Read on and learn about Ent Credit Union Personal Loans, with its super long terms and pre qualification possibilities.

Ent Credit Union Personal Loans – Access to loans even if you have fair credit, plus 72 months to repay.

Advertisement

Ent Credit Union Personal Loans offers super-long repayment terms for borrowers with a fair credit of about 600 or superior. With Ent you can get loans starting at $500 with repayment terms from 48 to 72 months, at some of the lowest interest rates you will find in the market. You can get loans that match your specific needs. Ent offers loans for you to pay your mortgage, college, car, motorcycle and even purchase a recreational vehicle!

Ent Credit Union Personal Loans offers super-long repayment terms for borrowers with a fair credit of about 600 or superior. With Ent you can get loans starting at $500 with repayment terms from 48 to 72 months, at some of the lowest interest rates you will find in the market. You can get loans that match your specific needs. Ent offers loans for you to pay your mortgage, college, car, motorcycle and even purchase a recreational vehicle!

You will remain in the same website

You can have access to the best rates and terms in the market even if your current score isn't as perfect as you'd like. Check out some of the perks getting into business with Ent Credit Union Personal Loans below.

You will remain in the same website

If you are thinking about applying for Ent Credit Union Personal Loans, you will be happy to know that these loans are available for a wide range of credit scores. Whether you have a 590-point credit score (which is considered a “fair” credit score), or an excellent credit score of 840, you are likely eligible for Members 1st loans. In addition to meeting these credit score requirements, you must be at least 18 years old or the state minimum, whichever is higher. When it comes to annual income requirements, the lender does not disclose any specific numbers in their official channels. However, the Credit Union requires that applicants are able to provide proof of their ability to repay their obligations. Ent Credit Union Personal Loans will examine applications regardless of borrowers’ employment status.

Yes, it does. Your payments to Members 1st Federal Credit Union Personal Loans will be reported to all the three major reporting agencies (Equifax, Transunion, and Experian). This means that when you make regular on-time payments to your creditor it positively impacts your credit score. It also improves your ability to demonstrate financial responsibility and sets you up for better interest rates on future loans or even credit cards.

If Ent Credit Union Personal Loans sounds like a fit to you, you should go ahead and check out our application guide. Click the link, and we will show you how to do it.

Ent Credit Union Personal Loans application

This Ent Credit Union Personal Loans application guide is going to help you get your loan for whatever you need today!

If you are looking for another offer to compare with this one, you should have a look at Clear Money Loans. This is a loan aggregator that makes things a lot more simple for borrowers.

It bundles together offers from multiple lenders that match your loan needs and credit profile.

Click the link and we will tell you all about it.

Applying for Clear Money Loans

The Clear Money Loans application is quick and easy to do, and once you are done, lenders will be competing for your business.

Trending Topics

Bilt Mastercard® Credit Card review

Read our Bilt Mastercard® Credit Card review to learn about this card’s unique features and benefits, and if it’s the right fit for you.

Keep Reading

Auto Credit Express application: Get your auto loan today!

Learn how to apply with Auto Credit Express and get access to multiple lenders and car dealers with flexible payment options.

Keep Reading

Aeroplan® Credit Card review: Loyal Air Canada customer? This is for you!

In this Aeroplan® Credit Card review, you will learn about this card's high earnings rate for loyal Air Canada customers.

Keep ReadingYou may also like

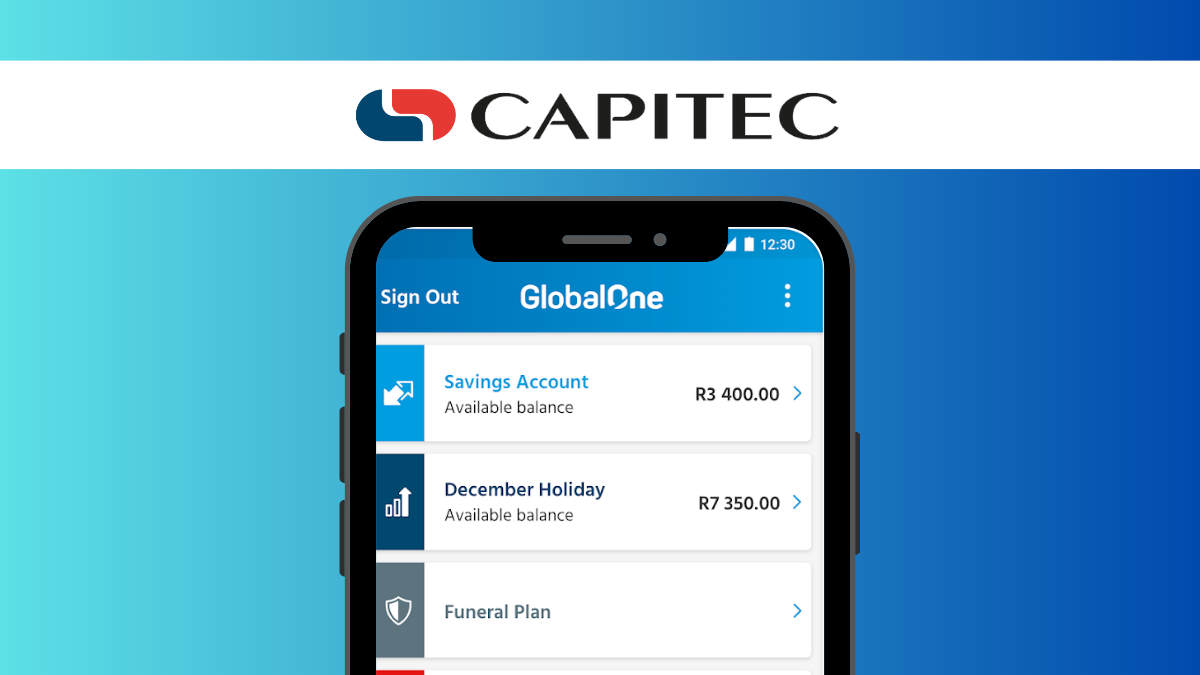

Capitec Tax-free Savings Account review: No Fees Attached

If you are looking for tax-free returns on your savings, check out this Capitec Tax-free Savings Account review.

Keep Reading

Clear Money Loans review: get a loan easily

In this Clear Money Loans review you will see how you can get multiple loan offers with a single online application.

Keep Reading

Eloan application process: Fast access to funds

In this Eloan application guide you will learn how to get a loan from this lender with a fast application and fast access to cash.

Keep Reading