Credit Cards

Navy Federal Visa Signature® Flagship Rewards Review: no fees

Embark on your journey to smart traveling with the Navy Federal Visa Signature® Flagship Rewards Card! Earn points, bypass fees, and revel in exclusive perks. Get prepared to uncover a universe of advantages!

Advertisement

Prepare to supercharge your travel and everyday spending! Discover a world of benefits, rewards points, and more!

Are you an avid explorer or someone who loves reaping rewards from your spending? Seize the chance to review the outstanding benefits of the Navy Federal Visa Signature® Flagship Rewards card!

This credit card becomes your gateway to optimizing the rewards of your expenditures. So, embark on a voyage to examine the features, benefits, and exceptional experiences that distinguish this card.

- Credit Score: Good to excellent credit;

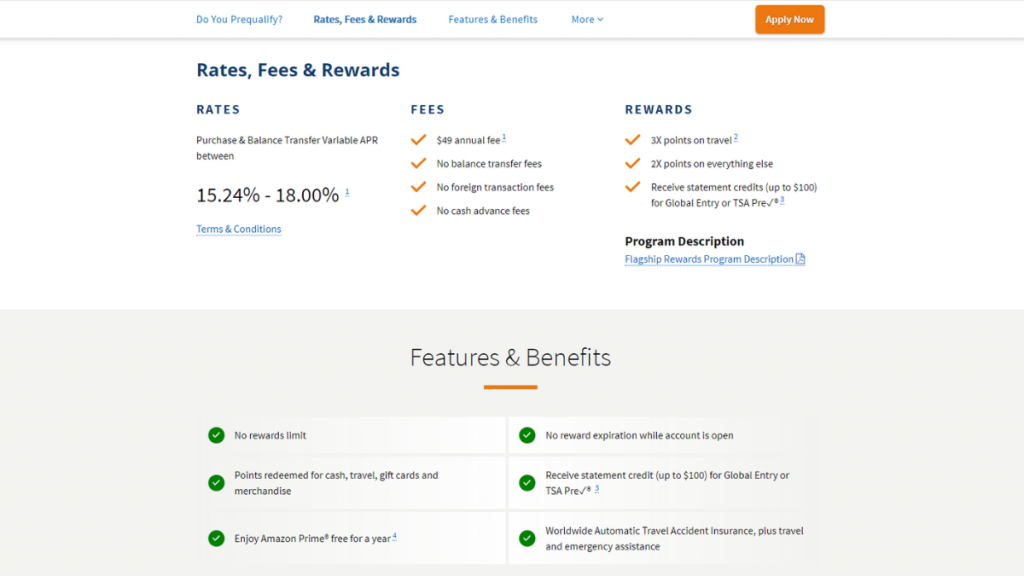

- Annual Fee: $0 annual fee in the first year, then you’ll pay only $49;

- Intro offer: New cardholders are warmly welcomed with an enticing offer. Receive a substantial 30,000 bonus points when you attain a spending milestone of $3,000.

- Rewards: Earn 3X points on travel and 2X points on every other purchase. Plus, get statement credits for Global Entry or TSA Pre✓® (up to $100);

- APRs: Ranges between 15.24% to 18.00%;

- Other Fees: N/A.

Navy Federal Visa Signature® Flagship Rewards: how does it work?

Within the expansive cosmos of credit cards, the Navy Federal Visa Signature® Flagship Rewards card glistens as a unique jewel, casting a spectrum of benefits ready for your review.

However, it’s important to highlight that this credit card caters to individuals with a track record of maintaining exceptional to excellent credit.

So, uncover the allure of triple points on your journeys while doubling your rewards on all other financial undertakings.

This feature empowers you to enhance your rewards, whether you’re navigating daily expenses or embarking on extravagant global adventures.

Furthermore, the card bestows a complimentary year of Amazon Prime, providing access to exclusive deals.

In summary, this card represents a versatile and rewarding choice for those with a passion for travel, outstanding credit histories, and a desire to maximize their spending potential.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Significant benefits and disadvantages you may find

At the outset, this credit card offers a distinctive fusion of benefits, ranging from a generous introductory offer to travel-related perks. However, like any financial instrument, it comes with its share of considerations.

Benefits

- An exceptional rewards program that distinguishes it from the rest;

- A hearty welcome accompanied by a generous bonus;

- Freedom from foreign transaction charges;

- Exclusive Amazon Prime benefits in your grasp;

- Benefit from essential travel support and emergency assistance services.

Disadvantages

- A necessity for a robust credit history;

- A relatively high annual fee;

- A variable APR, meaning interest rates can fluctuate.

Is a good credit score required for applicants?

Thus, becoming a member of the Navy Federal Credit Union is an indispensable condition for applying for the card.

Moreover, eligibility for membership primarily extends to active-duty and retired military personnel, veterans, DoD employees, and their families.

Furthermore, to satisfy the card’s eligibility criteria, you need to be a minimum of 18 years old and qualify as either a U.S. citizen or a U.S. resident with a valid Social Security number.

Learn how to apply and get the Navy Federal Visa Signature® Flagship Rewards

If, following a thorough exploration of this in-depth review, you’re enthusiastic about the Navy Federal Visa Signature® Flagship Rewards, continue reading to discover how to get this credit card!

Learn how to get this credit card online

So, embarking on the application process for this premium credit card is a simple yet significant journey, one that can unlock doors to exciting adventures and financial versatility!

- Visit the Navy Federal website: Commence your adventure by navigating to the official Navy Federal Credit Union website. Locate the “Loans & Credit Cards” section, where you can explore their range of credit card offerings.

- Explore the selection: Once you’ve reached the dedicated page, scroll down to identify the Navy Federal Visa Signature® Flagship Rewards card. Then, click on it for a detailed review.

- Initiate application: Take the next step by clicking the “Apply Now” button. Complete all the required fields with accurate and up-to-date information.

- Submit application: After you’ve filled out the application, submit it and patiently await a response from Navy Federal.

- Await approval: If your application gains approval, anticipate the arrival of your new credit card via postal mail!

What about another recommendation: Navy Federal More Rewards American Express® Credit Card!

Looking for an alternative that caters to your unique preferences? Explore the Navy Federal More Rewards American Express® Credit Card, an enticing choice that brings its own set of distinctive benefits.

Moreover, with a focus on flexible rewards and exclusive perks, this card is designed to elevate your financial journey. So, discover a complete review of this credit card by clicking the link below!

How to apply for Navy Federal More Rewards AMEX®

If you’re a Navy Federal member, learn how to easily apply for a Navy Federal More Rewards American Express® Card and earn rewards!

About the author / VInicius Barbosa

Trending Topics

First Digital Mastercard Credit Card application

Getting your First Digital Mastercard credit card will help you improve your credit score and your finances. We'll tell you how to get one!

Keep Reading

PREMIER Bankcard® Mastercard® Credit Card review

Are you looking for a product to help you fix your score? Then look at what the PREMIER Bankcard® Mastercard® Credit Card has to offer.

Keep Reading

Juno Checking Account review: is it trustworthy?

This Juno Checking Account review will show you how you can earn 5% cash back on cash purchases and 10% cash back on crypto purchases.

Keep ReadingYou may also like

What are the best Capital One cards for poor credit scores?

Check out our list with the best Capital One credit cards for poor credit scores to help you improve your finances and your lifestyle!

Keep Reading

Helpful strategies for living on a single income

Are you struggling to make ends meet? These tips will help you and your partner to live comfortably on a single income. Read on for more!

Keep Reading

Credit Firm application

See how the Credit Firm application process works and how you can get a personalized plan to help you fix your score.

Keep Reading