Credit Cards

Boost Platinum Card review: Making Smart Money Moves!

Are you on a quest for a better credit card to elevate your shopping experience? Find out if the Boost Platinum Credit Card aligns with your goals. Weigh the pros and cons, to make an enlightened choice!

Advertisement

Explore how this credit card is tailored to individuals who may have no credit history or a less-than-perfect credit score!

In this complete review of the Boost Platinum Card, you’ll find out how it aims to provide a holistic financial and support package for cardholders. However, is this the right credit card for you?

With a simplified application process, accessibility for those with limited or bad credit, and a suite of member privileges, it strives to be a comprehensive solution to your financial needs. Find out more!

- Credit Score: With the Boost Platinum Card, individuals with a wide range of credit histories, including those with less-than-perfect records, can seize a promising financial opportunity.

- Annual Fee: This card comes with an annual fee of $177.24.

- Intro offer: Regrettably, there are no introductory offers currently available for this card.

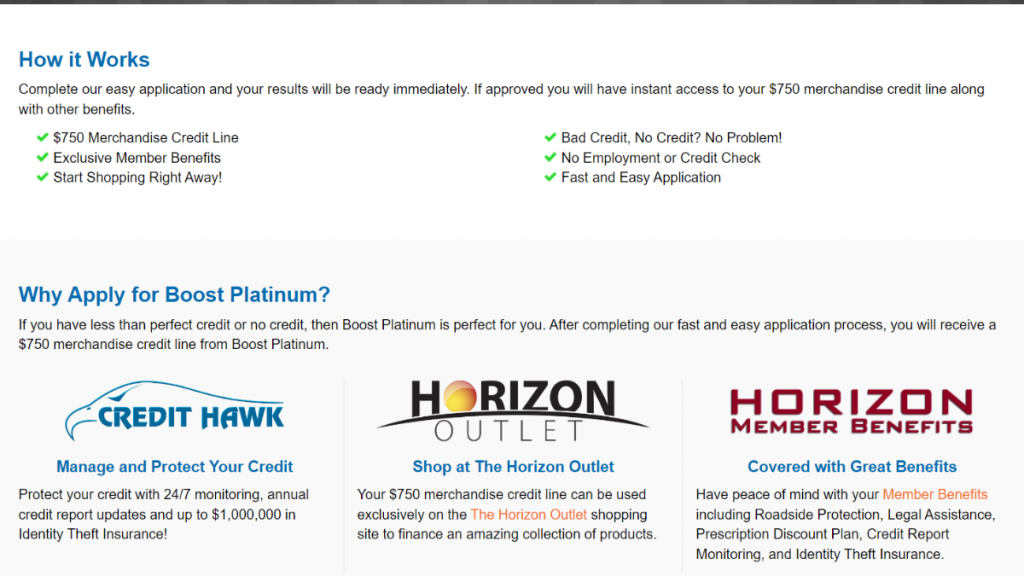

- Rewards: Cardholders can unlock a world of benefits, including valuable discounts at My Universal Rx, and gain access to premium privileges in Credit Hawk, My Roadside Protection, and My Legal Assistance.

- APR: Surprisingly, there are no annual percentage rates (APRs) for this unique card.

- Other Fees: N/A.

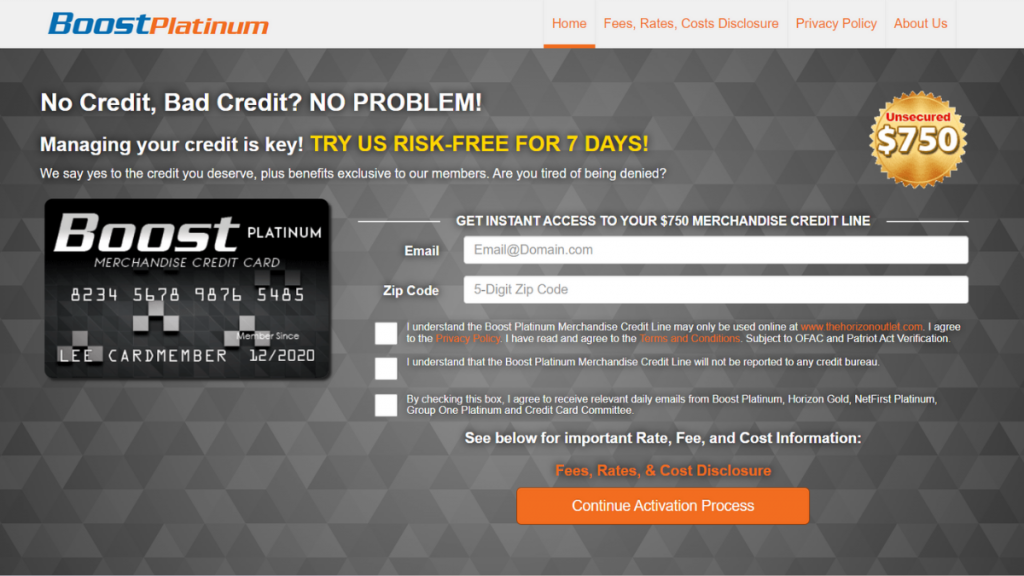

Boost Platinum Card: how does it work?

The Boost Platinum Credit Card serves as a valuable financial tool, capable of providing empowerment to individuals who may have encountered challenges in their credit history.

Distinguished by its commitment to accessibility, the Boost Platinum Card stands out with a noteworthy feature, it doesn’t mandate a specific credit score for approval, as detailed in the review.

Nevertheless, upon activating your membership, this card grants you a line of credit that is exclusively usable for purchases on the Horizon Outlet Website.

It’s essential to understand that this line of credit is limited to this particular website and cannot be utilized elsewhere.

In essence, the Boost Platinum Credit Card isn’t merely a credit card but rather a dependable financial ally tailored to those in pursuit of credit improvement and the initiation of their credit journey.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Significant benefits and disadvantages you may find

Contemplating whether this card should play a role in your financial journey? In this journey beyond our comprehensive Boost Platinum Card review, we’ll examine the merits and limitations of this card.

Benefits

- Count on the dedicated Customer Advocacy department for personalized assistance;

- Open financial doors with credit accessibility;

- Unlock a generous $750 merchandise credit line;

- Enjoy the privilege of credit monitoring and prescription discounts;

- Experience a straightforward and smooth application process.

Disadvantages

- Keep in mind the annual membership fee;

- It’s important to be aware that specific terms, conditions, and card features can evolve over time;

- Your card’s utility is exclusively tied to the Horizon Outlet Website;

- Note that the credit line has its constraints.

Is a good credit score required for applicants?

Feeling inclined to submit your application for the Boost Platinum Credit Card following this insightful review? To begin, ensure you meet the fundamental eligibility requirements:

- You should be a U.S. resident;

- Have a valid Social Security Number;

- Be at least 18 years of age.

Although this card is expressly tailored for individuals with limited or less-than-ideal credit histories, it’s worth noting that specific credit-related criteria might still play a role during the application procedure.

Learn how to apply and get the Boost Platinum Card

Furthermore, follow this guide to obtain this exceptional financial instrument, giving you a preview of what lies ahead after our comprehensive Boost Platinum Card review.

Learn how to get this credit card online

Applying for the Boost Platinum Card is a simplified procedure that enables you to secure this credit card without leaving the comfort of your home!

- Access the website: Firstly, begin by navigating to the official website of the Boost Platinum Credit Card. This serves as your online portal for the application process.

- Provide personal information: You will need to supply your personal information, including your email address and Zip Code. Don’t forget to review everything before submitting your application for the Boost Platinum Card.

- Activate your card: Then, affirm your consent to the Privacy Policies and Terms and Conditions by selecting the appropriate checkboxes. After completing this step, click on “Continue Activation Process.”

- Unleash your power card: Following the approval of your application, your very own Boost Platinum Credit Card will be on its way to your mailbox, ready to empower your financial journey.

What about another recommendation: Kohl’s Card!

So, looking for an alternative to the Boost Platinum Card after this review? Then, you should consider the Kohl’s Card! This is a store credit card that offers its own set of unique advantages.

Whether you’re a loyal Kohl’s customer or simply seeking a valuable store credit card, our in-depth review will provide all the details you need to make an informed decision. Click below to learn more!

How to get your Kohl’s Card?

Check out this Kohl’s Card application guide to learn how to get this card fast and start getting monthly discount offers.

About the author / VInicius Barbosa

Trending Topics

The best regulated crypto brokers in the US

If you are looking for regulated crypto brokers so that you can invest your money safely, you have come to the right place.

Keep Reading

BankAmericard® Secured application: Access Credit Education

In this BankAmericard® Secured application guide you will learn how to get this card in just a few minutes.

Keep Reading

What is a crypto card?

Read on and find out exactly what is a crypto card, and whether they present the best opportunity for your financial growth.

Keep ReadingYou may also like

How to open your account and start banking with GO2bank?

Open a GO2bank account today and get access to a convenient banking service with a high-yield savings account

Keep Reading

PenFed Pathfinder® Rewards Visa Signature® card application guide

In this PenFed Pathfinder® Rewards Visa Signature® card application guide, you will learn how to get your card with access to travel perks.

Keep Reading

7 Awesome Credit Cards With Airport Lounge Access

Looking for credit cards with airport lounge access? Here are our top 7 picks for the most awesome ones with great travel benefits!

Keep Reading