Finances

Learn how to start your own emergency fund fast

Do you have an emergency fund? It is important to have one and you can start building yours with these tips. Read more below!

Advertisement

An essential guide for building your emergency fund: how much should a beginner emergency fund be?

If you don’t have any money saved, you should start to build your emergency fund right now! You will thank yourself later.

We never know when something unexpected will surprise us and demand a little more money – or even much more money. It is even worse when you don’t have an emergency fund to cover it.

When that happens, and you don’t have the spare money you need, you must borrow money from lenders. And guess what: this will cost you even more money. So if you were in a hole, you just dig in a little deeper.

That doesn’t seem much good to live through, right? To avoid getting into an uncomfortable situation, you need to start saving money. Having an emergency fund will save you from bigger troubles and solve issues immediately.

And this emergency can be minor, like a little home or car repair, a bill you forgot about, and now you’ll have to pay a late fee. Or it can be more severe, like surgery, a full car repair that will bring your car back to its function, etc.

But you may be thinking that you can’t save any amount right now. Or you just don’t know how to start or how much you’ll need to save. Don’t worry. We got you covered. You’ll start building your emergency fund as soon as you read this article.

This article will give you the treasure map to build a decent emergency fund and get your peace of mind. Keep reading!

How to start an emergency fund in a simple way with our step by step guide for an emergency fund

Don’t feel bad if you didn’t start building your emergency fund yet. We totally understand. Many people don’t have an emergency fund and couldn’t cover even a minor emergency of a couple of hundreds of dollars. It is not the best case scenário, but it can happen. What you need to know is that you can find a way out of this situation.

How much should you save? Any savings are better than no savings at all. So, if you can reach $500, it is already good. Can you save $1,000? Better. Can you save enough to cover 3 months of expenses if you got unexpectedly unemployed? Perfect.

If you feel lost on your journey to saving money, you’ve come to the right place. Here you’ll find the best tips to build your emergency fund. There is nothing too complex about it. We know for sure that with a bit of discipline and clarity, you will conquer this goal.

We hope that this guide helps you with this important task of saving money for the future. Let’s learn more about finances and improve your financial management.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

First step to start an emergency fund: budgeting

This is the first step for every financial movement you want to do in your life and start an emergency fund. There is no way to save money if you don’t know your expenses, your income, and how to deal with both.

There are many ways to budget, and you find some methods on the internet, like the 50/30/20 method. There are also some apps with handy functions to make it practical. Or you can use the good old spreadsheet if you prefer.

Don’t matter the way you do it, it is important to do it. With a good budget, you’ll be able to find the money you have to save.

Stipulate your goal

Now that you know how much you earn and how much you can spend, you can stipulate how much you’d like to save. Start small, so you’ll have a higher chance of success.

This feeling is important to tell yourself you can accomplish your goals. It is an important message to your brain. Once you get better at it, you can raise your goal and you’ll save even more money. You’ll start your emergency fund with a happy mindset.

Look at the step right next to you, not the whole staircase

When your start, it may seem like you’ll never get there. Especially if your starting from zero and don’t have much to save per month. But this thought will be for no good.

The longest journey always starts with a single little step. And then another one, and another one, and so on. Keep focusing on your monthly goal and your emergency fund will soon be built.

Put your savings in a savings account

To avoid falling into the temptation of spending your emergency fund, take it off your sight. Transfer your monthly goal to a savings account to start and keep an emergency fund. Keep it out of your checking account, so you do not spend it. Also, savings accounts earn interest, so you’ll money will grow a little.

But what if you forget to put it in the savings account? A good way to prevent this is to set an automatic transfer or direct deposit from your checking account to your savings account. And let it be.

Did you get a surprise income? Save it!

Oh, what a blessing to earn some unexpected money. A bonus from your job, or some money you lend to a friend and they finally repay you. But instead of running to the mall to buy things, or going to a fancy restaurant and spending all of it, you’ll be better off putting this extra cash in your savings account for building an emergency fund.

Remember the importance of your emergency fund. Once you reach your goal you can go and spend more money on other things.

Don’t stop saving – but don’t save too much.

This may sound confusing, but let me explain. Even when after reaching your goal, you can keep saving money. After all, a bigger emergency fund is more safety for you and your family. But how much is too much?

This question is not about the amount itself. Is about your life quality. It is okay to save for the future, but remember to live the present. You deserve some gifts now and then. Some good vacations. Some new clothes. Save enough for building a good emergency fund, but don’t forget that life is supposed to be enjoyable too.

If you have trouble saving money, we can help you get started. Follow the link below to learn some important tips!

Start saving money like a pro: learn how!

Learn how to easily save money in order to build up your savings with our useful tips!

About the author / Aline Barbosa

Trending Topics

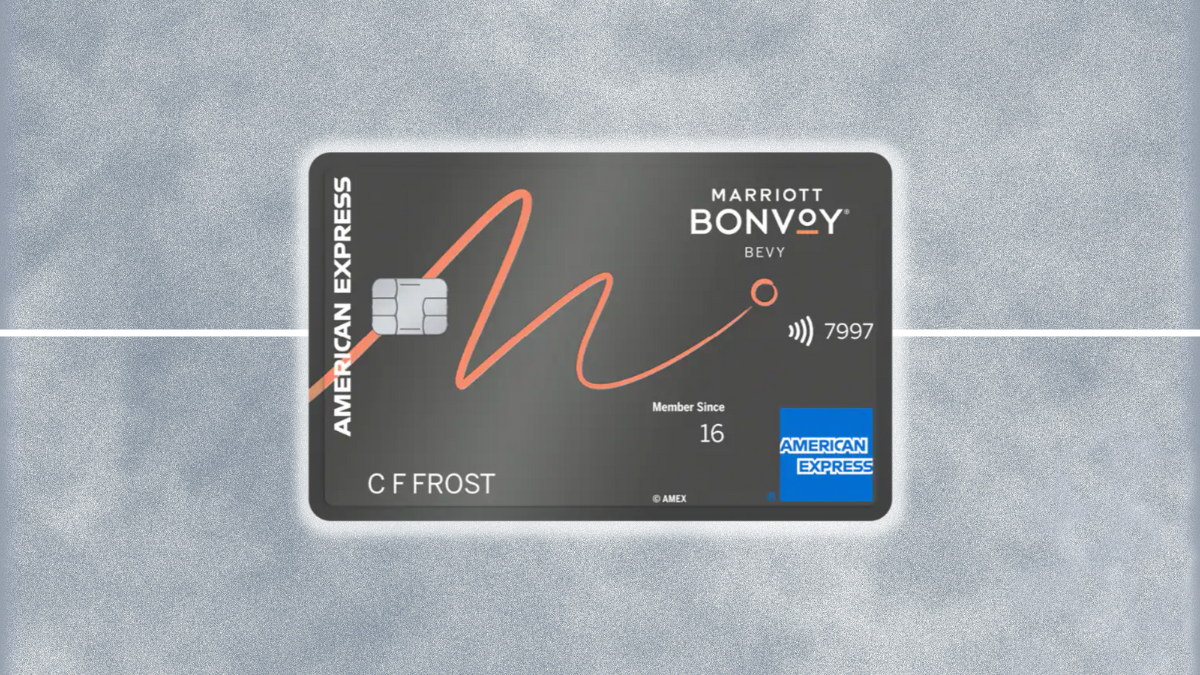

How to get your Marriott Bonvoy Bevy™ American Express® Card: online application

In this Marriott Bonvoy Bevy™ American Express® Card application guide you will learn how to get this card in just a few minutes.

Keep Reading

Petal® 2 Visa® Credit Card review

Read our Petal® 2 Visa® Credit Card review to learn more about a card that will make great value for your money while helping your score.

Keep Reading

What are the most profitable businesses in 2023?

Want to know which are the most profitable businesses in 2023? Look no further! This post covers everything you need to know.

Keep ReadingYou may also like

Best travel cards 2022: your 101 guide!

If you don't like traveling, maybe it's because you didn't travel enough. Get one of the best travel cards of 2022 to help you with this.

Keep Reading

Stocks as an Investment: Is it a good idea?

Thinking about stocks as an investment? Before you do it, read this article. We are going to help you watch your steps and avoid pitfalls.

Keep Reading

MyLoan review: Up to R250,000!

If you need to borrow up to R250,000 with good loan terms and a trusted platform, read our MyLoan Co review to learn more!

Keep Reading