Debit Cards

Chime Visa® Debit Card Review: Your Key to Hassle-Free Banking!

The future of banking is here with the Chime Visa® Debit Card! Find out why Chime is disrupting the industry with its innovative debit card and online banking solutions. Learn more!

Advertisement

Learn how Chime’s debit card offers a fresh approach to personal finance, minus the traditional bank fees!

Get ready for a financial transformation as you dive deep into this Chime Visa® Debit Card review. Chime has emerged as a beacon of fee-free, transparent, and accessible banking solutions!

So, explore the innovative features that make the Chime Visa® Debit Card an enticing choice, from early paycheck access to seamless mobile payments. Say goodbye to the status quo of banking!

- Credit Score: Not necessary.

- Annual Fee: No annual fee charged.

- Intro offer: None, for the Chime Visa® is a debit card.

- Rewards: N/A.

- APR: There’s no APR since this is a debit card only.

- Other Fees: N/A.

Chime Visa® Debit Card: how does it work?

The Chime Visa® Debit Card functions as your gateway to a world of fee-free, convenient banking, as you’ll discover in this review. This card allows you to make purchases, withdraw cash from ATMs, and more.

Moreover, Chime is dedicated to providing you with a no-fee checking account, eliminating one of the most common banking frustrations.

Besides, you can access a vast network of over 60,000 fee-free ATMs across the United States. This means you can withdraw cash without worrying about being nickel-and-dimed by ATM surcharges.

Furthermore, with the Chime app, which is closely tied to your card, you’ll receive real-time transaction alerts. These alerts keep you in the loop about every card activity, enhancing your sense of security.

Finally, expect the Chime Visa® Debit Card to seamlessly integrate with popular mobile payment platforms like Google Pay and Apple Pay, ensuring quick and secure transactions.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Significant benefits and disadvantages you may find

Like any financial product, the Chime Visa® Debit Card comes with its share of advantages and limitations you should review before applying. Explore some of them now to make an informed decision!

Benefits

- Experience banking without monthly fees;

- Benefit from enhanced security with EMV chip technology;

- Effortlessly connect with popular payment platforms;

- Access your funds easily at a vast network of ATMs;

- Customize your security preferences within the app;

- Stay in the know with immediate transaction notifications;

- Automatic savings features.

Disadvantages

- Chime operates primarily online;

- Chime has specific deposit limitations that you should be aware of;

- No joint account options;

- No traditional credit card rewards like cashback or reward points;

- Domestically focused design.

Is a good credit score required for applicants?

So, one of the appealing aspects of Chime’s banking services is its inclusivity. Chime doesn’t perform a credit check or require a minimum credit score to obtain the Chime Visa® Debit Card.

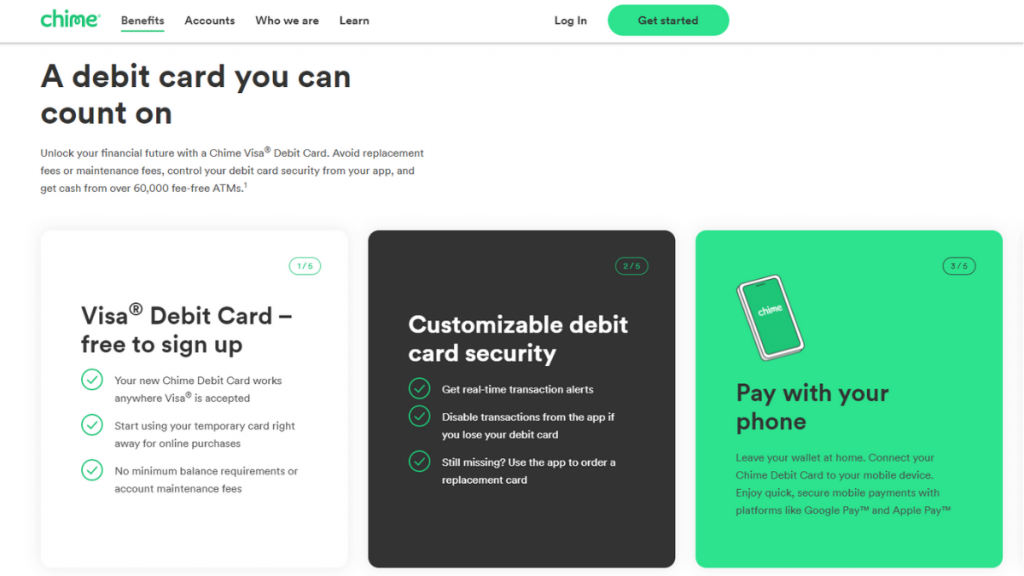

Learn how to apply and get the Chime Visa® Debit Card

So, are you ready to experience the convenience, transparency, and cost-effectiveness that Chime offers? Then, review an easy and straightforward step-by-step on how to apply for the Chime Visa® Debit Card.

Learn how to get this credit card online

Whether you’re new to online banking or looking to streamline your financial life, this guide will walk you through the process of applying for the Chime Visa® Debit Card!

- Visit the official website: To start your application process, point your browser to the official Chime website and steer towards the “Benefits” section in the menu. There, you’ll find your portal to financial convenience, “Free Debit Card”. Then, simply click to embark on this seamless process.

- Initiate your application: Once you’ve landed on the Chime Visa® Debit Card page, kick off your application by clicking “Get Started.” It’s your gateway to a straightforward online process, where you’ll furnish essential personal details like your name, address, and more.

- Finish your enrollment: Navigate through the intuitive prompts on the Chime website to seamlessly wrap up your enrollment process.

- Your card’s arrival: Finally, your brand-new Chime Visa® Debit Card is on its way and is set to arrive in your mailbox within the next few business days.

What about another recommendation: GO2bank Visa® Debit Card!

Looking for a viable alternative to the Chime Visa® Debit Card to review? Then look no further than the GO2bank Visa® Debit Card! This card offers a competitive alternative with a focus on fee-free banking.

In addition, you can enjoy a user-friendly mobile app and financial inclusion. This means that this card is accessible to a wide range of consumers. So, click the link below to find out more details now!

GO2bank Visa® Debit Card application

The GO2bank Visa® Debit Card application process is as simple as it gets. If you want to learn how to get yours, we’ll show you how.

About the author / VInicius Barbosa

Trending Topics

Citi® Diamond Preferred® application process: do it online!

Learn about the Citi® Diamond Preferred® application process and start reducing your debt today with their 21-month-long APR period.

Keep Reading

BankAmericard® for Students review: 0% Intro APR and No Annual Fee

Build your credit with this credit card and pay no annual fee. Learn all you need to know in this BankAmericard® for Students review!

Keep Reading

How to open your First National Bank Premierstyle Checking account easily

In this First National Bank Premierstyle Checking account application guide you are going to learn how to open this account in minutes.

Keep ReadingYou may also like

Surge Mastercard® card application

Learn the application process for the Surge Mastercard® card and start improving your score with the aid of this powerful tool.

Keep Reading

Quick Capital Cash review: get approved in as little as one business day

Read this Quick Capital Cash review to learn how you can get access to multiple lenders through a single online application.

Keep Reading

Progen Lending Solutions: Ultimate Guide to Hassle-Free Borrowing

Explore Progen Lending Solutions, your trusted partner in home financing. Discover tailored mortgages, transparent terms, and much more!

Keep Reading