Credit Cards

MyPoint Credit Union Visa Card Review: Elevated Rewards!

The MyPoint Credit Union Visa Card is your key to rewards, security, and financial freedom. Enjoy a high credit line, travel benefits, and a MyPremium Perks Program. Learn more!

Advertisement

From a substantial credit line to the MyPremium Perks Program, this card is designed to enhance your lifestyle!

Looking for financial empowerment? Then explore this review of the MyPoint Credit Union Platinum Visa Card and dive into a world of unparalleled benefits, security features, and rewards!

If you’re seeking a credit companion that goes beyond the ordinary, this is your chance to make informed financial decisions. Discover the distinctive qualities of the MyPoint Credit Union Platinum Visa!

- Credit Score: While a higher credit score may enhance your chances, there’s flexibility to accommodate various credit profiles.

- Annual Fee: Zero.

- Intro offer: N/A.

- Rewards: Earn points through the Perks Program. Whether you’re into travel, merchandise, or gift cards, your everyday purchases translate into exciting rewards, making each transaction more rewarding.

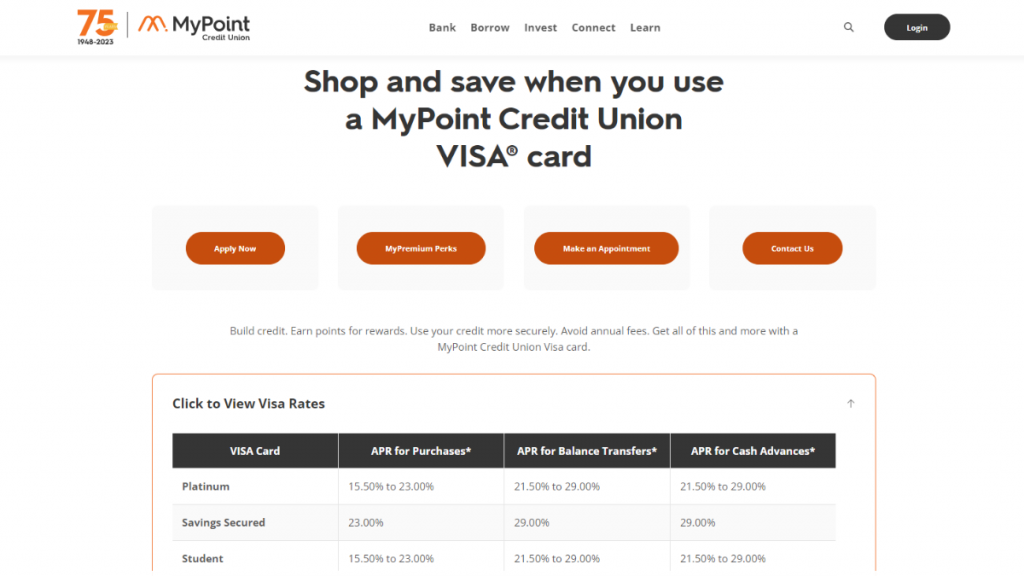

- APR: 15.50% to 23.00%.

- Other Fees: N/A.

MyPoint Credit Union Platinum Visa Card: how does it work?

Prepare to delve into a review of the myriad features offered by the MyPoint Credit Union Platinum Visa and determine if this credit card aligns seamlessly with your financial preferences.

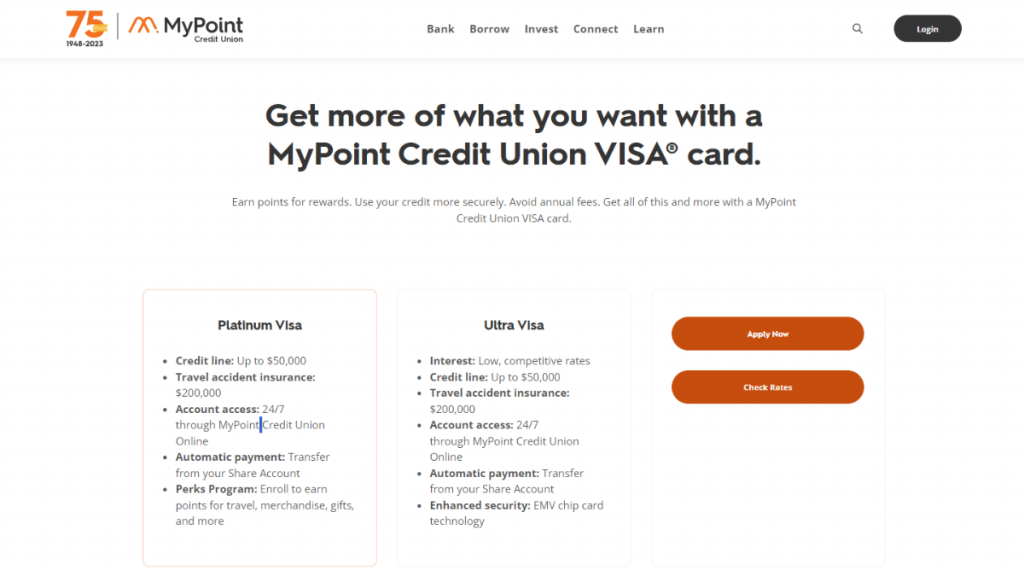

Designed to elevate your credit experience, this card offers a generous credit line of up to $50,000, providing the flexibility you need for your financial journey.

Besides, experience unparalleled convenience in managing your finances with round-the-clock account access via MyPoint Credit Union Online.

Moreover, this card brings added layers of security with a $200,000 travel accident insurance coverage, ensuring peace of mind as you explore the world.

Enrollment in the Perks Program unlocks a realm of rewards, enabling users to accumulate points for travel, merchandise, gifts, and more.

As part of MyPoint Credit Union’s commitment to enhancing the credit experience, the MyPremium Perks Program offers 1 point for every $1 spent on everyday purchases.

Although eligibility for this card is contingent on credit approval, it comes with no annual fees, offering a cost-effective solution for users.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Significant benefits and disadvantages you may find

In essence, the MyPoint Credit Union Platinum Visa redefines the traditional notion of a credit card, as evidenced in this in-depth review.

But, if you want to make a smart choice, it’s time to weigh the pros and drawbacks. Check it out now!

Benefits

- Enjoy a substantial credit line;

- Benefit from a robust $200,000 travel accident insurance coverage;

- Manage your finances effortlessly online;

- Simplify your financial transactions by setting up automatic payments;

- Enroll in the Perks Program and earn points for every purchase;

- No annual fees;

- Redeem your earned points for a variety of rewards.

Disadvantages

- Approval for eligibility is contingent upon a credit assessment;

- Limited introductory offers;

- The MyPremium Perks Program comes with a restricted duration.

Is a good credit score required for applicants?

The MyPoint Credit Union Platinum Visa Card generally favors applicants with a solid credit history, underscoring the importance of a commendable credit score in the approval process.

Learn how to apply and get the MyPoint Credit Union Platinum Visa Card

Ready for a journey that will unlock unparalleled financial possibilities? Then it’s time to review an easy and straightforward guide on how to apply for your own MyPoint Credit Union Platinum Visa Card!

Learn how to get this credit card online

So, take charge of your credit journey and apply for a card that goes beyond expectations!

- Visit the website: Firstly, go to the MyPoint Credit Union website and click on “Borrow” on the menu. After that, click on “Credit Cards”.

- Explore details: Before initiating the application, take a moment to review the detailed features and benefits of the MyPoint Credit Union Platinum Visa Card. When you’re done, click on “Apply now” to initiate the process.

- Application form: Follow the prompts and carefully input the required information. Ensure accuracy to expedite the processing of your application.

- Submit and wait for approval: Once you’re done, submit your application. The MyPoint Credit Union will review your application, considering factors such as credit history, income, and other relevant details.

- Activation: Upon approval, you’ll receive your MyPoint Credit Union Platinum Visa Card along with a welcome kit. Follow the instructions provided in the welcome kit to activate your card.

What about another recommendation: Check out the Navy Federal Visa Signature® Flagship Rewards!

So, are you looking for an alternative that blends premium benefits with a focus on rewarding your spending? Then consider the Navy Federal Visa Signature® Flagship Rewards Card!

With an impressive credit line and an enticing rewards program, this card stands out as a compelling option for those who value travel perks and flexible redemption options. Find out more features now!

Navy Federal Visa Signature® Flagship Rewards

Navigate towards rewards with this Navy Federal Visa Signature® Flagship Rewards review! Start earning points on your travels!

About the author / VInicius Barbosa

Trending Topics

The many advantages of shopping online with a virtual card

Learn about the benefits of shopping online with a virtual card, including added security and protection against fraudulent transactions.

Keep Reading

My Green Loans review

Are you looking for a top loan provider? Check out our My Green Loans review to see if they're the right fit for your financial needs!

Keep Reading

Discover it® Cash Back review

Read our Discover it® Cash Back Card review to learn everything about this credit card and just how much you can earn every day.

Keep ReadingYou may also like

How to make money using the internet: Simple ways to increase your budget!

If you’re short on cash or currently unemployed, there are some simple ways you can make money using the internet! Read on to learn more.

Keep Reading

Phone tracker apps: Accurate location tracking and safety features

Unlock a world of possibilities with a free phone tracker app as we unveil the top choices that deliver accurate tracking!

Keep Reading

First Premier Lending application process for all credit types

In this First Premier Lending application guide you will learn how to use this tool to find just the right loan for your needs.

Keep Reading