SA

How to get your Standard Bank World Citizen Credit Card: online application

Read this Standard Bank World Citizen Credit Card application guide and learn how to get this card in just a few minutes to start enjoying rewards, and low interest rates.

Advertisement

Wit this card you have low interest rates, no annual fee, and cashback rewards

This card is perfect for people who frequently travel and want to benefit from exclusive rewards and discounts. This is our Standard Bank World Citizen Credit Card application guide.

This credit card offers low interest rates, no annual fees, and a rewards program for frequent international travelers. Read on and learn how to apply in just a few minutes.

Learn how to get your Standard Bank World Citizen Credit Card online

Go to Standard Bank’s website and locate the “Products and Services” option at the top of the page, right beside the bank’s logo.

Once you run your mouse over this option, you should see a dropdown menu. On that menu, you must locate and click on “see all cards” under the “credit cards” category.

Then, on the next page, scroll down until you find the Standard Bank World Citizen Credit Card to start your online application process.

You can then either check whether you qualify by clicking on “do I qualify?” or learn more details about the card by clicking on “tell me more”.

For this article, we are going to click on “do I qualify?”. This will take you to the form page where you must enter your information.

Enter your first name and surname, your South African ID number, and your phone number. You must also inform your gross monthly income and total monthly expenses.

Once you have done that, you must check the boxes to confirm that you are not insolvent, under debt review (current or applied for), administration or sequestration.

By checking the boxes you also agree to the following:

- Standard Bank can collect and process your personal information from external and public sources, where lawful and reasonable, for credit, fraud, identity, address, income and compliance purposes.

- Standard Bank can collect and process your personal information to create a personalised experience, between the bank and you, by assessing your application for products and services.

Further below you will check three more boxes to consent to Standard Bank collecting and processing your personal information.

After that, click on “submit”. If you qualify, you can complete the application for the Standard Bank World Citizen Credit Card, and once you have been approved you will receive a confirmation email.

Standard Bank will mail your card to you. You can then activate your credit card and start using it to make purchases.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

What about another recommendation: NedBank Gold Credit Card

If you would like to compare cards before you make up your mind, here is a card you should check out: The NedBank Gold Credit Card.

The NedBank Gold Credit Card is an excellent tool for managing your money. It comes with attractive and tailored interest rates, rewards schemes.

You also have access to a user-friendly online banking platform that allows customers to easily access their account.

With a low monthly fee of R40, you can enjoy one of the most cost-effective credit cards in the market. Additionally, there is a one-time setup cost of R180, and an optional Greenbacks program for an extra R27 per purchase.

Sounds interesting? Then click on the link below and learn all you need to know about it.

How to get your NedBank Gold Card?

Here’s a guide on how to apply for the NedBank Gold Card with all the information you need to know about this exclusive credit card.

About the author / Danilo Pereira

Trending Topics

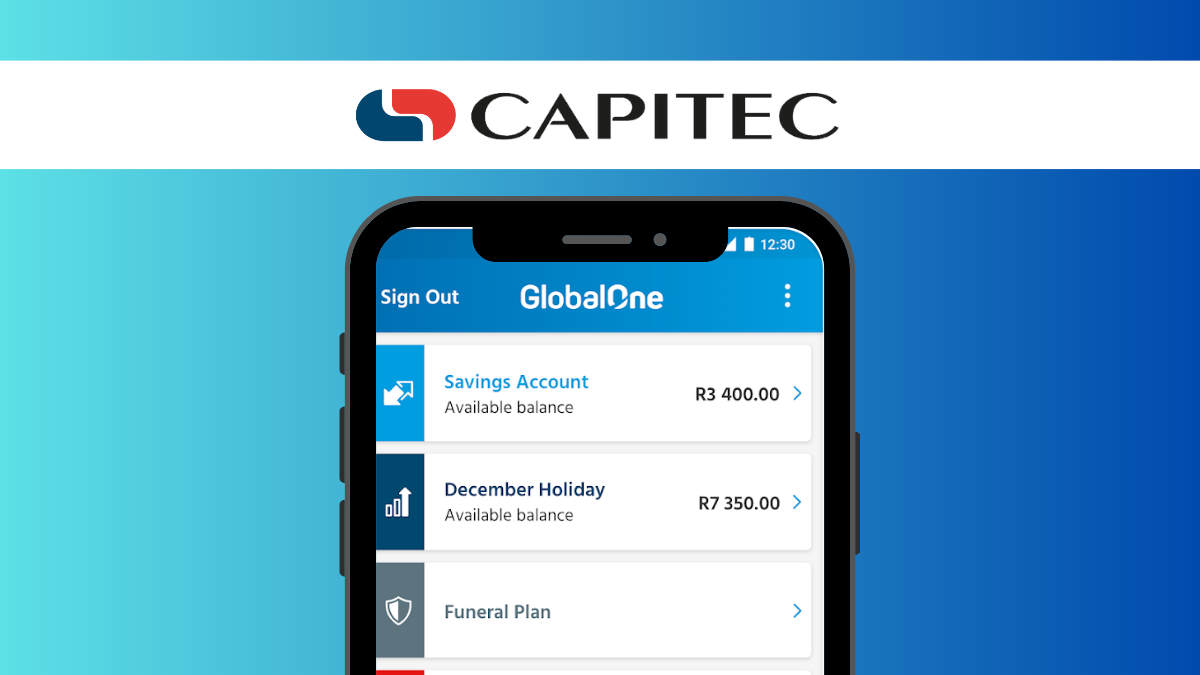

Capitec Tax-free Savings Account review: No Fees Attached

If you are looking for tax-free returns on your savings, check out this Capitec Tax-free Savings Account review.

Keep Reading

Chime Visa® Debit Card Review: Your Key to Hassle-Free Banking!

No more banking fees! Unveil the Chime Visa® Debit Card in this review and say goodbye to hidden charges and hello to convenient banking!

Keep Reading

How can you invest in Series I savings bonds?

Learn everything you need to know about Series I savings bonds, including what they are, how they work, and where to buy them.

Keep ReadingYou may also like

Nedbank Personal Loans review

Need a personal loan? Check out this comprehensive Nedbank Personal Loans review and get the best deal for your financial needs.

Keep Reading

Bank of America® Customized Cash Rewards card application

To enjoy excellent cash back rates, read this post to learn how to apply for the Bank of America® customized cash rewards card.

Keep Reading

Absa Student Credit Card review: exceptional rewards

Build your credit! Read this Absa Student Credit Card review and learn how this card can help you do that.

Keep Reading