Credit Cards

Merrick Bank Classic Secured Mastercard® review

Read this Merrick Bank Classic Secured Mastercard® card review and learn how you can get the best of both worlds with a high credit limit and an improved credit score.

Advertisement

Build or repair credit with this card and get the chance to qualify for credit line increases

This card reports your activity to all three major credit bureaus (Equifax, Experian and TransUnion). Learn all about it in this Merrick Bank Classic Secured Mastercard® card review.

How to get your Merrick Bank Classic Secured card

In this Merrick Bank Classic Secured Mastercard® card application guide you will learn how to easily get this card and start building credit.

- Credit Score: Poor – Excellent

- APR: 19.7% Variable

- Annual Fee: $36 for the first year, then $3 monthly

- Fees: $40 late payment fee, 2% foreign transaction fee, $40 returned payment fee, Extra fees.

- Welcome bonus: N/A

- Rewards: N/A

If you have no credit history or a poor one, this secured card will help you build or rebuild your credit. It offers credit lines starting at $200 which can go as high as $3,000.

Keep in mind, however, that the card carries a number of fees and requires a security deposit.

Merrick Bank Classic Secured Mastercard® card: how does it work?

The Merrick Bank Classic Secured Mastercard® card is a secured card. This means it requires you to put down a security deposit.

This deposit can range from $200 to $3,000, which will then serve as your credit limit. Secured cards usually have a much lower credit limit than this.

A higher credit limit allows you to reduce your credit utilization ratio, which is the amount of credit you use versus the amount of credit you have available.

Merrick Bank regularly reviews your account activity so that, if you manage to maintain healthy spending habits and make regular on-time payments, you may qualify for a credit line increase.

If you qualify for a credit line increase, the bank will not require you to make any additional security deposit.

Merrick Bank also reports your account activity to all three major credit bureaus.

This means that, over time, if you make all of your payments by the due date, your credit card activity will help you improve your credit score and qualify for even better credit offers.

Some of the card’s downsides is that it does not offer a welcome bonus or ongoing rewards. Also, it charges a $36 annual fee which is deducted from your overall credit limit.

There are also a number of fees you may incur such as a $40 late payment fee, a $40 returned payment fee, a 2% foreign transaction fee, and other extra fees.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Significant benefits and disadvantages of the Merrick Bank Classic Secured Mastercard®

Now that you have become familiar with the card, it is time to compare its pros and cons. Our Merrick Bank Classic Secured Mastercard® card review would not be complete without it.

Have a look at the list of benefits and disadvantages we have prepared below.

Benefits

- Potentially high credit limit

- Possibility of a credit line increase

- Reports to all three major credit bureaus

- Does not require good credit

Disadvantages

- Charges an annual fee

- Does not offer rewards or bonuses

- Charges late fees

- Charges returned payment fees

Is a good credit score required for applicants?

The Merrick Bank Classic Secured Mastercard® card is intended for individuals who would like to build or repair their credit score. As such, it does not require applicants to have good credit.

Learn how to apply and get a Merrick Bank Classic Secured Mastercard® card

If you like what you have seen in this Merrick Bank Classic Secured Mastercard® card review, you might want to take the next step and apply for this card.

If that is the case, hit the link below and we are going to show you how to do it.

How to get your Merrick Bank Classic Secured card

In this Merrick Bank Classic Secured Mastercard® card application guide you will learn how to easily get this card and start building credit.

About the author / Danilo Pereira

Trending Topics

Citi Simplicity® Card review: ultra-long 0% APR period

In this Citi Simplicity® Card review you are going to see how this card's ultra-long 0% intro APR period can help you get out of debt.

Keep Reading

Walmart MoneyCard application

Learn about the eligibility requirements and how the Walmart MoneyCard application process works so you can request your card today!

Keep Reading

The Best Instant Approval Department Store Credit Cards

Don't wait to shop in style! Our blog post showcases the best department store cards that offer instant approval.

Keep ReadingYou may also like

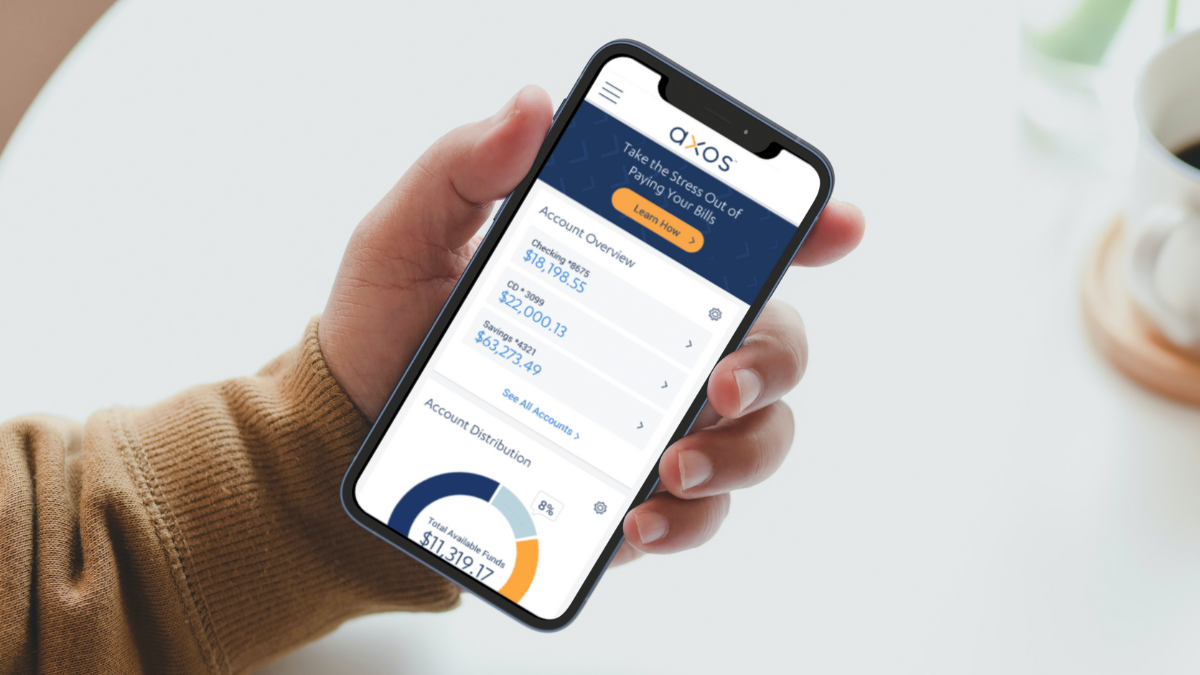

How to open your Axos Rewards Checking account easily

In this Axos Rewards Checking account application guide we are going to show you how you can open an account in just a few minutes.

Keep Reading

Bank of America® Unlimited Cash Rewards Secured review

Looking to earn cashback on all purchases a pay no annual fee? Check out this Bank of America® Unlimited Cash Rewards Secured review.

Keep Reading

Woolworths Gold credit card review: Get cash back, discounts, and more

In this Woolworths Gold credit card review you will learn about this card's exclusive perks and its cash back rewards.

Keep Reading