Read on and find out how First Premier Lending will help you find the right lender for your needs.

First Premier Lending – Find lenders that match your credit score and get the loan you need.

Advertisement

First Premier Lending is an online loans aggregator which allows you to find a number of lenders that match your borrower profile. All you have to do is fill out a single online form, and the platform will match you with potential lenders. Borrow from $100 to $2,500 and use your loan for multiple purposes even if you have bad credit.

First Premier Lending is an online loans aggregator which allows you to find a number of lenders that match your borrower profile. All you have to do is fill out a single online form, and the platform will match you with potential lenders. Borrow from $100 to $2,500 and use your loan for multiple purposes even if you have bad credit.

You will remain in the same website

Have a look at some of the benefits of using First Premier Lending to find the best loans for you.

You will remain in the same website

To be eligible for First Premier Lending you must be able to provide proof of employment or regular income. You must also be a U.S. citizen with a valid Social Security Number and have either a valid driver’s license, or a state ID. Other than that you must have a bank account, and NOT be a customer at MetaBank.

First Premier Lending is not a lender. Rather, it is an online loans aggregator that bundles together multiple lenders who compete to lend to people who fill out the form in the platform. First Premier Lending does not provide loans itself, and because of that it also does not perform credit checks on applicants. However, lenders perform credit checks as soon as you agree to their terms and decide to apply. For this reason it is advisable that you check your credit score, just to make sure you do not take an unnecessary hit to your score.

In order to get loan offers through First Premier Lending you must provide the information which the platform requires to match you to the best lenders. You can do that by logging on to First Premier Lending’s website, selecting the product you wish to acquire (whether a personal loan, a mortgage, insurance, or real estate), and then going through the steps indicated by the platform, providing truthful information. The information required might include (but not restricted to) personal information such as full name and Social Security Number, contact information such as home address, phone number and email, as well as financial information such as income and housing situation.

If First Premier Lending sounds like a fit to you, you should go ahead and check out our application guide. Click the link and we will show you how to do it.

First Premier Lending application process

In this First Premier Lending application guide you will learn how to use this tool to find just the right loan for your needs.

If you would like to check out another loan aggregator with different lender options, you might want to take a look at the Zippyloan.

With this tool you will find lenders in all shapes and sizes and loans ranging from $100 to $15,000 which you can use for a number of purposes.

Sounds like a fit? Then click the link below and we will tell you all about it.

Applying for Zippyloan: Get multiple loan offers

Read this Zippyloan application guide and learn how to get multiple loan offers by filling in a single online form.

Trending Topics

What is an NFT? Find out once and for all!

It's past time for you to learn what an NFT is, and this post will tell you all about it. Read this content to update yourself on this topic.

Keep Reading

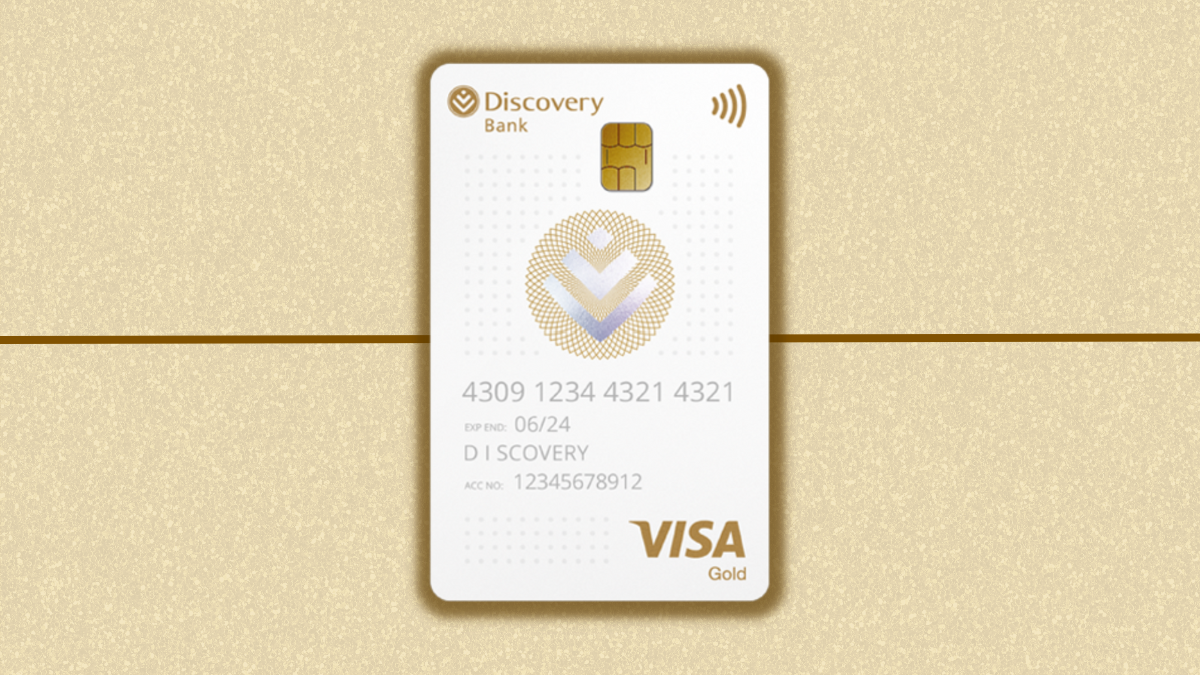

How to get your Discovery Bank Gold Card: online application

In this Discovery Bank Gold Card application guide you will learn how to get this awesome rewards card in just a few minutes.

Keep Reading

Pelican Pledge Visa Card Review: Leverage Your Savings!

Unlock financial possibilities with the Pelican Pledge Visa, and review a secured credit card designed to build your credit.

Keep ReadingYou may also like

OpenSky® Secured Visa® credit card application

Apply for the OpenSky® Secured Visa® credit card even if you have a bad credit score. Choose your credit limit and rebuild your finances.

Keep Reading

Ink Business Cash® Credit Card application: Unbeatable Rewards!

Looking to get a cashback business card? Read this Ink Business Cash® Credit Card application guide and get yours in a few minutes.

Keep Reading

Ent Credit Union Personal Loans application: up to 72 months to repay

This Ent Credit Union Personal Loans application guide is going to help you get your loan for whatever you need today!

Keep Reading