Credit Cards

First Progress Platinum Elite Mastercard® Secured Credit Card review

The first step to building or fixing your credit, the First Progress Platinum Elite Mastercard® Secured Credit Card is a great resource. Read our review to find out how it works!

Advertisement

First Progress Platinum Elite Mastercard® Secured Credit Card: No credit inquiry required!

The First Progress Platinum Elite Mastercard® Secured Credit Card is great for people with bad or no credit history. This card offers a low APR and a modest annual fee, making it a great option for those looking to rebuild their credit.

Since it’s a secured card, you’ll have to put down a security deposit anywhere between $200 and $2,000. That amount will be your spending limit and is fully refundable once you close your account in good standing.

First Progress offers an easy and online application with no credit check and no minimum score required for approval. So if you’re having trouble getting a credit card to give your score a boost, you might want to consider applying for this one.

How to get the First Progress Platinum Elite?

Learn how to improve your credit score with the help of a First Progress Platinum Elite Mastercard® Secured Card!

Check its main features below to see if the Elite Mastercard® Secured Credit Card is right for you. Then, keep reading our review to learn more about this product and how it can help you achieve a better financial future.

- Sign-up bonus: There is no sign-up bonus for this card.

- Annual fee: You’ll have to pay $29 annually to use this card.

- Rewards: There are no rewards.

- Other perks: Nationwide acceptance; works great as a credit builder.

- APR: 22.99% variable on purchases and 27.99% variable on cash advances.

First Progress Platinum Elite Mastercard® Secured Credit Card: is it a good card?

This is a secured credit card designed for people with limited or no credit history. The bank doesn’t perform a credit inquiry for approval, so if you have a severely damaged score, this can be your ticket to start improving it.

To activate the card, you’ll need to put down a security deposit between $200 and $2,000 which will become your spending limit. With responsible use, you can increase that credit line up to $5,000 with additional deposits. That amount is fully refundable once you bring your balance to zero and close your account.

First Progress reports all monthly payments to the three main credit bureaus in the country. Therefore, good use and on-time payments will help you achieve a better credit score in no time. The card has nationwide acceptance and you have access to your account 24/7 through the company’s free mobile app.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

First Progress Platinum Elite Mastercard® Secured Credit Card: should you get one?

While the Platinum Elite Mastercard® Secured Credit Card works as a credit builder, there are a few drawbacks you should be aware of before applying for it. See below to learn what they are.

Benefits

- Reports all monthly payments to Equifax, Experian and TransUnion;

- All credit levels have a chance of approval;

- Charges a modest annual fee.

Disadvantages

- Doesn’t offer a welcome bonus or rewards of any kind;

- Charges a moderately high APR;

- No possibility to upgrade to an unsecured card.

What is the required credit score?

You don’t need a good credit score to apply for this card. Matter of fact, there is no minimum score required by First Progress in order to approve your request. The institution doesn’t even perform a hard inquiry. Therefore, if you have a limited or no credit history at all, you can still get a First Progress Platinum Elite Mastercard® Secured Credit Card.

First Progress Platinum Elite Mastercard® Secured Credit Card application

The Platinum Elite Mastercard® Secured Credit Card application is easy and online. You’ll get an answer within minutes with no hard inquiries on your score. If you’d like to know more details on how to apply, follow the recommended link below.

How to get the First Progress Platinum Elite?

Learn how to improve your credit score with the help of a First Progress Platinum Elite Mastercard® Secured Card!

About the author / Aline Barbosa

Trending Topics

Spark Miles Select Credit Card application

Learn all you need to know about applying for the Spark Miles Select Card. From the application process to the benefits of owning this card.

Keep Reading

BankAmericard® Secured application: Access Credit Education

In this BankAmericard® Secured application guide you will learn how to get this card in just a few minutes.

Keep Reading

Discover it® Miles application: No annual fee

Trying to figure out how to get a nice mileage credit card? Read this Discover it® Miles application guide and learn how.

Keep ReadingYou may also like

MyPoint Credit Union Visa Card Review: Elevated Rewards!

Discover a world of possibilities in this MyPoint Credit Union Platinum Visa Card review. Elevate your experience with a generous credit line!

Keep Reading

United Gateway℠ Credit Card review

Pay no annual fee and earn 3X miles on groceries. Check this United Gateway℠ Credit Card review and see how it works!

Keep Reading

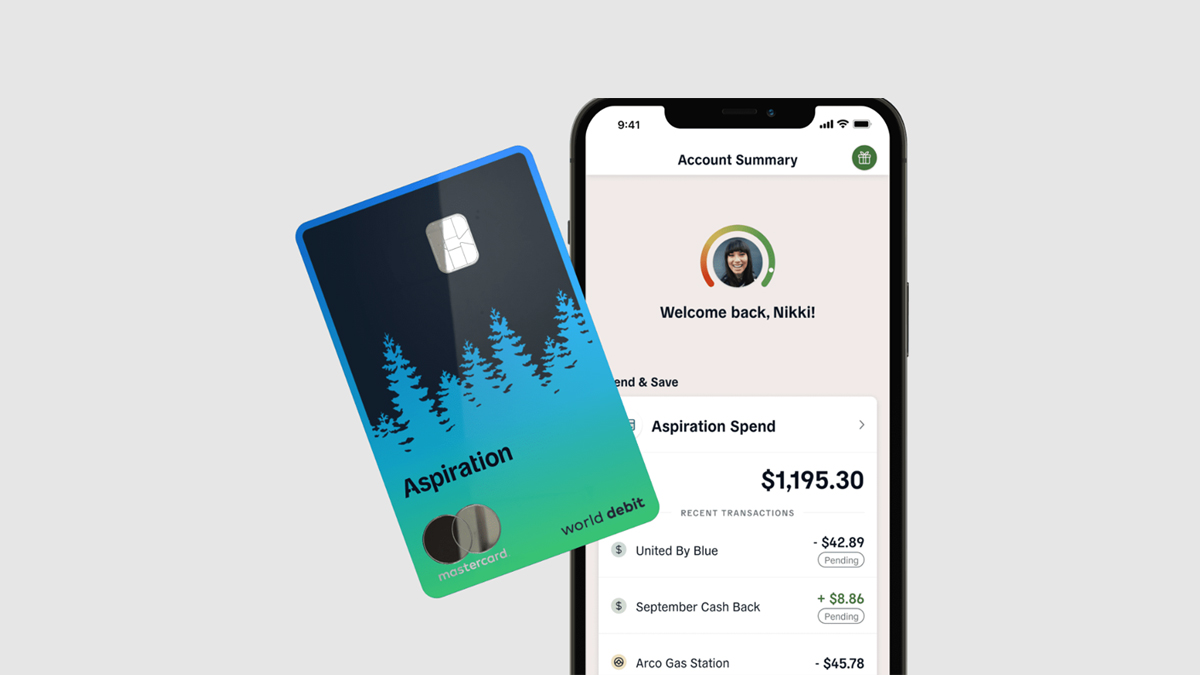

Aspiration Plus Account application

Learn everything you need to know about the Aspiration Plus Account application process and start earning interests right away!

Keep Reading