SA

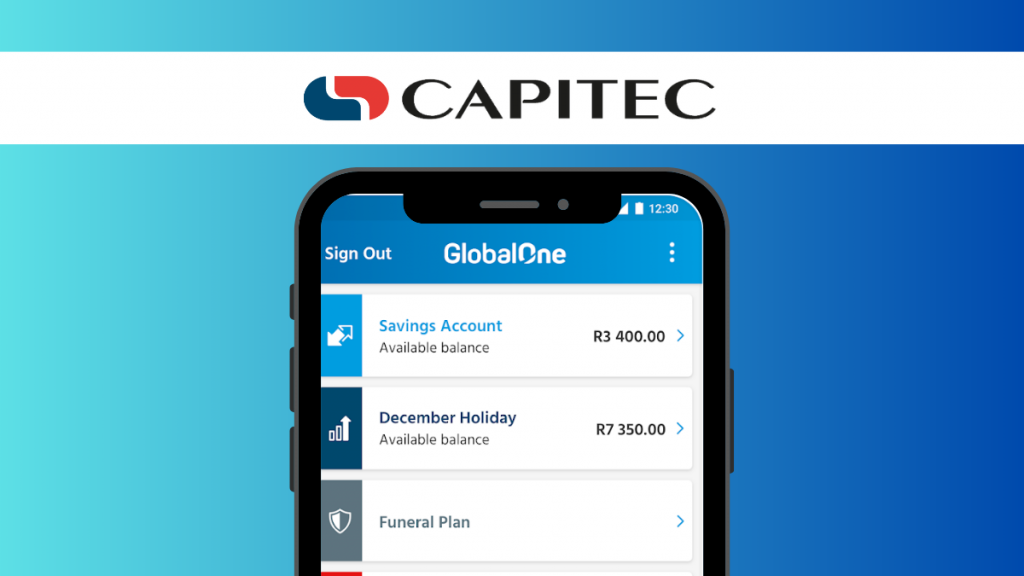

How to open your Capitec Tax-free Savings Account easily

Read this Capitec Tax-free Savings Account application guide to open your account today and start earning tax-free returns.

Advertisement

Capitec Tax-free Savings Account: Get competitive interest rates and tax-free returns

With this Capitec Tax-Free Savings Account application guide you’ll open an account that offers tax-free investment options and competitive interest rates. Fixed-term or flexible account? You choose!

With it, you’ll also gain access to flexible investment terms while paying no fees. Additionally, you’ll get multiple savings options and easy access to funds.

This is a versatile and tax-efficient way to grow savings with flexible investment options. Also, account holders can open up to four savings accounts for different purposes.

Discover how easy it is to open a Capitec Tax-Free Savings Account with our step-by-step application guide. Start saving tax-free today!

Learn how to open an account using the app

If you’re looking to open a savings account with Capitec, you will need to follow a few straightforward steps. Here’s our Capitec Tax-free Savings Account application guide.

Firstly, make sure you have your South African ID number, a valid email address, and a South African cellphone number. These details will be necessary for your application.

To start your application process, head over to Capitec’s website. There you will find a search bar located under the “Find ways to bank better” option.

Type “Savings Accounts” in the search bar and click enter. This will take you to the Transactional account page.

There you will find all the details you need about the account, including its benefits and interest rates.

Once you have familiarized yourself with the account details and are ready to apply, you have two options.

The first option is to locate the nearest Capitec branch and apply there. This option allows you to get expert assistance with your application and provides you with an opportunity to ask any questions you may have about the account.

Alternatively, you can click on the “open an account” button on the website to apply online. This option is convenient for those who prefer to apply from the comfort of their own homes.

Upon clicking the “open an account” button, you’ll arrive at a page where you can download the Capitec app from either Google Play Store, Apple App Store, or Huawei App Gallery.

After downloading the app, enter your South African identification number. This will start the account verification process.

As part of the verification process, you will need to take a few selfies to verify your identity. This ensures that your account remains secure and that no one else can access it without your permission.

Once you have verified your identity, provide your personal details and submit your Capitec Tax-free Savings Account application.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

What about a credit card with cashback?

Looking for a credit card that offers cashback? Then have a look at the African Bank Gold Credit Card. This might just be what you are looking for!

The Gold Credit Card from African Bank is a high-end option that extends a variety of advantages to its patrons.

This offering is quite competitive due to its monthly account fee being set at R23.00 and its credit ceiling at R90,000.00.

Sounds interesting? Then click the link below and learn all you would like to know about this credit card!

How to get your African Bank Gold Credit Card

In this African Bank Gold Credit Card application guide we will show you how to get this card fast so you can start enjoying its benefits.

About the author / Danilo Pereira

Trending Topics

Reasons to always check your credit report

Find out why you should constantly check your credit report to help you monitor what's going on with your financial status.

Keep Reading

How to get your Standard Bank World Citizen Credit Card: online application

In this Standard Bank World Citizen Credit Card application guide, we will show how you can get this card that gives you tons of benefits.

Keep Reading

How to join Live Better App easily

Join Live Better app today and get rewards for responsible financial behavior. Follow our Live Better App application.

Keep ReadingYou may also like

How to open your Novo Business Checking Account easily

In this Novo Business Checking Account application guide, you will learn how to open this account in just a few minutes.

Keep Reading

SmartAccess Prepaid Visa Debit Card application

Applying for a SmartAccess Prepaid Visa Card is as easy as managing your finances with it. Read on to learn the full process and get yours!

Keep Reading

United℠ Explorer card review: Get useful perks!

In this United℠ Explorer card review you will learn about this card's rich rewards and extremely handy perks. Check it out!

Keep Reading