. Follow our FNB Aspire credit card application guide and get yours today!

Keep Reading