Credit Cards

Coinbase Card review: a simple way to accumulate crypto

Read this Coinbase Card review and learn about this easy, simple and risk-free way to accumulate crypto.

Advertisement

Earn rewards in crypto with this simple and easy entry point card

This simple and straightforward debit card earns cash back in crypto on every purchase while charging no annual fee. Learn about it in this Coinbase Card review.

How to get your Coinbase Card

In this Coinbase Card application guide we will show you how to get this card so that you start earning crypto back on your spending.

- Credit Score: N/A

- APR: N/A

- Annual Fee: N/A

- Fees: N/A

- Welcome bonus: N/A

- Rewards: 1% cash back in USD Coin, 1% in Dai, 1% Ethereum, 1% Bitcoin, and 2% Amp.

You can use your Coinbase Card at any store or merchant that accepts Visa. The card does not require any credit checks and does not charge ATM fees.

However, there is a limit to how much you can earn in rewards, there are no bonus categories, and you must have a Coinbase account.

Coinbase Card: how does it work?

The Coinbase Card (a Metabank card) runs on the Coinbase platform, and allows cardholders to spend both U.S. dollars or cryptocurrency.

Coinbase automatically converts all of the user’s crypto to U.S. dollars when they make a purchase.

There are no fees for you to spend your crypto and the card boasts no annual fee and a simple structure for rewards.

Users can experience variance when it comes to spending limits, and you can check your monthly spending with the Coinbase app.

You can use your Coinbase Card to withdraw cash at ATMs all over the world, even if the money is still in crypto.

Coinbase automatically converts your current crypto into U.S. dollars when you make ATM withdrawals, just like when you make purchases.

The daily limit for ATM withdrawals is $1,000. This is a high limit even for traditional debit cards. Plus, the card offers users the opportunity to earn cash-back rewards on every purchase.

The cash-back rewards come in the form of crypto. The card registers your rewards as soon as you make a purchase with it, making it available within 24 hours or so.

You can select the cryptocurrency in which you will receive your cash back, and you can either transfer your rewards to your crypto wallet, trade for other cryptocurrencies or stake them.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Significant benefits and disadvantages you may find using the Coinbase Card

Now you are familiar with the details of this card. But our Coinbase Card review would not be complete without a comparison between its pros and cons.

So have a look at the list of benefits and disadvantages we have prepared for you below.

Benefits

- Earn cash back in crypto on every purchase

- The card does not charge an annual fee

- No credit requirements

- No ATM fees

Disadvantages

- Does not offer bonus categories

- Requires a Coinbase account

- Limited rewards with monthly spending limits

Is a good credit score required for applicants?

The Coinbase Card works pretty much like any regular debit card. It is not a credit card, and therefore it does not require applicants to have good credit to qualify.

Learn how to apply and get a Coinbase Card

If you like what you have seen in this Coinbase Card review, you might want to take the next step and apply for the card. If that is the case, click the link below and we will show you how to do it.

How to get your Coinbase Card

In this Coinbase Card application guide we will show you how to get this card so that you start earning crypto back on your spending.

About the author / Danilo Pereira

Trending Topics

Capital One Quicksilver Secured Cash Rewards Credit Card review

Read our Capital One Quicksilver Secured Cash Rewards Credit Card review and learn how this card can improve your financial life.

Keep Reading

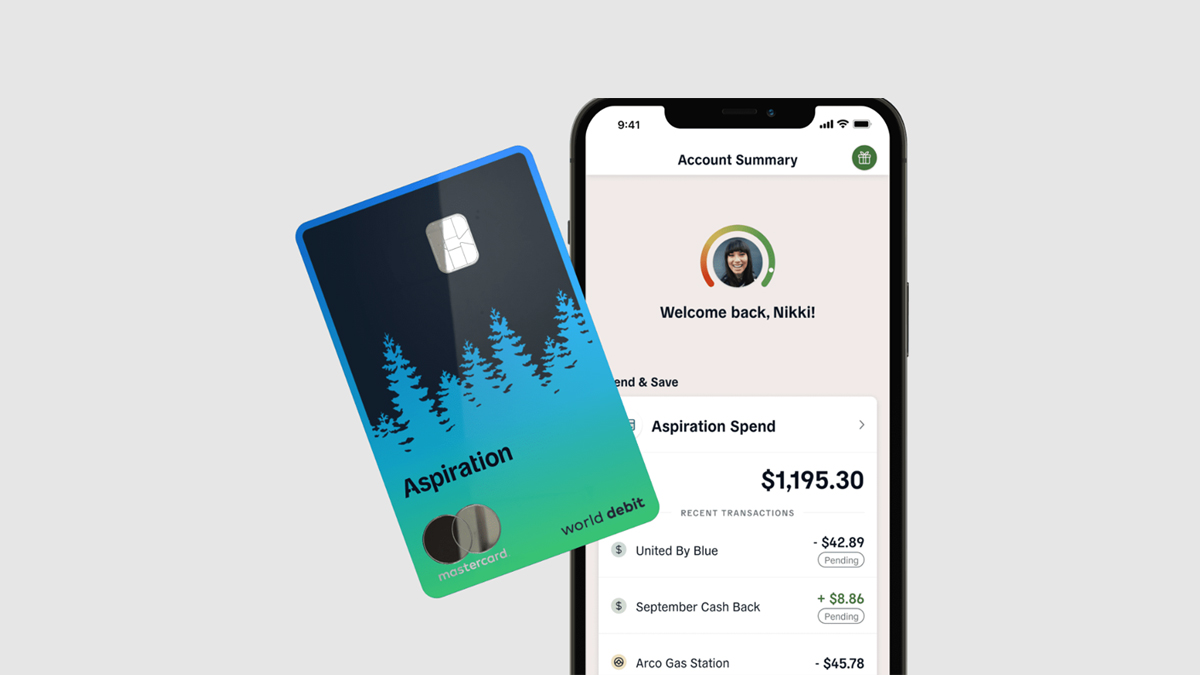

Aspiration Plus Account application

Learn everything you need to know about the Aspiration Plus Account application process and start earning interests right away!

Keep Reading

Capital One Bank review

This Capital One Bank review will show you how this bank works and highlight some pros and cons of using its services.

Keep ReadingYou may also like

ElectroFinance Lease application: no credit checks

In this ElectroFinance Lease application guide you will learn how to easily lease products using this platform.

Keep Reading

What Are Mutual Fund Expense Ratios?

When investing in mutual funds, it is essential to understand what mutual fund expense ratios are. Find out in this article.

Keep Reading

Tomo Credit Card review

Want a credit card that can help you build your credit history? Check out our review of the Tomo Credit Card to see how it can work for you.

Keep Reading