Loans

First Premier Lending review: get a loan easily

Read this First Premier Lending review and learn how this loans aggregator can help you get multiple loan offers within minutes.

Advertisement

First Premier Lending: Get multiple loan offers with only one application form

If you need to borrow cash, but your credit is less than perfect, here is a loan aggregator to help you get what you need. This is our First Premier Lending review.

First Premier Lending application process

In this First Premier Lending application guide you will learn how to use this tool to find just the right loan for your needs.

This is a loan aggregator for all credit types, whether excellent or bad credit. First Lending Premier will help you find the right lenders for you.

Read on and find out how this platform works and whether it is what you have been looking for.

- APR: N/A

- Loan Purpose: Any

- Loan Amount: $100 to $2,500

- Credit Needed: Any

- Terms: N/A

- Origination Fee: N/A

- Late Fee: N/A

- Early Payoff Penalty: N/A

How does First Premier Lending work?

First Premier Lending is a handy loan aggregator which helps you avoid the hassle of having to search for lenders one at a time before you can compare them.

As if searching for lenders wasn’t enough of a pain in the neck, you also need to make sure lenders match your borrower profile. First Premier Lending automatically matches your profile to the right lenders.

By filling out a simple online form, this loans aggregator can find the right lenders for you, making the whole process a whole lot easier.

The platform requires that you are able to provide proof of employment or regular income in order to be eligible for loans. If you have a job, you have more chances of getting approved.

If not, do not worry. You can still get approved if you have a source of regular income. The source can be retirement, pension or social security, as long as the income is at least $1,000 a month.

In addition to that, you must be a U.S. citizen, have a valid Social Security Number, as well as have a valid driver’s license or a state ID.

You must also have a bank account and NOT be a MetaBank customer.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

First Premier Lending: should you apply for it?

Now that you are familiar with this loan’s details, it is time to compare its benefits and disadvantages. Our First Premier Lending review would not be complete without it.

Have a look at the list of pros and cons we have prepared for you below.

Pros

- Receive multiple offers with one application

- Convenient and user-friendly platform

- Fast processing

- Accepts applicants with all credit scores

Cons

- Loans limited to $2,500

- Does not guarantee approval

- Not open to MetaBank customers

What is the required credit score?

First Premier Lending is not a lender. It is a loan aggregator that matches borrowers to lenders. Therefore, it does not set up credit score requirements for applicants.

So you do not need to worry about your credit score when searching for loans through First Premier Lending.

Learn how to apply for First Premier Lending

Do you like what you have seen in this First Premier Lending review? If so, you might want to take the next step and try the platform.

Click the link below and we will show you how to do it.

First Premier Lending application process

In this First Premier Lending application guide you will learn how to use this tool to find just the right loan for your needs.

About the author / Danilo Pereira

Trending Topics

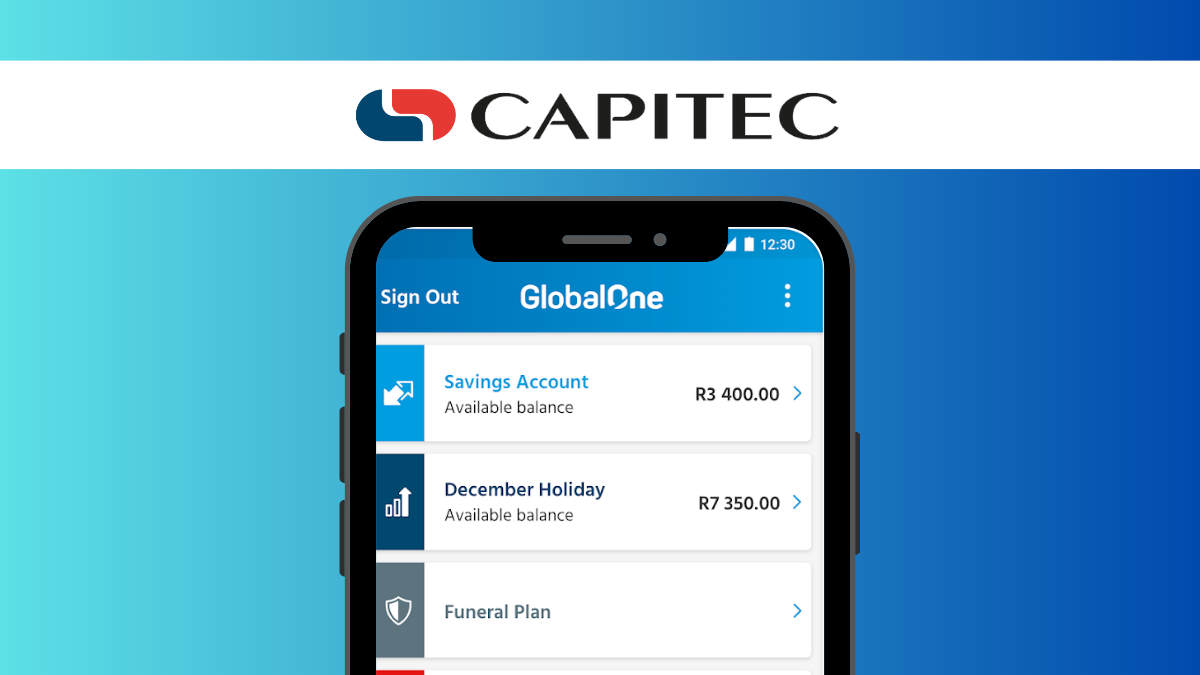

Capitec Tax-free Savings Account review: No Fees Attached

If you are looking for tax-free returns on your savings, check out this Capitec Tax-free Savings Account review.

Keep Reading

American Express Cash Magnet application guide

In this American Express Cash Magnet application guide you will learn, step by step, how to apply for this card to start earning cash back.

Keep Reading

Elevate Your Android Experience: The Ultimate Guide to the Best Apps for Android!

Looking for new apps to fulfill your apps list? Discover the cream of the crop with our list of the best apps for Android!

Keep ReadingYou may also like

Absa Student Credit Card review: exceptional rewards

Build your credit! Read this Absa Student Credit Card review and learn how this card can help you do that.

Keep Reading

Blue Cross Blue Shield Plans: Supporting Communities, One Policy at a Time

Find out why so many Americans are choosing Blue Shield Blue Cross plans, from its reliable service to community support.

Keep Reading

How to Close A Bank Account

In this article you will see that closing a bank account can have more steps that one would expect. Read on and get informed!

Keep Reading