Credit Cards

Kohl’s Card review: Exclusive deals!

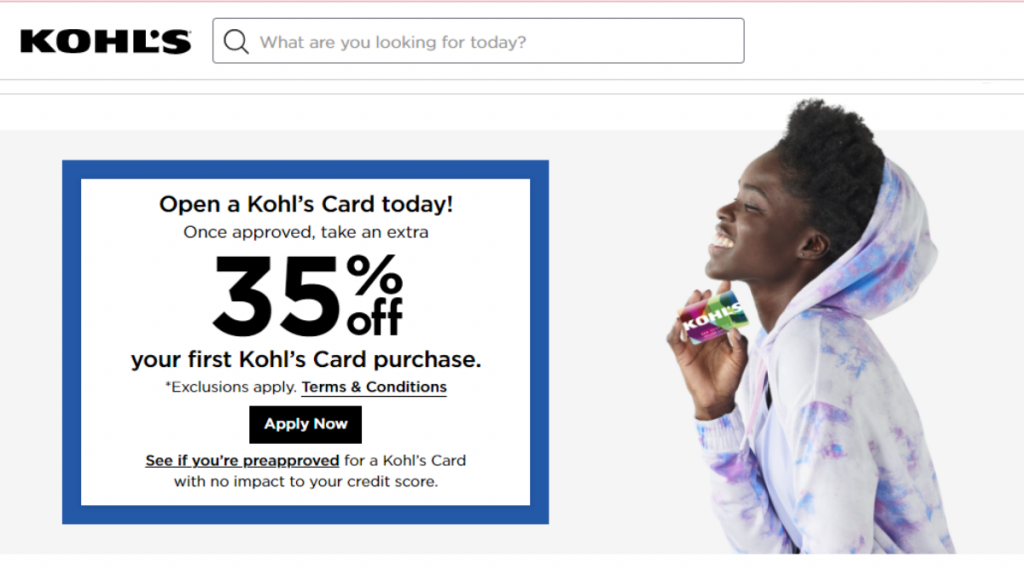

With the Kohl’s Card you will get a welcome bonus of 35% off, monthly discount offers and much more. Check it out!

Advertisement

Maximize Your Rewards on Department Store Purchases with your Kohl’s Card

Welcome to our Kohl’s Card review! This card offers boosted rewards on department store purchases, exclusive savings, and mobile payment options.

How to get your Kohl’s Card?

Check out this Kohl’s Card application guide to learn how to get this card fast and start getting monthly discount offers.

- Credit Score: Fair (580-669)

- APR: 30.24% variable APR on purchases

- Annual Fee: $0

- Fees: No balance transfer fees, no cash advance fees, and no foreign transaction fees.

- Welcome bonus: 35% off one purchase after opening the card.

- Rewards: Boosted rewards on department store purchases, with an extra 2.5% rewards over the standard rewards program. Rewards are automatically converted to store credit for use toward purchases.

If you frequently shop at Kohl’s, the Kohl’s Card could be a great option to maximize rewards on department store purchases. Keep reading and learn all you need to know about this credit card.

Kohl’s Card: how does it work?

The Kohl’s Card could be a good option for those who frequently shop at Kohl’s to maximize rewards on Kohl’s purchases.

You’ll get an extra 2.5% rewards over the 5% you earn through Kohl’s Rewards Membership. So that gives you 7.5% rewards when using the Kohl’s Card, though rewards are only redeemable at Kohl’s.

Also, the card offers a welcome bonus of 35% off one purchase after opening the card, monthly discount offers, and no annual fee.

However, the high variable APR of 30.24% on purchases is a significant downside, so we don’t recommend carrying a balance on this card.

The Kohl’s Card also offers exclusive savings, an anniversary gift, and monthly free shipping opportunities. However, you must spend $600 or more on the card in a year.

Additionally, the card automatically converts rewards into Kohl’s Cash for use toward purchases at Kohl’s. Kohl’s Cash expires 30 days after issuance.

Also, you can’t use it toward Sephora at Kohl’s purchases or to pay for Kohl’s gift cards or charitable items.

While you can add the Kohl’s Card to mobile wallets for contactless payments, those who are not frequent Kohl’s shoppers may not find much value in the card.

Additionally, when adding another credit account, carefully consider whether this card is worth it for you.

The Kohl’s Card could be a good option for frequent Kohl’s shoppers who are looking to maximize their rewards, but it may not be worth it for casual shoppers.

The card’s high APR and limited use outside of Kohl’s stores are significant drawbacks, so be sure to weigh the benefits and downsides before applying.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Significant benefits and disadvantages you may find

Ready for the high point of our Kohl’s Card review? As always, here is a list of benefits and disadvantages for you to compare and decide if this is the right card for you.

Benefits

- Boosted rewards on department store purchases.

- Welcome bonus of 35% off.

- Monthly discount offers.

- No annual fee.

Disadvantages

- High variable APR of 30.24%.

- Limited use outside of Kohl’s.

- Monthly free shipping for high spenders only.

- Rewards expire after 30 days.

Is a good credit score required for applicants?

The answer is no. If you would like to apply for the Kohl’s Card you only need fair credit. This means a credit score of about 580 to 669 FICO points.

Learn how to apply and get a Kohl’s Card

Want to apply for the Kohl’s Card after reading our Kohl’s Card review? We can help you with our application guide – click the link below to get started.

How to get your Kohl’s Card?

Check out this Kohl’s Card application guide to learn how to get this card fast and start getting monthly discount offers.

About the author / Danilo Pereira

Trending Topics

Capital One Spark 1.5% Cash Select application: High rewards!

Get a $500 cash bonus as a new card holder! Apply today with our Capital One Spark 1.5% Cash Select application guide.

Keep Reading

United℠ Explorer card review: Get useful perks!

In this United℠ Explorer card review you will learn about this card's rich rewards and extremely handy perks. Check it out!

Keep Reading

Milestone® Mastercard® Card application

Wondering how to get ahold of the Milestone® Mastercard® Card? This guide will take you through the application process step-by-step.

Keep ReadingYou may also like

SmartAccess Prepaid Visa Debit Card application

Applying for a SmartAccess Prepaid Visa Card is as easy as managing your finances with it. Read on to learn the full process and get yours!

Keep Reading

Simple ways to save money

How about starting the next year with the right food? Here are some simple ways to save money if you’re looking to cut down expenses.

Keep Reading

Instacart Mastercard® Card application

Learn how to easily and quickly apply for the Instacart Mastercard® Card, and get all the amazing and exclusive benefits that come with it!

Keep Reading